As the old saying goes, 'In this world, nothing can be said to be certain, except death and taxes'...

As the old saying goes, 'In this world, nothing can be said to be certain, except death and taxes'...

But as politicians debate the tax code, even that may not hold true.

That's why smart people shy away from absolutes. Instead, they often talk in probabilities – especially with regard to the stock market.

Here at Altimetry, we discuss different risk/reward scenarios when we make stock recommendations. We cover what a company might do, rather than what a company will do.

That's why, when we first started our research firm, we built a large number of "Monte Carlo" simulations for our investing framework.

These model the probability of outcomes in a process that can experience different variables. The technique can help us understand the effect of risk and uncertainty in prediction and forecasting models.

The real power behind the Monte Carlo simulation is that it shows folks a range of outcomes based on a specific set of inputs or variables rather than just a single scenario.

The simulation is used across many fields of study...

The simulation is used across many fields of study...

In gambling, it can help model probabilities of extraordinary things that could happen. This helps to control risk and also determine if someone is hustling a casino. For example, it can be used to figure out how often a person can hit the same number on a roulette table 10 times in a row.

It's also used in insurance to understand the risk of a disaster and potential losses.

Another use case is in the oil and gas drilling industry, where the Monte Carlo simulation can model out probable scenarios for oil extraction and identify the best places to drill.

Here at Altimetry, we often plug in variables such as net income, top-line growth, and capital expenditure ranges as reasonable assumptions for a given company.

Using these inputs, we extract potential return on asset ("ROA") or valuation outcomes we would otherwise never expect.

A Monte Carlo simulation is a great first step before diving deeper into complex modeling with more non-financial variables.

Humans don't deal well with probabilities. This is why we promote a framework that takes the outcome determination out of human hands, while still letting humans define the needed variables.

You might be wondering how we conduct this probability analysis through a Monte Carlo simulation...

You might be wondering how we conduct this probability analysis through a Monte Carlo simulation...

Rather than spending hundreds of hours trying to build our own, we used a tool called Crystal Ball. It's a simple but powerful Monte Carlo simulator.

And this specialized tool is owned by one of the largest software companies in the world: Oracle (ORCL).

The company has made a habit of owning niches like these to solve business problems and keep customers coming back to its products.

Oracle boasts powerful tools and is known as a "one-stop shop" for software solutions. However, that doesn't seem to translate into big returns...

