Editor's note: Every Friday, we showcase a featured topic from our YouTube show, Altimetry Authority.

This week, we tackle themes from our upcoming episode, including the tough consumer environment... and a discount retailer that Wall Street is underestimating.

Read on below...

Dollar General (DG) isn't built like the rest of retail...

Dollar General (DG) isn't built like the rest of retail...

Inflation ravaged the low-end consumer over the past two years. Rising costs for basic goods ate into margins. And retail investors worried that tariffs could pile on even more pain.

Shares plunged more than 50% from its 2022 peak to last year's low. But Dollar General is turning around... and Wall Street is halfway to admitting it.

Equity-research firm Oppenheimer upgraded the stock to "Outperform" after strong earnings last week. But it set a $130 price target – implying less than 20% upside from today's levels. That's also still well below last year's high.

Oppenheimer's lukewarm response doesn't square with the shift underway at Dollar General. As you'll see, the company is gaining traction with higher-income shoppers... even as its core customers remain squeezed by inflation.

This could be the start of a rebound...

Dollar General booked its biggest one-day gain ever last week...

Dollar General booked its biggest one-day gain ever last week...

Shares soared 16% on June 3 after the discount retailer raised its full-year earnings and sales guidance. It's now up nearly 50% in 2025.

That kind of move would normally prompt a chorus of bullish upgrades. But as the Oppenheimer upgrade shows, the response from Wall Street was oddly cautious.

The "experts" are overlooking a big tailwind. CEO Todd Vasos said roughly 60% of Dollar General's core customers now feel too constrained to buy some necessities. And yet, the company is seeing a surge of new business from middle- and upper-income households.

This kind of consumer behavior shift is known as "trading down." Folks are pivoting away from midrange retailers, which benefits low-cost options like Dollar General.

And while peers like Dollar Tree (DLTR) and Walmart (WMT) rely heavily on imports, especially from China... Dollar General is insulated.

Only about 4% of its inventory comes from China. And just 10% is imported overall. New tariffs shouldn't hit its supply chain hard.

Plus, Dollar General can maintain pricing power while tariffs raise its competitors' costs. As inflation keeps falling, it can start to claw back profitability.

Dollar General is in a much better position than its peers...

Dollar General is in a much better position than its peers...

The company is ripe for a rally. But investors aren't convinced.

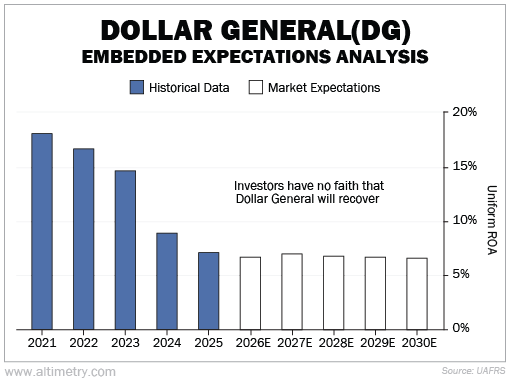

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Dollar General's Uniform return on assets ("ROA") was in the mid-teens before inflation hurt the business. Profitability fell to just 7% over the past two years.

And that's where investors expect it to stay...

The market still expects prolonged weakness from this retailer... even though consumer behavior and supply-chain dynamics suggest otherwise.

The worst may already be over for Dollar General...

The worst may already be over for Dollar General...

But the consensus price targets propose a different story. Oppenheimer only expects a small gain in the future, despite its theoretical "bullish" outlook.

Wall Street seems confused by this stock. And that's an opportunity...

Even a modest profit recovery could send shares much higher. Now that the pressure is easing, so is the fear. And with shares still so cheap, expectations remain low.

The so-called experts might be slow to adjust to Dollar General's turnaround... But you don't have to be.

Regards,

Joel Litman

June 13, 2025

P.S. We dive deeper into Dollar General in the upcoming episode of Altimetry Authority, which airs at 11 a.m. Eastern time today. Check it out on our YouTube channel right here... and be sure to click the "Subscribe" button.

Dollar General (DG) isn't built like the rest of retail...

Dollar General (DG) isn't built like the rest of retail...