On paper, Microsoft's (MSFT) most recent quarter looked like a victory lap...

On paper, Microsoft's (MSFT) most recent quarter looked like a victory lap...

The company posted its first-ever $50 billion quarter in cloud-technology revenue.

Yet Wall Street hit the "sell" button.

The stock dropped so violently, it lost $357 billion in market value in a single trading session. It was Microsoft's steepest one-day wipeout since 2020. And it's still down 18% year to date.

Other tech giants have followed suit...

Alphabet's (GOOGL) cloud-tech revenue grew 48% in the latest quarter. And Amazon's (AMZN) cloud business rose 24%, which beat analyst estimates.

But all three stocks are down since reporting earnings. The problem is, software is in a rout.

AI startup Anthropic's Claude coding tool reignited fears that "software will get automated away."

Whether or not that's true, it's driving a lot of emotional investing. But it's also creating good entry points for investors who recognize the magnitude of the AI build-out.

The market isn't paying attention to the fundamentals...

The market isn't paying attention to the fundamentals...

Instead, it's buying into the narrative that software is losing its footing. The hard data says otherwise.

You see, along with Big Tech's strong quarterly results, companies like Microsoft and Alphabet announced major spending in 2026...

Alphabet is carving out up to $185 billion in capital expenditures ("capex") this year. That's more than it has spent in the past three years combined. And most of that capex is aimed at building the data centers that power AI projects.

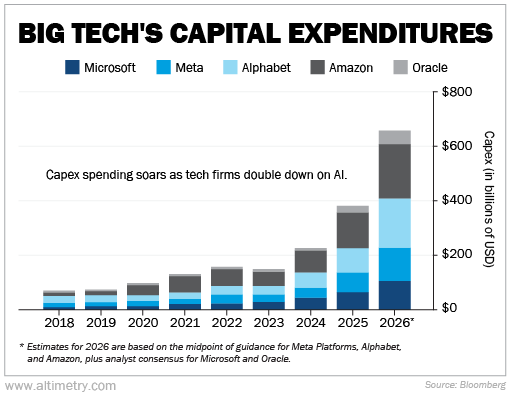

The five biggest U.S. tech companies are forecast to hit about $650 billion in capex in 2026, based on company guidance and consensus estimates.

That's nearly triple the $224 billion total in 2024. And it's substantially higher than last year's $380 billion figure. Take a look...

These aren't hollow statistics...

Big Tech companies are already following through on their AI promises...

Big Tech companies are already following through on their AI promises...

Alphabet is aggressively scaling its custom microchip to power Project Genie – the company's generative-AI research prototype.

Microsoft is securing massive quantities of graphics processing units and central processing units to expand its AI infrastructure. That's the only way it can meet the exploding enterprise demand.

Last week alone, Alphabet raised almost $32 billion through bond issuances. And that's just one week after Oracle borrowed $25 billion. Morgan Stanley expects Big Tech companies to borrow as much as $400 billion throughout the year.

This is what tends to happen in a serious investment cycle...

This is what tends to happen in a serious investment cycle...

Companies don't borrow billions of dollars unless they're in a spending mood.

Now, investors are right to fear the latest software panic... especially with all the volatility we saw last year.

Back in January 2025, we warned that the AI investment cycle would bring several big drawdowns. But our advice was clear... These would be buying opportunities.

Big Tech companies are prioritizing AI... whether they're investing in new AI chips or global cloud capacity.

This goes hand in hand with current capex trends. (And the bond market is still bankrolling these investments.) If that continues, any temporary sell-offs will be just that: temporary.

Make no mistake... The companies leading the AI build-out are more confident than ever... and you should be, too.

Regards,

Joel Litman

February 18, 2026

On paper, Microsoft's (MSFT) most recent quarter looked like a victory lap...

On paper, Microsoft's (MSFT) most recent quarter looked like a victory lap...