Let's examine what goods are climbing in price...

Let's examine what goods are climbing in price...

Going shopping has never been this expensive.

You may have come across headlines in the past year highlighting how inflation has been a bigger concern than it has at any time in recent history.

While we have seen the market rebound faster than any of us expected, the inflation rate has skyrocketed right alongside it.

These discussions about inflation have centered around increases seen in categories like used cars, oil, and rent.

However, a big category has often been left out of the conversation...

Due to a confluence of bottlenecks, food prices were up 40% year over year in May 2021. Supply chain disruptions from the "farm" to the "plate" have meant prices have spiked.

Perishable foods such as fruits and vegetables need rapid transportation to grocery stores, which means refrigerated transportation costs are soaring.

Shortages in truck drivers mean grocery store distribution networks are paying higher fees to get any foods across land routes. Meanwhile, huge rate hikes in dry bulk ships for items such as grains or sugar that travel across the ocean has meant many inputs are undergoing prices hikes.

The result has been that a lot less has arrived at its destination on schedule.

Another factor that has challenged the food industry even before the coronavirus pandemic was the 2018 swine flu outbreak in China.

The outbreak forced China, a vital global supplier, to cull half its pig herd. It took more than two years to rebuild stocks to replace the lost pigs. This has created even more shortages as the pig population is still recovering.

Some experts worry that signs of an outbreak with a new coronavirus variant in 2022 could destabilize the food and livestock industries with more disruptions.

It doesn't appear as though there are any easy solutions to remedy these problems in the food industry. Unfortunately, none of it looks likely to resolve in the near term. High prices are here to stay...

But high prices today don't mean higher prices tomorrow...

But high prices today don't mean higher prices tomorrow...

It's important to note that there is another side to the story.

Even as prices stay high, particularly in perishables like food, it is important to note that many of these prices have started to stabilize. Items such as orange juice, sugar, soybeans, and corn, just to name a few, are seeing prices level off.

While prices remain elevated, if prices stick where they are, inflation itself will taper.

Annualizing these spikes becomes important as we look at the potential of stabilization in the markets.

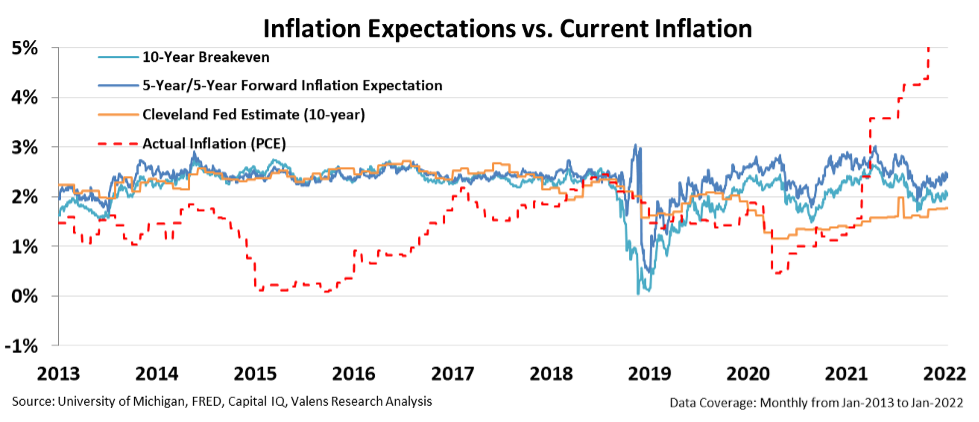

In the chart below, the dotted red line is actual inflation, or personal consumption expenditure, which tracks prices themselves. This has spiked as food prices have climbed the past year.

The light and dark blue lines represent the 10-year inflation expectations, which remain flat and have even trended down over the past year. As supply chains ease, prices will flatten and come back down to normal levels, not continue to climb.

News outlets use our understanding of inflation, or protracted price increases thanks to monetary policy, to talk about the current, short-term phenomenon happening in the current overheated economy.

While inflation numbers have risen significantly in the past year, these rates will taper off and should fall in the long term.

Thanks to pandemic shutdowns declining and large corporate investments in supply chain infrastructure, companies will begin to lower prices as they seek to undercut the competition. That is why inflation expectations in the long term remain low.

We're not going to have high inflation forever... eventually, it'll come back down...

We're not going to have high inflation forever... eventually, it'll come back down...

When we look at Software as a Service ("SaaS") firms, it's an area that has been whacked... And it's because of how their valuations are impacted by inflation worries.

But that doesn't mean it doesn't represent an opportunity... as these firms are trading at a discount.

Once inflation cools down, there will be folks who will regret having sold these stocks.

Here at Altimetry, it's our business to know when these companies roll out their business models, inflation or not, if they're huge winners.

Right now, we have a special report about how you can make money on these e-businesses. But you'll have to act soon... since these firms are currently trading at a discount...

Click here to watch the special presentation.

Regards,

Joel Litman

January 24, 2022

Let's examine what goods are climbing in price...

Let's examine what goods are climbing in price...