Warren Buffett says to buy low and sell high. But Richard Driehaus preferred to buy high and sell higher...

Warren Buffett says to buy low and sell high. But Richard Driehaus preferred to buy high and sell higher...

Driehaus wasn't focused on companies with cheap valuations. Instead, he'd buy stocks at any price... as long as he expected them to grow their earnings in the future.

To Driehaus, earnings revisions mattered more than valuations. Beating market expectations drove most of a stock's performance. And his hedge fund, Driehaus Capital Management, runs a number of earnings growth-oriented funds to this day.

His flagship Driehaus Micro Cap Growth Fund (DMCRX) has returned more than 17% per year since inception... far better than the 7.8% annualized return from its benchmark, the Russell Microcap Growth Index.

And his other flagship fund, the Driehaus Small/Mid Cap Growth Fund (DSMDX), has returned almost 18% per year. That's versus the 12% annualized return of the Russell 2500 Growth Index in the same time frame.

Said another way, these funds returned an extra 6% to 9% per year.

Watching earnings isn't just a job for stock punters. Anyone who cares about the market's direction should be keeping an eye on this metric.

Today, we'll talk about a recent trend in corporate earnings growth... and what investors should do in the wake of interest-rate cuts.

So far this year, investors would have been rewarded for following the Driehaus playbook...

So far this year, investors would have been rewarded for following the Driehaus playbook...

The market saw a big rally in the first six months of 2024. A big reason for that was because of expectations... specifically, expectations for higher earnings in the future.

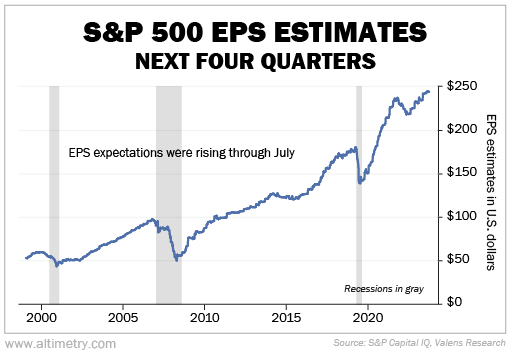

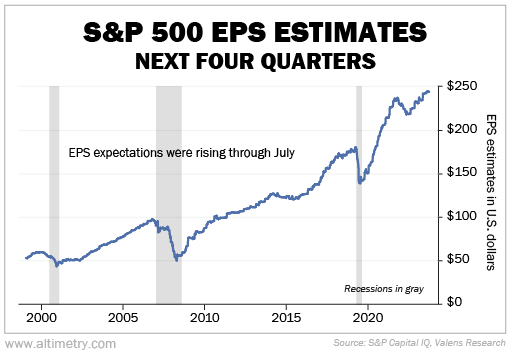

Take a look at the following chart. It shows Wall Street's earnings per share ("EPS") expectations for the next four quarters, at any given time since 1999. Through July, estimates rose about 12%, to $243.

Check it out...

Since July, expectations have flattened out. And so has the market.

But now that the Federal Reserve is cutting rates, folks are wondering where the market will go next. That's when we turn to earnings growth...

The big question has to do with timing. Was last month's 0.5 percentage-point rate cut timed just right to fuel investment and keep earnings growing?

Or was the Fed too slow to see weakening employment metrics... and is the economy already locked in to a recession?

This rate cut was twice as big as many expected. So it may be enough to help the Fed keep the economy humming. After all, the S&P 500 is already up another 2% since the announcement. Investors know lower interest rates can help grow corporate earnings.

But as frustrating as it may be, we simply don't know if it was enough yet...

But as frustrating as it may be, we simply don't know if it was enough yet...

We have to let this rate-cut cycle play out for a while... and see what comes of it.

Employment numbers have been looking shaky. In August, the economy violated the Sahm Rule, a consistent recession indicator.

Much of the market is waiting for big macro data to trickle out. But smart investors would be well served to channel Driehaus... and watch where earnings go.

That will give you the best idea of the market's next direction.

Regards,

Rob Spivey

October 4, 2024

Warren Buffett says to buy low and sell high. But Richard Driehaus preferred to buy high and sell higher...

Warren Buffett says to buy low and sell high. But Richard Driehaus preferred to buy high and sell higher...