We'll warn you now – a lot of folks won't like what we're about to say...

We'll warn you now – a lot of folks won't like what we're about to say...

But if you've been following our research for a while, it shouldn't come as a surprise.

You see, much of the investing world is fixated on price action. They believe you can tell where stocks are going next by examining what stocks are doing now.

The market has rallied 69% since it bottomed in early October 2022. So, as the conventional logic goes, we must be in a bull market.

Here's what they don't realize, though...

The market bottom doesn't really matter.

Economists base the traditional definition of a bear or bull market – arbitrarily – on price action...

Economists base the traditional definition of a bear or bull market – arbitrarily – on price action...

If the market is up 20%, it's a bull market. If it's down 20%, the bears have their day.

But smart investors understand price action doesn't tell the full story... not by a long shot. Rather, you have to track the real fundamental driver of a bull or bear market.

And that's credit.

Look at what happened during the dot-com bust, which bottomed out in October 2002. The S&P 500 stopped falling as investors decided valuations were overblown... and started buying stocks.

Folks had no reason to be so bullish, though. U.S. corporations were still starving themselves of capital. They weren't investing in their own businesses.

We can see this through commercial and industrial (C&I) loan growth. Companies use C&I loans to fund capital projects instead of relying on cash flows. So we can tell a lot about corporate investment and the corporate outlook from C&I loan growth trends.

From October 2002 through May 2004, these loans just kept shrinking. They dropped from about $1.1 trillion to $850 billion... a sure sign we weren't in an actual bull market.

And yet, the market rallied more than 40% in that time frame.

Once lending started to take off, the economy really started growing. C&I loans increased from $850 billion to about $1.5 trillion in 2008. And the stock market took off, too.

The same thing happened following the Great Recession. Stocks bottomed in March 2009... and recovered for no real reason (from a fundamental standpoint).

People were still worried banks might go under. Bankruptcies were still high. But at last, it looked like the world might not end. So investors started buying.

The market rallied 68% from those March 2009 lows, all while corporations still couldn't borrow. It wasn't until October 2010 that businesses started to invest in themselves and the economy soared another 200%.

We haven't seen much corporate loan growth since October 2022...

We haven't seen much corporate loan growth since October 2022...

Companies haven't been willing to invest, thanks to high interest rates and tight credit standards. By that definition, the past two years have resembled a truly impressive bear market rally... not a bull market at all.

That is, until now.

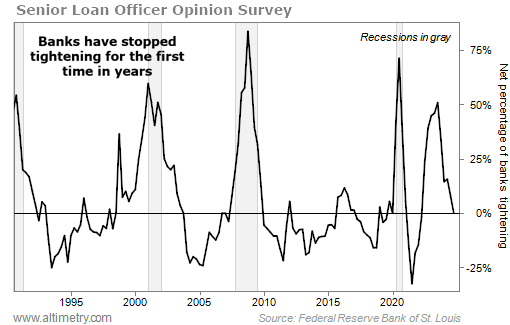

At long last, banks are finally showing signs of life. Just look at the Senior Loan Officer Opinion Survey ("SLOOS")...

Longtime subscribers know the SLOOS is a poll conducted every quarter by Federal Reserve regulators. It asks loan officers if their lending standards have tightened, loosened, or stayed the same over the past three months.

Said another way, it tells us how willing banks are to make loans... and how easy or difficult it is for corporations and consumers to access credit.

The chart below shows the percentage of domestic banks that tightened standards for C&I loans to large- and middle-market firms.

For the first time in 10 quarters, banks didn't tighten their lending standards. Take a look...

Banks are coming to terms with the fact that we don't need to worry about a wave of defaults.

It will take some time, of course...

It will take some time, of course...

After 10 straight quarters of tightening lending standards, it's still pretty tough to get a loan.

But this is the first step toward better access to credit. And as we'll explore tomorrow, companies are taking any opportunity they can to raise money.

As banks start lending again, this market rally could really accelerate. It was a key missing ingredient to take the economy and the stock market to the next level.

We're still waiting on one more ingredient... significant corporate earnings growth. Now that companies can get bank loans, we're ready to enter the "good" part of the rally.

Regards,

Rob Spivey

December 3, 2024

We'll warn you now – a lot of folks won't like what we're about to say...

We'll warn you now – a lot of folks won't like what we're about to say...