This summer, residents across Columbus, Ohio opened their energy bills to an unpleasant surprise...

This summer, residents across Columbus, Ohio opened their energy bills to an unpleasant surprise...

Their monthly bills jumped an unexpected $27.

And the culprit wasn't a heat wave or a new power plant tax...

It was just AI.

The surge came as utility companies scrambled to supply power to nearby data centers. These aren't your average server rooms... they're sprawling, high-intensity AI clusters.

Each demands as much electricity as tens of thousands of homes.

This trend isn't isolated to Ohio. Capacity prices at PJM Interconnection, which oversees energy flow in 13 states, shot up more than 830% last year. Nearly three-quarters of that jump was tied directly to data center demand.

From Virginia to Illinois, the pattern is repeating. Utilities are paying a premium to keep the grid online. They're passing the cost straight to consumers.

But that doesn't mean there's no way to profit. Thanks to some key regulatory changes, the tide may be turning for a once-sleepy energy mainstay...

Independent power producers are the first to profit from the AI energy boom...

Independent power producers are the first to profit from the AI energy boom...

Also called "IPPs," these companies are a bit different from your usual energy utility.

Utilities own and operate most power plants. And since most utilities have a monopoly over their regions, they're heavily regulated. They can only charge a slight premium above their costs, at pre-negotiated rates.

Regulation stabilizes utilities' returns when energy prices are low. But it also caps profitability when prices rise.

IPPs sell power to customers at the market rate. While IPPs struggle when energy prices are low, they outperform traditional utilities when prices take off.

In today's AI-heavy environment, IPPs are in a prime position. Vistra (VST), one of the biggest IPPs in the U.S., is seeing cash flows surge alongside energy prices.

The market has been quick to react. Shares are up more than 150% in the past year.

IPPs have become indispensable in deregulated markets like Texas and parts of the Midwest. They're helping meet the grid's growing needs while generating higher margins than traditional utility peers.

Regulated utilities, meanwhile, have lagged in profitability. Because their rates are set by state commissions, they can't always raise prices to reflect higher costs.

But pretty soon, regulated utilities might follow in the footsteps of IPPs...

But pretty soon, regulated utilities might follow in the footsteps of IPPs...

In the first half of 2025, utilities requested a record of $29 billion in rate adjustments.

Typically, about 60% of any particular rate increase gets approved. So we're in for a record year of utility prices... and utility profits.

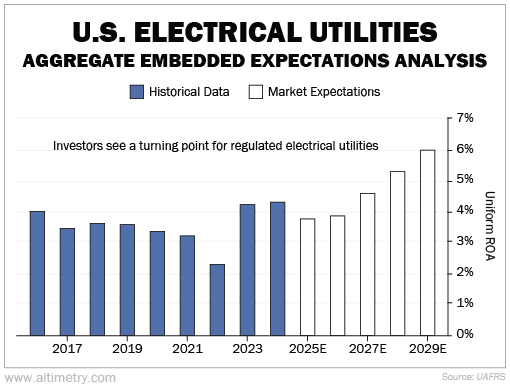

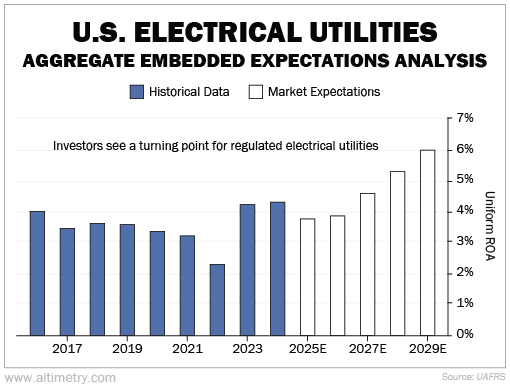

The market is taking notice. We can see this through our aggregate Embedded Expectations Analysis ("EEA") framework.

We start with the average stock price of all U.S. regulated electrical utility companies.

From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well the U.S. regulated electrical utility industry has to perform in the future to be worth what the market is paying for it today.

Profitability has been stable enough in this industry... but nothing to write home about. Uniform return on assets ("ROA") has hovered around breakeven, between 3% and 4% over the past decade.

But even regulated utilities are finding ways to recoup their investments faster. Investors are getting excited. They think Uniform returns can reach 6% by 2029.

Take a look...

Investors believe regulated utilities will follow in the footsteps of IPPs. If that happens, industry valuations won't stay put for long.

This could be one of the biggest regulatory changes we've seen in energy...

This could be one of the biggest regulatory changes we've seen in energy...

Investors already expect higher returns out of regulated utilities. Regulators are helping these companies funnel cash into important investments, like transmission upgrades and battery storage.

In short, utilities should start to make a bit more money than they have in the past.

This has long been viewed as a sleepy industry because of profit caps. But investors know the utility story is changing. Expect a lot more eyes on the energy and power industries.

Regards,

Joel Litman

August 12, 2025

P.S. There's another hidden piece of this energy puzzle. And it's coming to a head much sooner than you think.

My team has been tracking a disturbing story out of Washington, D.C. It involves a broken regulator... and a situation that could spiral into a 2008-style meltdown in a matter of weeks.

If you're caught off guard, I believe what's coming could be one of the worst days of your financial life. But with just a few straightforward steps, you can prepare your wealth before it hits. Get the details here.

This summer, residents across Columbus, Ohio opened their energy bills to an unpleasant surprise...

This summer, residents across Columbus, Ohio opened their energy bills to an unpleasant surprise...