Introducing the first of its kind software – a veritable "stock truth detector" for individual investors. You simply enter a ticker symbol and our stock Altimeter instantly shows you if the stock is a buy, hold, or sell... and even where the stock is likely to go next – all using forensic analysis of company earnings.

There is a gap in GAAP.

Antiquated rules from Generally Accepted Accounting Principles (GAAP) along with the International Financial Reporting Standards (IFRS) require companies to publish financial statements that don't best reflect the true earnings of a company. You can learn more about this earnings gap here.

The bottom line is that we have identified more than 130 potentially meaningful inconsistencies between reality and what we refer to as "as reported" numbers. Understanding these inconsistencies and seeing the true earnings of a company can help investors make a fortune on stocks that Wall Street is incorrectly pricing.

For every stock, our team of more than 100 financial analysts and accountants breaks down the as-reported financials and then reconstructs what is known as Uniform Accounting-based financial statements.

That data is then loaded into our stock Altimeter, allowing you to see the true earnings for any stock and how mispriced the stock is.

Once you search for a stock, you will see the as-reported numbers (the same numbers you will see in Yahoo Finance or Bloomberg) alongside our re-calculated Uniform numbers.

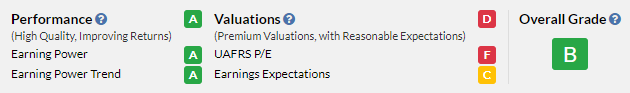

You'll also see our Stock Grades for every company in The Altimeter. We grade each stock on four variables that aggregate into a final score. That final score is between "A" (high-quality names with low market expectations) and "F" (low-quality names with high market expectations).

Click here to subscribe to The Altimeter.