Electric vehicles ('EVs') have had a tough year...

Electric vehicles ('EVs') have had a tough year...

Back in July, the Trump administration rolled back legislation that included tax breaks for buying EVs.

U.S. EV adoption forecasts plunged. EVs only make up about 8% of today's new-car sales. Analysts previously forecast that number to reach 48% by 2030. But they now only expect it to hit 27%.

In other words, current expectations for EV adoption are almost half of what they were.

The problem is, big automakers built their strategies around a version of the future that no longer exists. Starting around 2020, they funneled billions of dollars into beefing up EV production – only to halt almost all of it over the past few years.

The industry-wide write-downs are ugly. And they're still growing. Automakers took a gamble on EVs and lost big... to the tune of $50 billion across the industry.

Those same automakers are now desperate to reclaim some of their losses. And like so many companies today, they're doing it by chasing the latest trend.

Since EVs were a multibillion-dollar bust, automakers and battery partners are overhauling their factories...

Since EVs were a multibillion-dollar bust, automakers and battery partners are overhauling their factories...

Their goal is to make something similar, but for a different customer...

We're talking about energy storage systems.

These systems are a critical part of the data centers that power the AI boom. They're basically stacks of batteries – paired with software – that can store power on-site and help data centers manage load.

Put simply, energy storage systems provide uninterrupted power to avoid data-center outages.

In some cases, storage can even help buyers skip the grid interconnection line.

Automakers are overhauling 10 North American EV plants to make data-center batteries. You'll likely recognize plenty of the businesses involved... like Stellantis (STLA), General Motors (GM), and Ford Motor (F).

And this pivot to a new, popular market isn't a bad thing... in theory...

And this pivot to a new, popular market isn't a bad thing... in theory...

On paper, it's better that these factories are producing something rather than sitting idle.

It's also a good way to get investors back on board. They've been bombarded with headline after headline about the failing EV market for years.

The problem is, this pivot isn't doing much for profits...

By rushing to make these data-center batteries, Ford and the other big automakers are going to flood the market. And energy storage is already pretty competitive. Chinese battery makers already sell backup systems to data centers for less than American producers like Tesla (TSLA).

Tariffs are narrowing the gap. But the competitive pressure is still too high for all these companies to make money by selling what's already a hot commodity.

Let's use Ford as a case study. Last year was a tough one for the legacy automaker. The company wrote down almost $20 billion in EV investments.

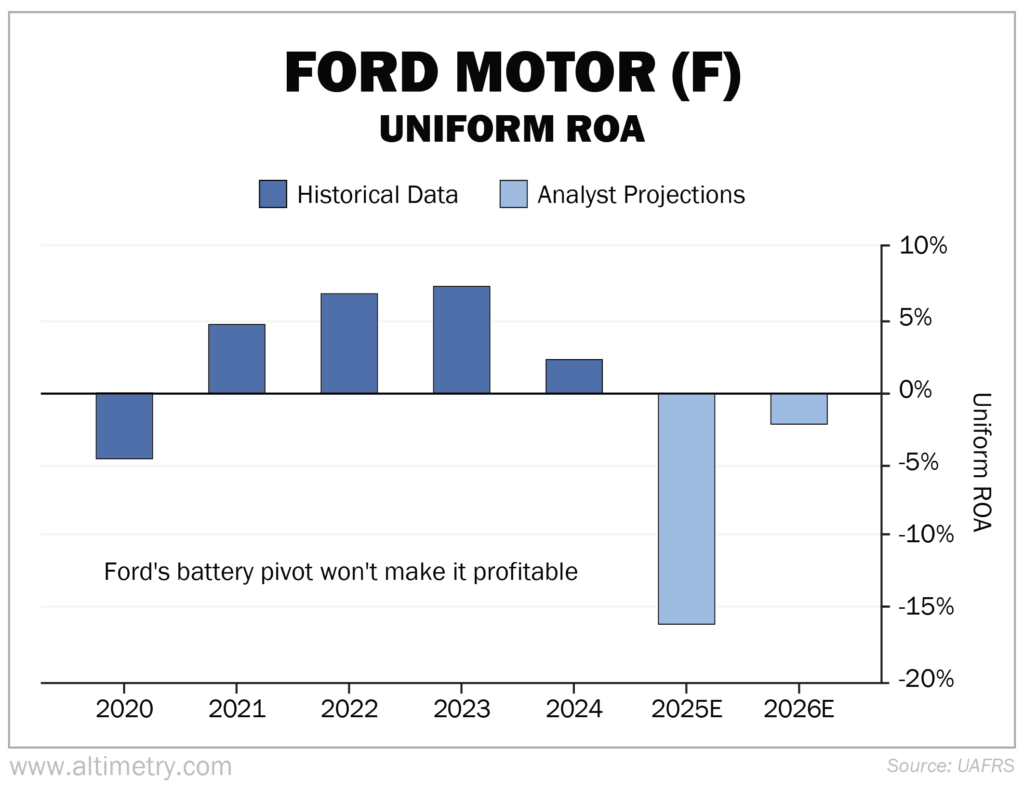

Uniform return on assets ("ROA"), which was an already-low 2% in 2024, is expected to be negative 16% when 2025 numbers are finalized.

Investors (and Ford itself) are hoping the push into batteries will make back those losses. But 2026 doesn't look much better. Returns are projected to improve... somewhat.

But they'll still stay negative through at least this year...

As it stands, Ford is still set to lose money this year. The business pivot won't be enough to fix profits.

And even in a good year, Ford's highest recent Uniform ROA was just 7%... barely above breakeven.

It doesn't seem like batteries will make much of a difference.

Legacy automakers are catering to the AI market...

Legacy automakers are catering to the AI market...

However, the pivot won't help as much as they're hoping.

Sure, plants will stay active. That might excite investors, at least in the short term.

But automakers don't seem to have had much trouble overhauling their facilities. There's not much of a competitive edge in the product.

And over the coming months, we could see a flood of batteries hit the market... the opposite of what investors are looking for.

Automakers like Ford seem to be replacing one low-return business with another. Shares might pop at first. But this plan doesn't bode well in the long run.

Regards,

Joel Litman

February 20, 2026

Electric vehicles ('EVs') have had a tough year...

Electric vehicles ('EVs') have had a tough year...