Last year was set to end on a high note... Then the Federal Reserve got involved.

Last year was set to end on a high note... Then the Federal Reserve got involved.

Just two weeks before the end of 2024, the central bank graced us with its worst decision day in 23 years.

Chair Jerome Powell announced the Fed would cut rates by another 0.25%... but warned that investors could expect no more than two cuts in 2025.

Investors panicked. The S&P 500 fell 3% in one day. Folks are now worried about persistent inflation and a weaker 2025 economy than we were promised.

But we're still beating the same drum we have been for months.

Nothing has changed in terms of how strong the economy should be this year...

Nothing has changed in terms of how strong the economy should be this year...

Corporate credit availability is finally improving. Companies will be able to borrow and invest in their operations.

And with the incoming administration's tax plans, corporations have no excuse not to grow earnings this year.

It's natural to worry when stocks start falling. That said, the last thing you want to do is sell when the market is set up for success.

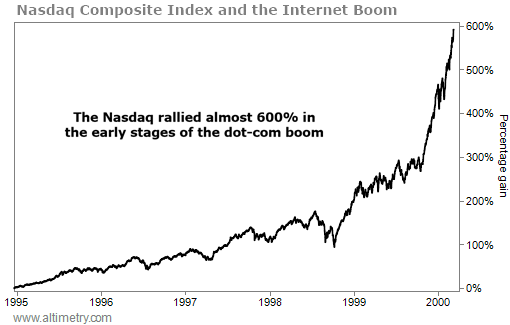

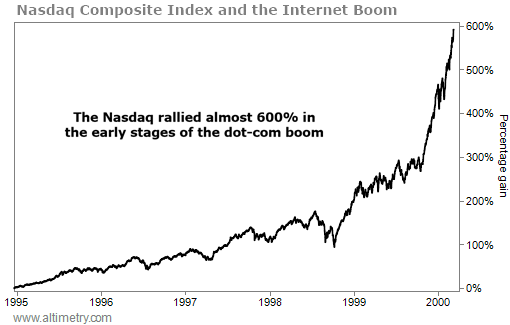

Back in July, we wrote that today's market looks a lot like the early stages of the mid-to-late-'90s Internet boom. Since the launch of ChatGPT, the Nasdaq is up 68%... and we're still far from the best part of the market rally.

The Nasdaq went on to rally nearly 600% through the March 2000 market top...

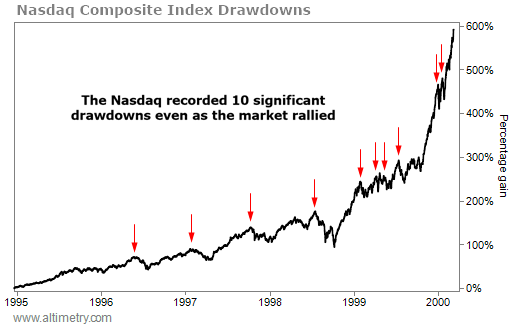

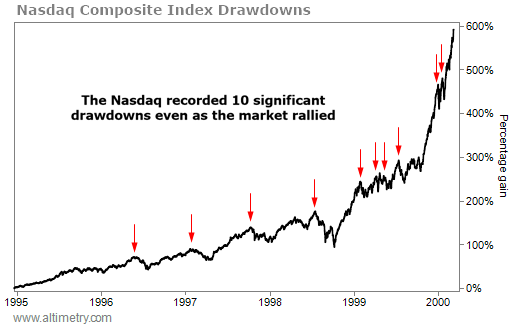

In hindsight, it's hard to imagine why anybody wouldn't have stuck with that market. That is, until you realize how many times the average investor would've panicked...

Despite how strong that market rally was, the Nasdaq fell 10% on 10 separate occasions over that five-plus-year period.

Take a look...

Each of those drawdowns would've felt like the market top at the time. Plus, folks who sold out of fear would've struggled to find a good place to buy back in.

Our point is simple... As long as the market has reason to grow, like it does today, the best thing to do is remain patient when the market is volatile.

Even after the recent sell-off, both valuations and investor sentiment are bullish...

Even after the recent sell-off, both valuations and investor sentiment are bullish...

That means we could continue to experience short-term volatility. That doesn't mean investors should panic.

We're seeing all the key factors that drive the market, from limited debt headwalls to improving credit availability, growing corporate investment, and a backdrop of deregulation and potential tax reductions.

Investors should recognize the pullbacks as just that... pullbacks in a bull market.

Regards,

Rob Spivey

January 6, 2025

Last year was set to end on a high note... Then the Federal Reserve got involved.

Last year was set to end on a high note... Then the Federal Reserve got involved.