Scammers have recently turned to dating apps to find their next victim...

Scammers have recently turned to dating apps to find their next victim...

If you've binged Netflix (NFLX) at all during the past couple of months, no one will blame you for concerns of being scammed.

First on Netflix was Inventing Anna, where a fake German heiress swindles wealthy New Yorkers and banks into giving her money. Then it was The Tinder Swindler, who convinced girls he met on Tinder to open credit cards in his name, take out loans, and empty their bank accounts to give him money to live a lavish lifestyle on their dime.

Now, based on recent news articles, it looks like there is a new angle appearing in the dating app con game, with dating apps filling a dark purpose beyond finding a new partner.

It's called cryptocurrency scamming.

There have been reports of people meeting on dating apps, where scammers will convince unsuspecting users to give them money to get rich quickly. They'll fake months-long romantic relationships and use the allure of cryptocurrency to get people to hand over large sums of their savings.

In one instance, one woman sent her entire life savings of $390,000 to a scam artist and was left with nothing.

Last year, 56,000 Americans reported love-bait ploys to the Federal Trade Commission ("FTC"), totaling $547 million in losses. That's almost twice as many as the year before.

Cryptocurrency is a hot topic these days. When combined with people being lonely from the pandemic, it makes sense that this type of scam is on the rise.

According to the February FTC report on romance scams, $139 million of last year's scams were paid in cryptocurrency. The report found...

In 2021, the median individual reported loss using cryptocurrency was a staggering $9,770. While cryptocurrency losses were the [costliest], it was not the most common payment method for romance scams. In 2021, more people reported paying romance scammers with gift cards than with any other payment method.

With such terrifying headlines filling the news, one might expect people to be swearing off dating apps in droves.

One reason why con artists are there in the first place is that no one is leaving those apps...

One reason why con artists are there in the first place is that no one is leaving those apps...

Bumble (BMBL) is proof of that...

Bumble is an online dating app where users can swipe left on profiles to reject or swipe right to show interest in other users. What sets it apart from other dating apps is that women must make the first move by messaging – it's a move to challenge antiquated dating rules and create an empowering environment.

Bumble also has a "BFF mode" dedicated to meeting new friends, alongside "Bumble Bizz," where users can network for their careers.

Despite being one of the most popular dating apps in the country with the ability to retain users at record rates, Bumble seems to be hurting financially.

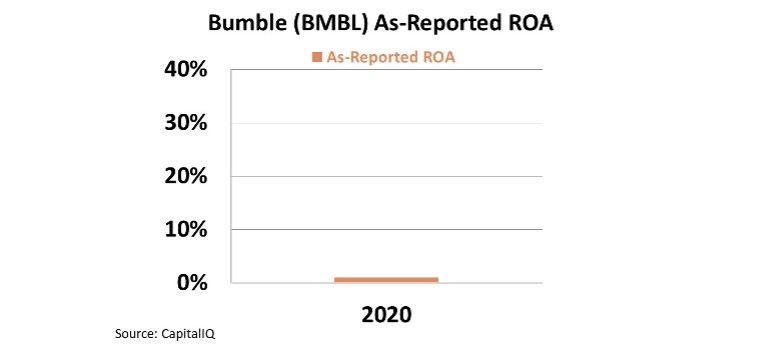

As-reported metrics make it look like Bumble is just a commodity that can't earn a return, sitting at just 1% return on assets ("ROA") in 2020.

Considering 2020 was dominated by the pandemic and people couldn't go out to bars, users should have been on dating apps more than ever to meet new people. The as-reported metrics make it look like that wasn't the case.

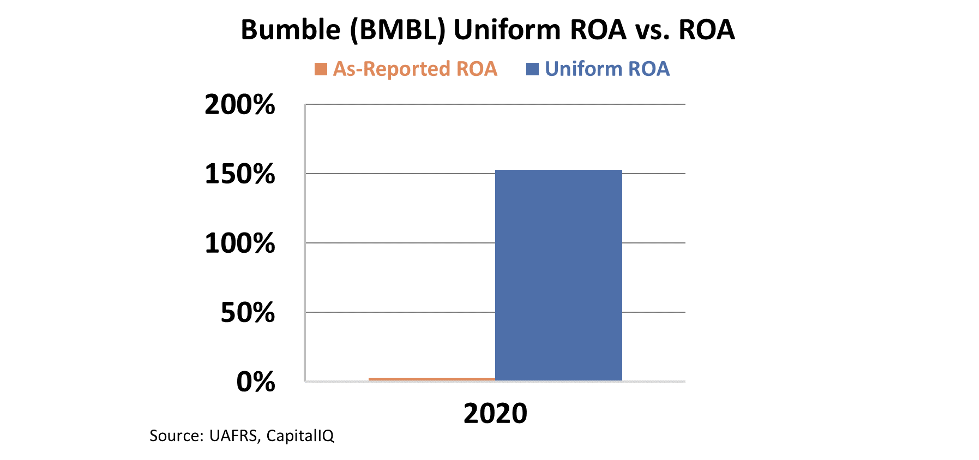

But Uniform Accounting shows a different story, and we see just how addictive Bumble is for people.

Last year, Bumble had a staggering profitability level of 154%. To reach that level, a company must be selling something that keeps people coming back.

Uniform Accounting makes it obvious that Bumble is thriving. People like its platform and have found dating success, which has led to its strong returns.

That also means it's the perfect place for scammers to stake out...

With the rise of crypto scamming, dating app users must be diligent and careful.

Crypto con artists only wish they could generate profitability the way Bumble does, which is why they continue to use the app.

And as both Bumble and crypto continue to grow, there's the potential this issue could, too.

Regular readers know we're skeptical of cryptocurrencies...

Regular readers know we're skeptical of cryptocurrencies...

Part of that skepticism has to do with cryptos not having any fundamentals, making them impossible to evaluate and value properly using Uniform Accounting.

But I've recently grown extremely bullish on another emerging area of the market. It has nothing to do with crypto, and I expect early investors to make 1,000% over the next few years as this megatrend takes hold.

I just published a brand-new presentation where you can get all the details... including my favorite way to profit from this trend – ticker symbol included – without having to enter a credit card, e-mail address, or phone number.

Watch it here.

Regards,

Joel Litman

March 8, 2022

Scammers have recently turned to dating apps to find their next victim...

Scammers have recently turned to dating apps to find their next victim...