It has been a stellar run for health care companies...

It has been a stellar run for health care companies...

Health care stocks enjoyed a stellar five-year run with growth and innovation exploding.

The landmark Affordable Care Act ("ACA") increased demand for health care products and coverage, combined with a stream of innovative treatments paving the way for new health care applications and markets.

While many industries faltered during one of the most critical public health emergencies in history, many companies in the health care industry were able to scale even more rapidly than in the past.

Access to cheap debt during 2020 and 2021 allowed them to finance large acquisitions for bargain prices, while other companies were granted large sums of money to develop products rapidly.

Before the coronavirus pandemic, the largest pharmaceutical firms tended to acquire emerging companies and roll up the competition to create health care behemoths. Traditionally, it has been easier for large pharmaceutical companies to buy startups developing new drugs than it would be to develop in-house.

Since 2017, there has been more than $50 billion in annual mergers and acquisitions (M&A) in just the pharmaceuticals and biotech industries alone.

But late 2021 finally marked the end of this banner run for health care M&A.

There were about 30% fewer deals in 2021 than in 2020, and it was the first year since 2017 without a major, $30 billion-plus deal.

How could the mighty fall so quickly?

How could the mighty fall so quickly?

After a period of rapid growth in the space, some were disjointed by the sudden drop-off in M&A activity. Concerns arose about rising interest rates that could be hampering debt-financing decisions.

Many point to President Joe Biden's antitrust agenda as slowing down the party. Last July, the president signed an executive order to promote competition within the U.S economy.

In his official memo, his administration highlighted the "excessive concentration of industry, the abuses of market power, and the harmful effects of monopoly and monopsony."

As Big Tech has come to learn, regulators are no longer looking away from large companies that stifle competition. Now, they are taking a hard look at reducing concentration at the top.

There are also broader regulatory concerns in the space as leaders and regulators from other regions are also tightening up their antitrust policies.

European regulators, for example, are looking at ways to promote more competition in the industry and keep drug prices reasonable.

With regulators beginning to instill more regulation around competition in the industry, it has started putting breaks on M&A in the space. As a result, biotech stocks have massively underperformed the broader stock market in recent months.

But growth is still possible without M&A...

But growth is still possible without M&A...

Fortunately for biotech and pharmaceutical companies, M&A isn't the only way to grow and maintain relevance.

These companies can also invest in organic growth, including investments in physical infrastructure like labs and production facilities and the ever-important research and development (R&D) that powers future drugs and cash flows.

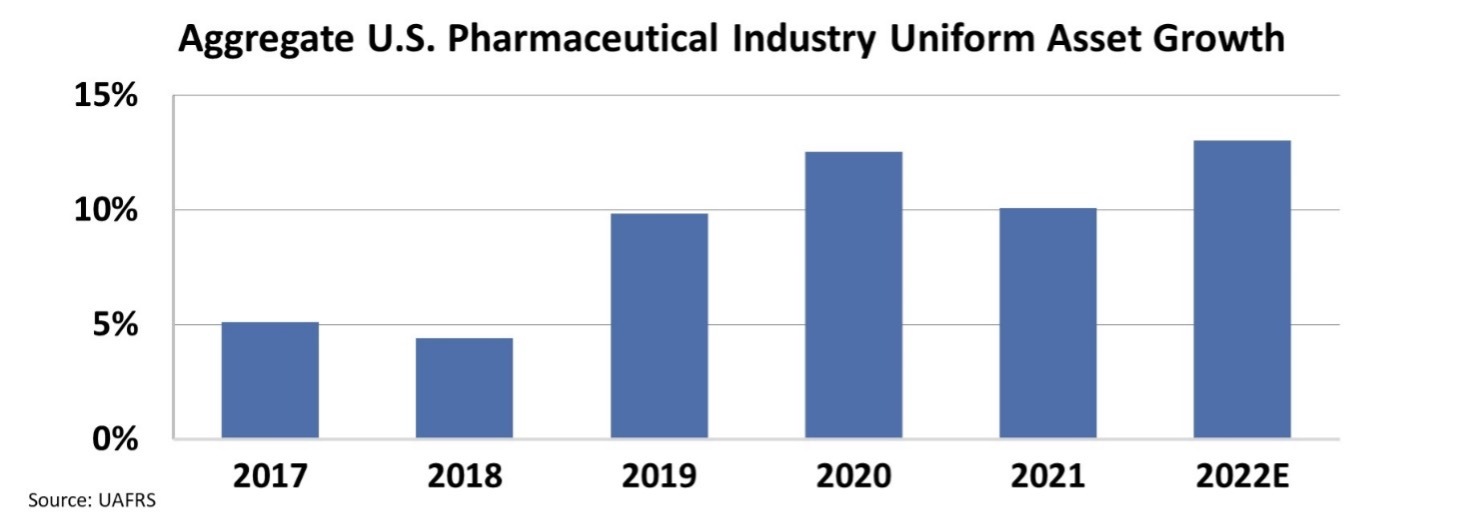

Under Uniform Accounting, pharmaceutical and biotech companies' asset growth includes all forms of growth, including M&A, physical investments, and R&D.

When we look at the United States' pharmaceutical and biotechnology aggregate growth, we can see if growth is slowing down or if it's just transitioning from buying to building.

We see when looking at aggregate growth in the industry that total investment isn't slowing at all. Organic growth has improved from sub-five percent levels in 2017 and 2018 during the M&A boom to now decade-level highs of 13%.

With greater regulatory pressure clamping down on big M&A deals, these companies have transitioned where and how they invest.

With a robust pipeline of potential drugs in place, pharmaceutical companies will continue to grow their businesses if they make the appropriate investments in their product development.

Even though consolidation may be slowing, it's not killing growth in the industry itself, which likely indicates that the market's recent sell-off is unwarranted.

Regards,

Joel Litman

April 18, 2022

It has been a stellar run for health care companies...

It has been a stellar run for health care companies...