Health insurance was one of the market's most dependable businesses...

Health insurance was one of the market's most dependable businesses...

For decades, these companies could set their own prices for monthly premiums. Because they represent so many customers, they gained tremendous leverage over hospitals and drugmakers.

That structure helped create giants like UnitedHealth (UNH), Elevance Health (ELV), and Cigna (CI). While they were never exciting, they were reliable. UnitedHealth is up more than 100,000% since our data starts in the '80s.

Elevance and Cigna have both risen by several thousand percent in a similar time frame.

Profitability held up even through economic downturns. During the pandemic, returns improved as government subsidies sought to keep enrollments stable.

But that once-dependable backdrop is changing. President Donald Trump is pushing drugmakers to cut prices. And insurers, once largely ignored, are now taking some heat. Trump is framing them as part of the cost problem rather than a neutral intermediary.

The market is growing uneasy with health insurers. And as we'll explain, the industry's longstanding stability is weakening.

A major source of insurers' recent strength came from Washington...

A major source of insurers' recent strength came from Washington...

Pandemic-era legislation expanded Affordable Care Act subsidies... pulling millions of new members into exchange plans.

One subsidy opened signups to folks of all income levels, not just lower-income groups. Another limited payments as a percentage of household income.

But those subsidies became a major political debate during the recent government shutdown. While they help provide health care coverage to more Americans, they're also expensive.

Congress chose not to extend them. They've since expired.

As subsidies end, enrollment is shrinking. And it's skewing older – meaning higher medical costs per member and less profitability, on average.

Medicaid is moving in the same direction. Trump's Big Beautiful Bill, signed back in July, is expected to cut roughly $1 trillion from the program.

And these changes are scaring investors away from health insurance.

Insurers like UnitedHealth and Centene (CNC) have lost about 30% of their value in the past year...

Insurers like UnitedHealth and Centene (CNC) have lost about 30% of their value in the past year...

These stocks have been top performers for decades. Now, investors are worried that insurers' collective power is finally eroding.

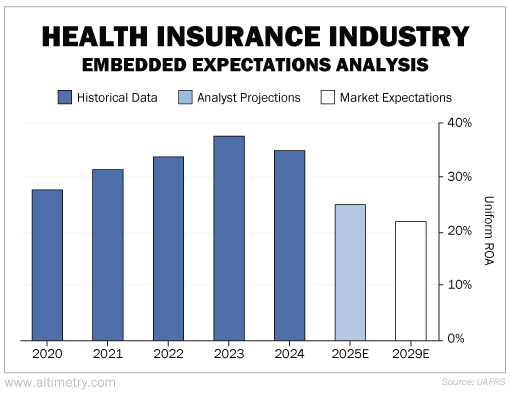

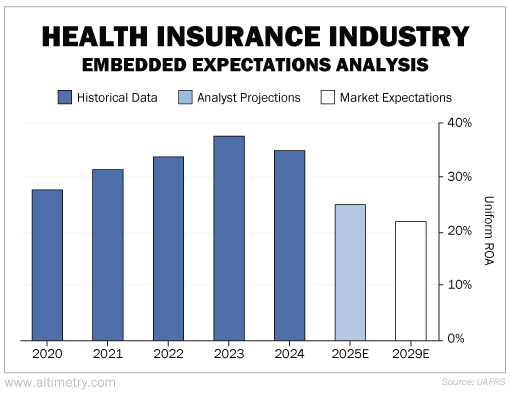

We can see this through our aggregate Embedded Expectations Analysis ("EEA") framework.

We start by looking at the average stock price for top managed-care companies. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well insurers have to perform in the future to be worth what the market is paying for them today.

Longtime subscribers know we also look at near-term Wall Street expectations. Analysts tend to have a pretty good grasp on where a company or industry is headed in the next year or two.

Our aggregate EEA looked at data from UnitedHealth, CVS Health (CVS), Elevance, Cigna, Centene, and Molina Healthcare (MOH).

They've averaged a Uniform return on assets ("ROA") above 30% for years. But analysts think last year's returns will be around 25% when the numbers are finalized.

And as for investors... their long-term expectations are even worse. These folks expect the top health insurers' average Uniform ROA to be just 22% by 2029.

Take a look...

Investors are worried that the best is over for insurers.

Trump has publicly criticized their role as middlemen. He has even floated ideas that would route funding directly to patients rather than through health plans.

The administration has taken a softer tone with drugmakers willing to negotiate. But insurers that pushed back have found little sympathy.

The message is straightforward... insurance is in the crosshairs.

The worst is yet to come for this industry...

The worst is yet to come for this industry...

Health insurers were once considered investment gems because of their predictability. Their relationship with the government and their tremendous bargaining power gave them a safe position.

Trump has made it clear that's no longer the case.

The insurance business model hasn't changed. But when an industry relies heavily on public policy, changes in political direction matter more.

Right now, policy momentum is moving against insurers. Don't let the cheap prices tempt you.

Regards,

Joel Litman

January 6, 2026

Health insurance was one of the market's most dependable businesses...

Health insurance was one of the market's most dependable businesses...