Editor's note: Over the next several days, we'll cover everything you need to know about our view of the tariffs... what they mean for the market... and what investors should (and shouldn't) do.

We recommend starting with our initial Liberation Day assessment right here.

Keep in mind, this story is moving fast. So what we discuss one day may have changed just a day or two later. But it's still important to look at the overall context of these announcements.

Read on below...

The U.S. started this trade war... and the U.S. will suffer the most from it...

The U.S. started this trade war... and the U.S. will suffer the most from it...

At least, that's what the market thinks.

Domestic stocks have been in a tailspin since Trump's "Liberation Day" announcements. The S&P 500 has plunged 7.1%.

And the rest of the world – as measured by the iShares MSCI ACWI ex U.S. Fund (ACWX) – is down a mere 6.5%. ("ACWI" stands for All Country World Index.)

Investors have concluded that the Trump administration will lose its own trade war. But there's a lot more to this story than meets the eye.

In a world of trade uncertainty, U.S. stocks look a lot better than you think...

'Reciprocal tariffs' don't actually have much to do with tariffs, per se...

'Reciprocal tariffs' don't actually have much to do with tariffs, per se...

That is, it's not about tariffs other countries have levied on the U.S. Trump's numbers are a rudimentary calculation of the U.S.'s trade deficit with each country.

We don't think this is the right way to look at global trade. Slapping double-digit tariffs on these countries won't close the trade gap overnight. But the numbers are, admittedly, staggering...

Take Vietnam, which runs a 90% trade surplus with the U.S. That means we buy far more goods from Vietnam than it buys from us.

And it's nearly as bad in other parts of the world. China runs a 70% surplus with the U.S. India's is more than 50%. Even the EU is looking at a 40% surplus.

Those numbers make it look like we're "losing" because other countries don't want our goods.

Here's the thing, though... Trade deficits are a calculation of revenue...

Here's the thing, though... Trade deficits are a calculation of revenue...

They look at how much a country's industry ships to the U.S. They don't consider how much money those countries make from selling to the U.S.

This nation has spent decades moving out of lower-return businesses. Our corporations haven't been outsourcing for three decades to do other countries a favor.

They took the least-profitable parts of their business models... and found overseas partners to handle them.

That's why Big Tech giant Apple (AAPL) turned to Chinese electronics-maker Foxconn to assemble iPhones. It's why athletic-apparel retailer Nike (NKE) lets its Vietnamese and Chinese partners stitch together shoes and sportswear.

The list goes on and on. And all the while, those U.S. businesses have held on to the profitable pieces...

Apple still designs the iPhone and many of its components. It creates the software that allows its products to run. And Nike still controls its brand, innovation, and partnerships with famous athletes.

So while other countries might sell us a lot of goods, we're still coming out on top...

So while other countries might sell us a lot of goods, we're still coming out on top...

If an industry is focused on innovation, knowledge leadership, and most other competitive advantages, it's probably centered in the U.S.

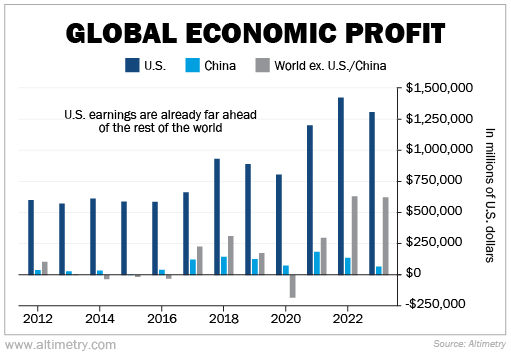

And that's why our economic profit – our corporate earnings minus costs and investments – has dominated the rest of the world for decades... trade imbalance or not.

Take a look...

As you can see, U.S. economic profit was almost double the rest of the world in 2023. It was almost 20 times higher than China's. And the gap between the U.S. and China is rising.

The real story today is just how dominant the U.S. already is...

The real story today is just how dominant the U.S. already is...

Other countries have plenty of trade barriers, both tariffs and otherwise. They're designed to keep U.S. companies from maximizing how much they can sell to the rest of the world.

And it hasn't mattered. We still come out on top.

The gap is so large – and U.S. corporations so far ahead – that nothing else matters. The U.S. is not reliant on selling its goods abroad.

Tomorrow, we'll cover a corner of the market that's getting hit particularly hard... and the opportunity it's creating for investors.

In the meantime, do your best to ignore the noise. The U.S. has so many other ways to turn a profit that won't get hurt by a trade war.

Regards,

Rob Spivey

April 14, 2025

Editor's note: Rob and Altimetry founder Joel Litman dive deeper into the tariff news in the latest episode of their YouTube show, Altimetry Authority. Watch for free right here. And be sure to click "Subscribe" so you don't miss an episode.

The U.S. started this trade war... and the U.S. will suffer the most from it...

The U.S. started this trade war... and the U.S. will suffer the most from it...