In 2021, LVMH Moët Hennessy (MC.PA) pulled off one of the boldest moves in luxury retail history...

In 2021, LVMH Moët Hennessy (MC.PA) pulled off one of the boldest moves in luxury retail history...

It closed a $16 billion deal to acquire Tiffany & Co. and transform the 187-year-old American jeweler into a global powerhouse.

At first, the strategy seemed to work... Ultra-wealthy clients lined up to buy rare products, like the limited-edition Patek Philippe Nautilus 5711 watch.

The dial showcased Tiffany's signature robin's-egg blue... and it cost about $52,000. (Since then, the watch has sold for as much as $6.5 million at auction.)

But behind the scenes, LVMH's rollout was anything but elegant...

Longtime Tiffany clients were frustrated by the company's opaque purchasing rules. Some sued Tiffany. Others walked away entirely.

Patek Philippe – one of the most prestigious names in Swiss watchmaking – quietly terminated its 170-year-long partnership with Tiffany.

These missteps are a glaring sign that LVMH's luxury empire may be losing its footing.

So investors shouldn't be surprised if selective consumers and fading demand stifle company returns going forward.

Tiffany was supposed to anchor LVMH's expansion into the U.S. luxury market...

Tiffany was supposed to anchor LVMH's expansion into the U.S. luxury market...

On paper, the Patek Philippe watch campaign was successful... The "Blue Dial" generated hundreds of millions of dollars in high-margin sales.

But the excitement didn't last...

LVMH restricted the watch to customers who spent between $2 million and $3 million on other jewelry. Yet there was no waitlist or guarantee they would get their hands on it.

Tiffany also refused to share customer data with Patek Philippe. That was basically the last straw. And it convinced the watchmaker to pull out of all but one Tiffany location.

Since then, Tiffany's share of the global luxury jewelry market has slipped by 1 percentage point. That may not sound like much, but it translates into more than $500 million in losses since LVMH took over.

This has allowed competitors to swoop in and grab some of the market share...

This has allowed competitors to swoop in and grab some of the market share...

Western luxury product sales in China are a good example of that. They usually account for more than one-third of total global demand. Yet they're slowing down...

In 2024, these sales fell around 20%.

Chinese consumers increasingly favor domestic brands, like Laopu and Mao Geping. They're winning over customers with products that showcase local designs and cultural pride.

Laopu alone sold 200,000 pieces of gold jewelry in the first half of 2025... and reached a market capitalization of $15 billion.

The bottom line is, the ultra-rich are becoming more selective about where they spend their money.

The shift in discretionary spending may signal tough times ahead for LVMH...

The shift in discretionary spending may signal tough times ahead for LVMH...

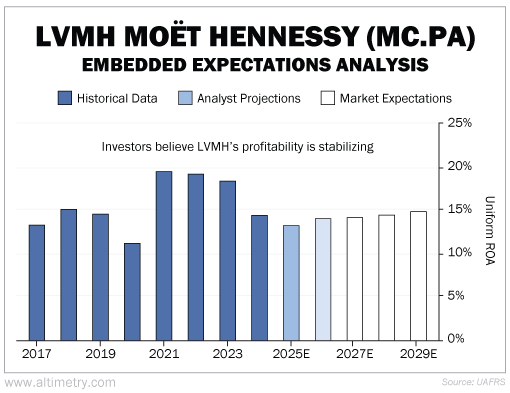

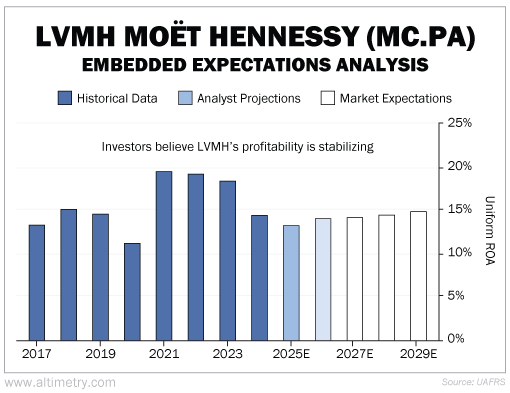

And this might catch investors off guard. We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

LVMH's Uniform return on assets ("ROA") was around 13% before the COVID-19 pandemic. Once people started splurging on luxury products, the company's Uniform ROA jumped to 20%... It remained at that level until 2023.

However, it fell to 14.6% last year. And analysts are expecting similar numbers over the next two years. The market thinks returns will stabilize around pre-pandemic levels of 15% by 2029. Take a look...

We think that's slightly optimistic, as consumer behavior shifts and LVMH's missteps pile up.

Luxury alone doesn't guarantee profits...

Luxury alone doesn't guarantee profits...

LVMH remains the largest luxury goods company on the planet.

But today's consumers expect more. They also want transparency, personalization, and flawless retail experiences. And when they don't get that, they leave.

Market expectations for LVMH have stabilized since the pandemic surge. But investors may be underestimating just how fragile its "luxury moat" has become.

If consumer demand keeps falling and LVMH stumbles again, its profitability could tank. Ultimately, the company's luster is fading... and investors need to tread carefully.

Regards,

Joel Litman

August 13, 2025

In 2021, LVMH Moët Hennessy (MC.PA) pulled off one of the boldest moves in luxury retail history...

In 2021, LVMH Moët Hennessy (MC.PA) pulled off one of the boldest moves in luxury retail history...