Flight cancellations are the new norm for American Airlines (AAL)...

Flight cancellations are the new norm for American Airlines (AAL)...

The past few years have not been kind to the airline industry. In 2020, the COVID-19 pandemic brought travel to a standstill. And while last year was a step in the right direction, traveling hasn't been easy in 2022.

Anyone who has flown this year has probably had to deal with any number of issues... like widespread flight cancellations and long delays. Recently, pilot strikes and inflation are making matters worse.

Tickets are expensive and more flights are being canceled. Airlines halted thousands of flights on Father's Day weekend.

This has been inconvenient for travelers. But airlines aren't happy about it, either...

In total, the airline industry has lost more than $200 billion since 2020. To offset these losses, many airlines looked to their less profitable low-traffic regional routes.

Temporary route cancellations have been common throughout the industry. But American is taking things a step further. It just canceled three routes for good.

Travelers looking to fly to Toledo, Ohio or Ithaca or Islip, New York will have to choose a different airline.

American blamed the pilot shortage. But using Uniform Accounting, we can see that the real story runs deeper.

The truth is, American has struggled for years...

The truth is, American has struggled for years...

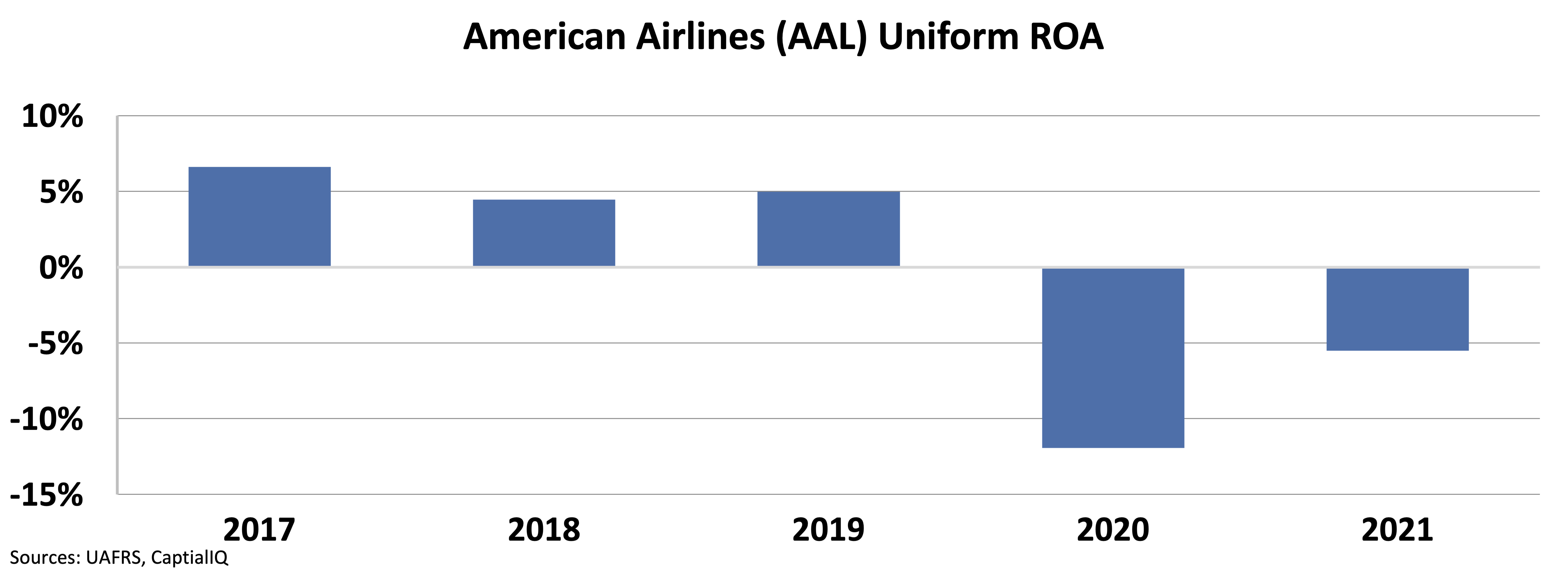

Even before the pandemic, the airline wasn't very profitable. In 2017, when American was operating at its best, its Uniform return on assets ("ROA") peaked at 7%.

