Retail industry players converged for the 'Big Show' in New York last month...

Retail industry players converged for the 'Big Show' in New York last month...

But it looked more like a technology conference than a retail expo.

Google (GOOGL), Microsoft (MSFT), and Salesforce (CRM) all set up booths in the Jacob Javits Center to promote their latest innovations... around shopping.

To find a product, you'd normally type its name in a search engine and sort through results. You might also toggle between web pages to compare products. Soon, AI "agents" will do all that work for you.

Market research firm Emarketer expects AI-driven sales to generate about 1.5% of U.S. e-commerce retail this year. That might sound like a drop in the bucket. But shopping behaviors can quickly take off once consumers get comfortable with new technology.

Web-based search engines used to decide who dominated online retail. AI is now beginning to dictate product options. And retailers are rushing to become the top recommendations on agentic AI platforms.

Right now, one retail giant is playing defense while a worthy challenger is leaning into the opportunity. We'll detail what investors should expect in the next few years... as AI defines the next stage in search engine optimization ("SEO").

In theory, Amazon (AMZN) should be owning this trend...

In theory, Amazon (AMZN) should be owning this trend...

After all, it wrote the playbook on e-commerce and built an entire logistics machine. The latter still sets the bar for delivery speed and reliability in online retail.

Amazon also has a massive cloud business. That means it has the infrastructure to power AI's large language models. Yet the early AI shopping data is pointing elsewhere...

According to analytics firm Similarweb's referral data (which covers major retailers and marketplaces), Walmart (WMT) doubled its share of monthly referrals from AI platforms through 2025...

It reached 32.5% by December. Amazon's share, on the other hand, slid from about 40% in January 2025 to below 11% by December.

That doesn't mean Amazon's core business is collapsing.

Although it does reflect a clear difference between the companies' AI strategies...

Although it does reflect a clear difference between the companies' AI strategies...

Walmart has been using AI as a tool to boost sales. It also hired Sean Scott – an AI shopping executive who has worked at Google and Amazon – to lead the effort.

Walmart struck up partnerships that have pushed its products directly into AI search results. Google's Gemini chatbot, for example, prioritizes Walmart items for online shoppers. The company also announced a deal with OpenAI to support this retail push.

Amazon has been more guarded... Its website blocks many shopping chatbots, including those developed by startups and tech groups like Anthropic. (Interestingly, Amazon owns a stake in that company.)

When Perplexity's Comet agent (an AI-powered web browser) sidestepped its restrictions, Amazon sued.

For Amazon, this is about controlling its brand...

Agentic AI mimics human interaction and decision-making. It also raises questions about transparency and liability. Amazon thinks this could erode its customer relationships.

The technology could also hurt "retail media" – the high-margin business of selling sponsored ads inside a retailer's search results... Online shoppers could ignore the ads and simply choose an AI agent's recommendations.

Investors already seem to understand that Walmart is the early leader in this space...

Investors already seem to understand that Walmart is the early leader in this space...

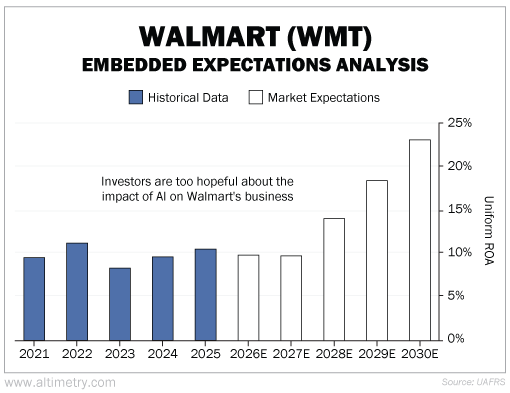

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Unsurprisingly, Walmart is a solid business... Its Uniform return on assets ("ROA") typically falls between 8% and 11%. However, investors expect it to hit an unprecedented 23% by 2030. Take a look...

Simply put, investors expect a steep improvement in Walmart's future performance. Although AI-powered commerce has a lot of upside, we believe that outlook is too optimistic.

Chatbot optimization is the next phase of SEO...

Chatbot optimization is the next phase of SEO...

And Walmart is leading the pack today. But it's still early.

Retailers that welcome AI agents and sales partnerships will likely become the top recommendations when consumers ask chatbots about specific products.

Retailers that restrict AI agents will have to keep customers inside their retail bubble. But that's not a guarantee.

Web-based searches created the first era of e-commerce winners. The next one is being built inside agentic AI platforms. Retailers who treat those platforms like prime shelf space will come out on top.

Regards,

Joel Litman

February 5, 2026

Retail industry players converged for the 'Big Show' in New York last month...

Retail industry players converged for the 'Big Show' in New York last month...