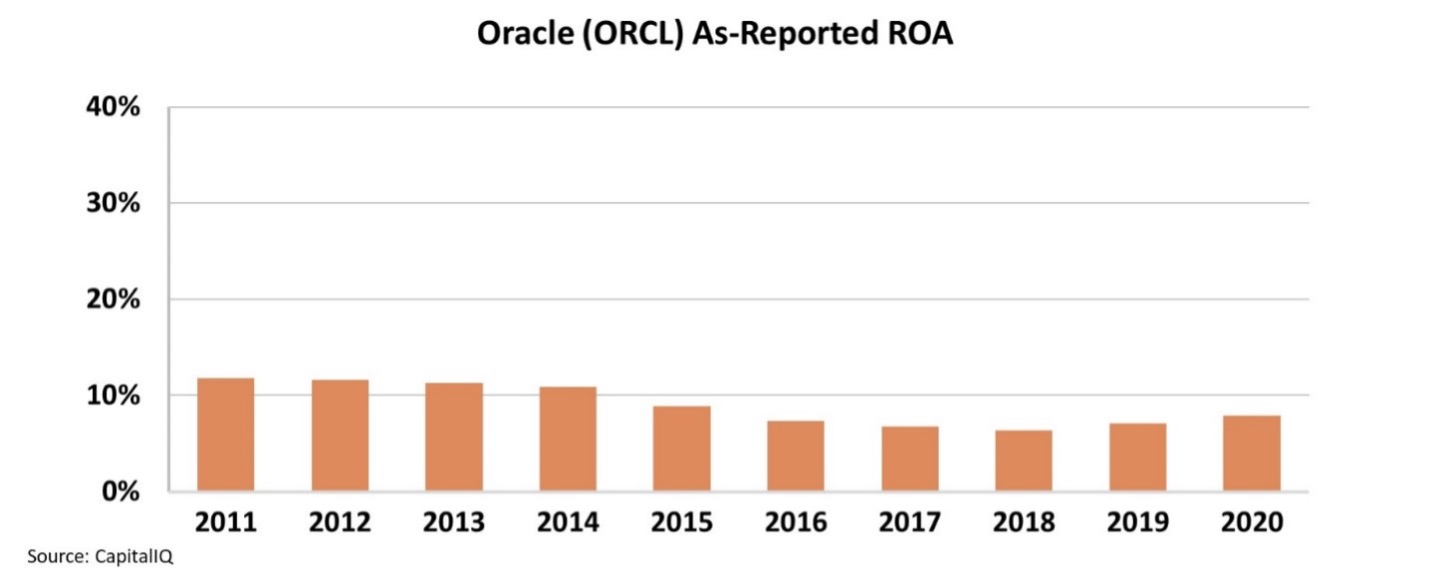

According to as-reported accounting metrics, Oracle has weak profitability levels.

Since 2011, the company's ROA has faded from 12% to 8%.

Looking at the GAAP metrics, investors would conclude that Oracle struggles to make average returns for U.S. corporates, which are around 12%. Take a look...

In reality, these weak ROA levels are just 'noise' from bad accounting...

In reality, these weak ROA levels are just 'noise' from bad accounting...

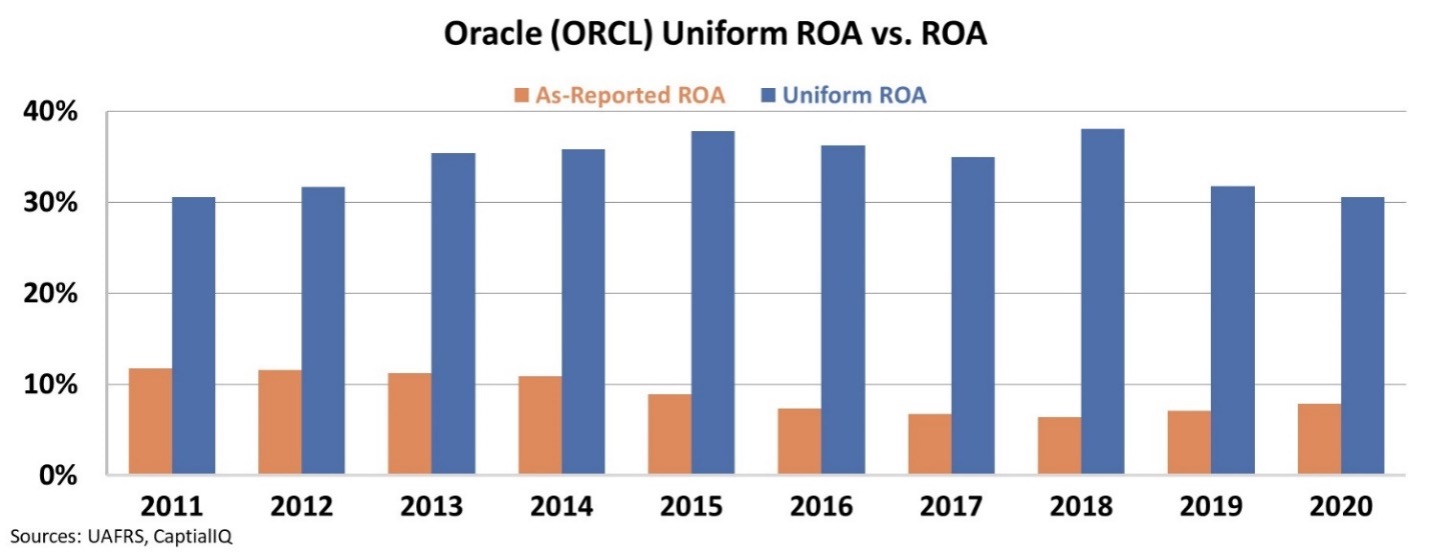

To see the real story, we can turn to Uniform Accounting to remove the financial distortions. We adjust for one-off items, excess cash, and other distortions.

Uniform Accounting metrics show that Oracle has done a great job with its goal to be everything a corporation needs in terms of software solutions.

As you can see in the chart below, instead of continued weak profitability, Oracle has actually seen strong returns. The company's ROA has sustained levels of at least 31% since 2011.

Over the past decade, a robust business model has helped Oracle achieve impressive ROA levels. And that's not something you need an actual crystal ball to see – just good, clean data.

Regards,

Rob Spivey

March 24, 2021

As the old saying goes, 'In this world, nothing can be said to be certain, except death and taxes'...

As the old saying goes, 'In this world, nothing can be said to be certain, except death and taxes'...