Private credit has been a little too quiet lately...

Private credit has been a little too quiet lately...

We saw some major blowups last year – like $10 billion auto-parts supplier First Brands, which went belly-up in late September.

But contrary to what you might expect, we haven't seen much in the way of panic in private credit or private equity.

Part of that uncharacteristic calm has to do with interest rates. In a higher-rate world, lenders have been collecting double-digit yields. Investors aren't in a rush to complain about that.

The SPDR SSGA IG Public & Private Credit Fund (PRIV) – about as close as we can get to a private-credit index – has been flat in the past year.

But we're not out of the woods yet. Private credit is now coming up against its next major hurdle...

Surviving the AI-led software rout.

AI threatens to undo as much as a decade of software investments...

AI threatens to undo as much as a decade of software investments...

And private lenders could be stuck collecting pennies.

One lender has already hit the brakes. Marathon Asset Management is a major private credit lender. And as of June 2025, the company stopped lending to software companies altogether.

The reason is simple... AI is moving too fast for comfort. What seems like a good, safe deal today could be worthless tomorrow.

That even applies to software companies investing in AI. There's no guarantee those businesses will have an advantage tomorrow. A five-year loan assumes the borrower's product stays relevant long enough to keep renewing contracts and paying interest.

But in the age of AI, there's no guarantee. Features that used to take quarters to build are becoming simple prompts. The "stickiness" lenders used to underwrite is getting harder to prove.

Marathon CEO Bruce Richards framed it as a "Blockbuster Video moment" for software. He said we're seeing a wave in which business models either adapt quickly or get left behind... with near-zero recovery rates for lenders.

Today's tough environment could spell disaster for many creditors...

Today's tough environment could spell disaster for many creditors...

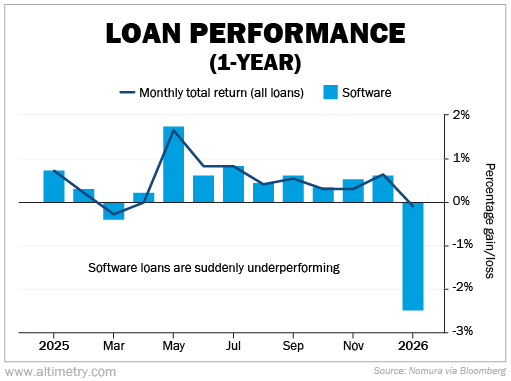

Throughout 2025, software loans largely matched the return of the overall loan market.

But those same software loans lost 2.5% in January alone... while the rest of the market was roughly flat.

Software loans are coming under pressure because of AI disruption. And financial-services firm UBS expects things to get much worse...

In its "aggressive disruption" scenario, UBS sees U.S. high-yield defaults reaching 4%. Defaults would jump to 13% in private credit.

That's Armageddon territory.

UBS also estimates that as much as 35% of the $1.7 trillion private credit market is exposed to AI disruption risk.

In other words, this isn't a niche problem confined to a handful of bad deals.

Creditors spent years giving cheap debt to software companies... and that system could be about to implode.

Now, we're not saying it's time to panic...

Now, we're not saying it's time to panic...

So far, this is all speculation. Software companies aren't declaring bankruptcy left and right.

But it's still a good reminder that all is not well in private credit. Just because the sector has been quiet doesn't mean it's safe.

AI is only going to make things harder on the crowded software market. And private lenders can't do much about it.

They've already made the loans. Now they have to deal with the consequences. But you don't have to...

There are plenty of publicly traded private creditors. And you should stay far away – no matter how "cheap" they might get.

Regards,

Rob Spivey

February 9, 2026

P.S. We're living in unprecedented times for the credit markets – both private and public.

In fact, my team and I are following a fast-moving story in corporate credit that's already playing out in the national news.

And most folks have no idea what it means.

This is one of the best opportunities we've seen in decades. It involves a chance to make up to 6 times the return of stocks... with the risk profile of U.S. Treasurys. But the window of time to buy in is closing fast. Learn more here.

Private credit has been a little too quiet lately...

Private credit has been a little too quiet lately...