That's nothing to be excited about, considering the corporate average ROA is closer to 12%. American's returns in its best year only barely cover its cost of capital.

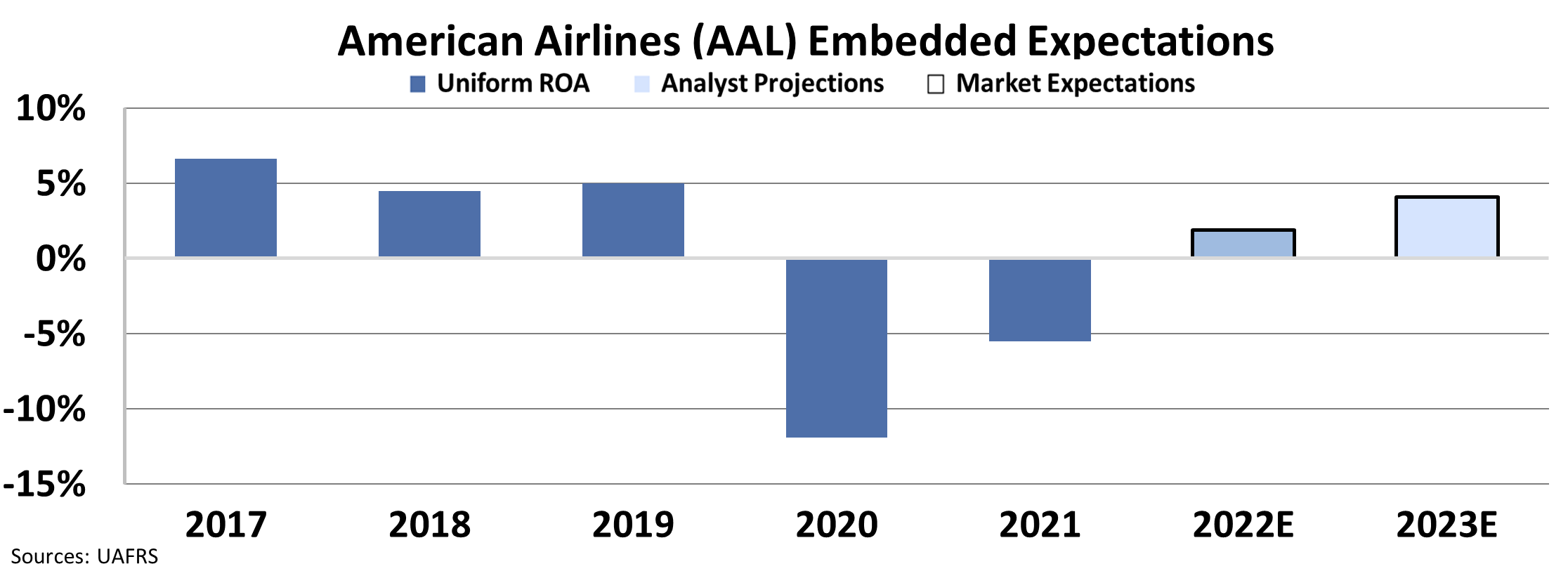

And since the pandemic, Uniform ROA has plummeted. The company returned negative 12% in 2020. That number only improved to negative 6% in 2021. Take a look...

Even as travel demand recovers, American has struggled with higher costs – as have other airlines today.

Oil prices are soaring. Thousands of pilots have retired. Those who remain are going on strike and demanding higher wages.

These factors have hurt Wall Street's view of the company. Analysts only expect American's Uniform ROA to recover to 4% by 2023.

That's still below pre-pandemic levels... and far below corporate averages.

Clearly, these subpar returns are due to more than a lack of demand.

Not every airline is feeling this much pressure...

