There's a long-running joke in corporate America about the 'Big Three' consulting firms...

There's a long-running joke in corporate America about the 'Big Three' consulting firms...

In short, CEOs who hire McKinsey, Bain, or BCG ("MBB") are spending millions of dollars... all so a fresh MBA student can tell them to "fire people and cut costs."

As if they didn't already know that's the best way to improve their businesses.

Honestly, the joke has some basis in reality. But it isn't totally true. If you talk to most CEOs, they'd tell you that over the past 25 years, MBB has been more focused on three buzzwords...

Outsource. Just-in-Time. Lean Six Sigma.

If only companies could get someone else to do their manufacturing for them... run with as little working capital as possible... and get super-efficient at the manufacturing they do handle... shares would shoot higher.

It's that simple... at least, if you ask the Big Three.

Of course, in reality, running a business is far more complex than that advice might make you believe. And after two decades of slimming down our domestic assets, corporate America was due for a wake-up call...

For almost all of 2000 to 2020, U.S. corporations took MBB's advice...

For almost all of 2000 to 2020, U.S. corporations took MBB's advice...

They made a conscious decision to not invest in their own assets. They found others to do the heavy lifting.

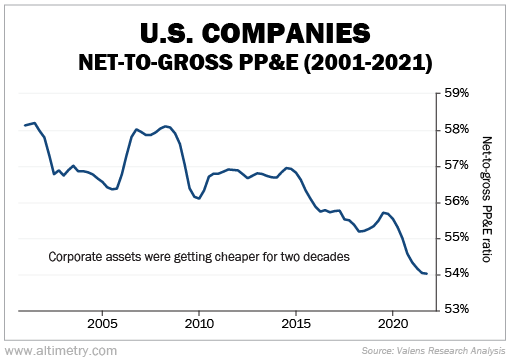

This trend played out through two data points, both involving property, plant, and equipment (PP&E)...

Gross PP&E is the total value a company has paid for all its assets – factories, machinery, data centers, offices, computers, trucks, you name it.

Think of it like a car. A 2024 Honda Accord retails for $28,000. That's gross PP&E.

Then there's net PP&E... the current value of all those assets after they've been used for some time.

In our Honda Accord example, that would be the value of the car after you've driven it for a few years. You've put miles on it. Maybe it has been in an accident. It certainly has some normal wear and tear. It might only be worth $24,000, or maybe $21,000.

To track how old corporate assets are, we compare net to gross PP&E...

To track how old corporate assets are, we compare net to gross PP&E...

The lower the ratio, the older the assets.

In 2001, the net-to-gross PP&E ratio sat between 58% and 59%. Said another way, the average company's assets were roughly 40% through their usable life.

By 2010, that metric sat between 56% and 57%. And by early 2021, as we emerged from the worst of the pandemic, the ratio had dropped to 54%...

Companies were desperate to conserve cash as they recovered from COVID-19. But they let things go too far...

Rolling global shutdowns prevented goods from getting out of ports. Supply chains were a disaster. They were far too complex and running with limited inventory.

The Big Three's advice wasn't working anymore. So companies started to reinvest... and rebuild their supply chains closer to home.

The war in Ukraine only furthered these trends. And when the AI explosion took off, it became a race to invest in the U.S. supply chain.

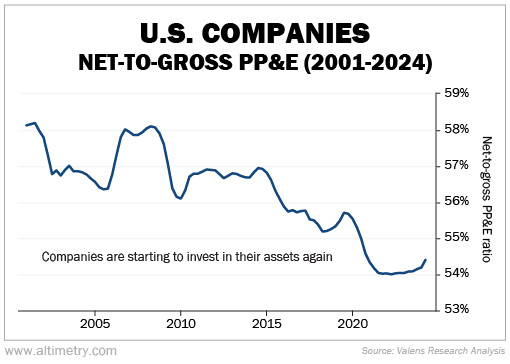

For the first time in a long time, corporate investment is finally turning around. Check it out...

In the past few years or so, the net-to-gross PP&E ratio has jumped from around 54% to 54.5%.

That might seem trivial... But it translates to $1.6 trillion more in net investment.

Big spending commitments from the U.S. government – like the Bipartisan Infrastructure Law, the Inflation Reduction Act, and the CHIPS and Science Act – have combined with these big shifts to change corporate investing.

These types of investment cycles can be long-lasting. And we still have a long way to go...

These types of investment cycles can be long-lasting. And we still have a long way to go...

We'd need at least another $3 trillion in net investment just to get back to the 2019 ratio. Corporations are finally motivated to do it.

So far, all of this has happened even with tight credit standards... meaning limited access to credit. Most of this investment has been financed via cash flows and other means.

The Federal Reserve's rate cuts could push banks to ease standards. That could turbocharge this investment trend... which would lead straight to growing earnings.

And as astute subscribers know, earnings growth is the single most important determinant of where the market goes next.

Regards,

Rob Spivey

November 4, 2024

P.S. Earnings growth tells us a lot about the market's moves... But this week, all eyes are on the presidential election. Investors are desperate to know who will run our country for the next four years...

But if you position your portfolio right, you can win from either candidate's plan.

My team and I have scoured decades of data to find one little-known buy signal that's flashing now. And importantly, it looks the same... no matter who takes office in January. Learn more here.

There's a long-running joke in corporate America about the 'Big Three' consulting firms...

There's a long-running joke in corporate America about the 'Big Three' consulting firms...