Editor's note: Every Friday, we showcase a featured topic from our YouTube show, Altimetry Authority.

This week, we tackle themes from today's episode, which airs at 8 a.m. Eastern time.

Read on below to learn about our take on today's scorching hot IPO market...

Wall Street is buzzing about froth in the market...

Wall Street is buzzing about froth in the market...

Stocks have been hitting record highs after the Federal Reserve's September interest-rate cut. But it's the initial public offering ("IPO") market that has really taken center stage...

Last month, U.S. exchanges saw the busiest week of new listings since 2021... raising more than $4 billion in fresh capital.

Gemini Space Station (GEMI), a crypto exchange backed by the Winklevoss twins, raised $425 million in its IPO... and then jumped higher. Klarna (KLAR), the Swedish payments company, also drew intense investor demand.

On average, IPOs this fall opened 31% above their offering price. That kind of premium hasn't been seen in years.

CNBC, Bloomberg, and the Week have all issued warnings that investors are getting carried away.

But today, we'll explain why the chatter about "frothy" IPOs is actually a sign this bull market still has legs.

The drought has made the rebound look bigger than it is...

The drought has made the rebound look bigger than it is...

The headlines are right that IPOs are running hot. Roughly $29 billion has been raised on U.S. exchanges this year through mid-September.

That's a 45% jump from last year's $20 billion, and more than triple the depressed $9 billion raised in 2022. With companies like Gemini and Klarna surging in early trading, it's easy to see why investors think we're back in bubble territory.

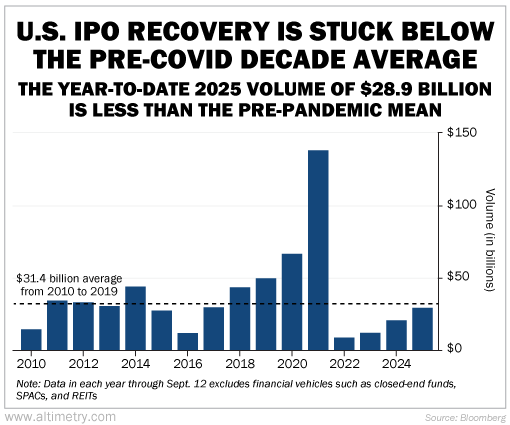

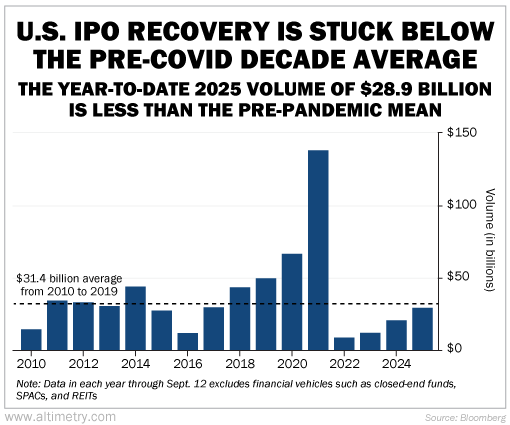

But context tells a different story. From 2010 through 2019, the U.S. averaged about $31 billion annually in IPO volume.

Take a look...

By that measure, today's revival still hasn't caught up to normal. It only looks extreme because the starting point was so weak. After years of drought, a return to the long-term average feels like a flood.

And unlike the special purpose acquisition company ("SPAC") craze of 2020 and 2021, today's listings are mostly traditional, with the businesses already up and running. Gemini is a recognizable player in crypto trading, and Klarna has global reach in payments.

Strong first-day gains don't mean investors are getting reckless. Instead, it's a sign that companies are finally excited about entering the public markets again.

Executives play a big role in timing IPOs. For the past few years, leaders have kept their companies private – even when they needed cash – because valuations were too low... partially due to high interest rates.

Now, conditions are supportive. Leaders' willingness to go public signals confidence in both their companies and the market environment. We talked about this in August... And management teams are getting extremely optimistic.

A wall of worry is sturdier than euphoria...

A wall of worry is sturdier than euphoria...

In sum, warnings about "froth" are everywhere in the headlines. Critics point to 30% IPO pops and say investors are getting ahead of themselves.

But the rest of the economy, from falling interest rates to rising management sentiment, suggests otherwise. We're still below the pre-pandemic average for IPOs, and the companies going public today have much stronger fundamentals than the SPACs of just a few years ago.

The very fact that skepticism is so prominent tells us markets aren't complacent. Bull markets don't end when investors worry... they end when everyone agrees the rally will never stop. Right now, the wall of worry is high, and stocks are climbing it.

Regards,

Joel Litman

October 3, 2025

P.S. We dive deeper into the market's wall of worry in today's episode of Altimetry Authority. New episodes air every Tuesday and Friday at 8 a.m. Eastern time.

Check out our YouTube channel right here... and be sure to click the "Subscribe" button.

Wall Street is buzzing about froth in the market...

Wall Street is buzzing about froth in the market...