Not every airline is feeling this much pressure...

Going forward, American might not be able to cover its costs of flying. That's why the company is announcing permanent cancellations. COVID-19 or not, American isn't making a profit on these smaller regional routes.

But most other airlines aren't following suit. Simply put, the other major airlines are better operators than American.

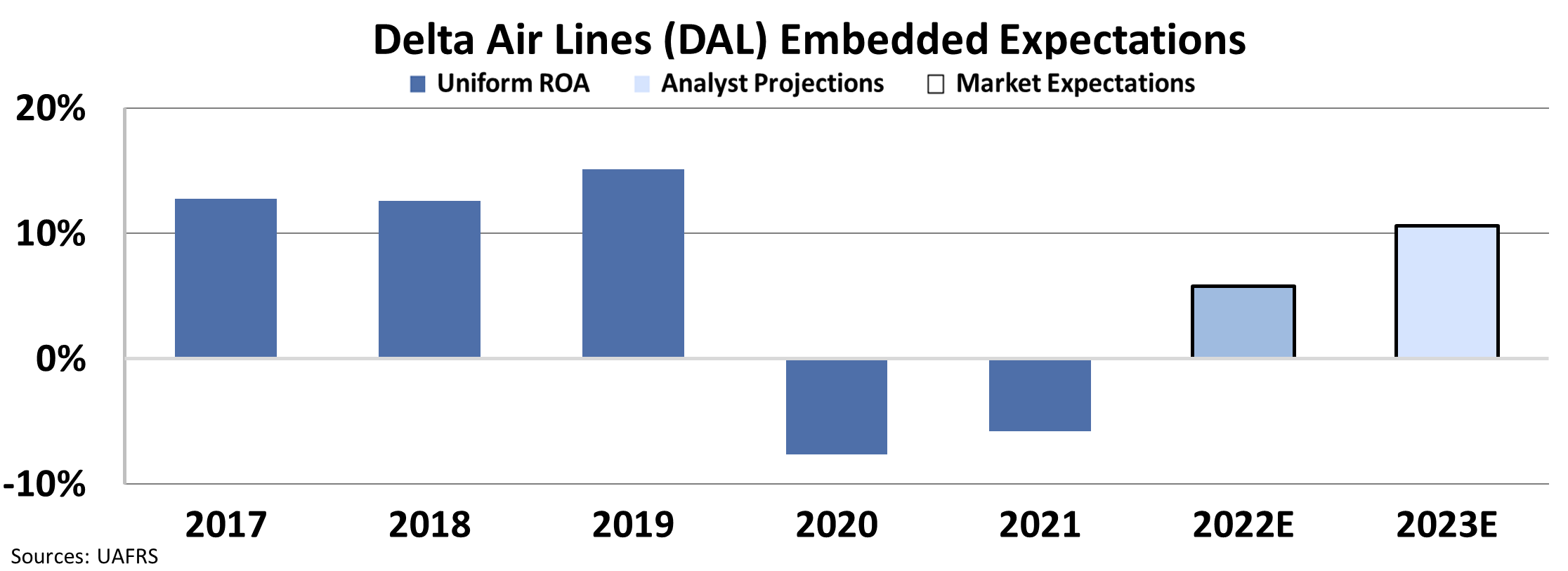

If we look at the performance of Delta Air Lines (DAL), one of American's largest competitors, this becomes clear.

Before the pandemic, Delta's Uniform ROA ranged between 13% and 15%. While the company had its struggles during the pandemic, analysts are predicting a strong rebound.

By 2023, they project Delta's Uniform ROA will reach 11%. That's well above the cost of capital... and more than twice American's expected ROA of 4%.

As the travel industry continues to recover, don't be surprised if things look different than they did in 2019.

Despite recovering demand, rising costs will force airlines to change their ways. More than ever, they have to strategically plan routes to maximize profits.

This will expose companies like American – those that haven't been efficient operators for the past decade or more.

Regards,

Rob Spivey

July 6, 2022