Wildfires ripped through Southern California, forcing evacuations and blanketing hillsides in smoke...

Wildfires ripped through Southern California, forcing evacuations and blanketing hillsides in smoke...

As the flames approached Los Angeles County back in January, planes released a thick red fire retardant. The goal was to slow down the blaze before it consumed homes.

Nearly every drop of that liquid came from Perimeter Solutions (PRM) – the only approved supplier of aerial fire retardants for the U.S. Forest Service.

But Perimeter isn't just a government partner... It's the only player in town.

The company has fended off competitors for years. And its fire retardants have become the gold standard in wildfire response.

Over the past 60 years, they've saved thousands of properties from destruction. And the market is starting to catch on, especially as wildfires become more frequent.

Perimeter's stock is up nearly 50% year to date. But, as we'll explain, it may have room to run even higher.

Perimeter has built a monopoly around the U.S. fire-retardant market...

Perimeter has built a monopoly around the U.S. fire-retardant market...

The company controls the nation's product supply. It also operates dozens of air bases used by federal and state firefighting agencies. So they're forced to rely on Perimeter's services and solutions.

Its best-known fire retardants are PHOS-CHEK and FIRE-TROL. And since 2021, their prices have jumped 20% to 30%. Federal spending on these products more than doubled during the same period, reaching about $250 million.

As we noted earlier, Perimeter also knows how to eliminate the competition...

Back in 2021, a promising startup called Fortress entered the scene. After its fire retardant passed the U.S. Forest Service's laboratory tests, Perimeter took action... It lobbied aggressively against the company and cast doubts on product safety.

Regulators delayed Fortress' approval and eventually revoked it altogether. By the spring of 2025, the company shut down, restoring Perimeter's exclusive control.

That kind of market muscle has generated extremely strong earnings...

That kind of market muscle has generated extremely strong earnings...

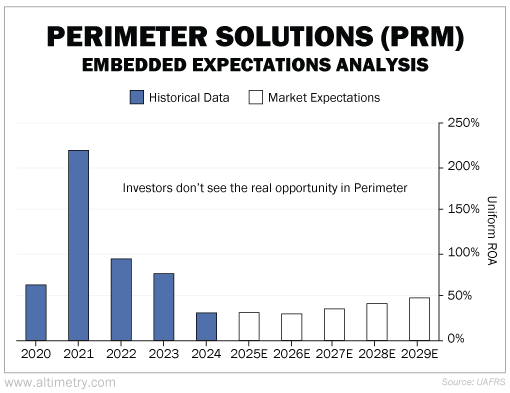

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Perimeter's Uniform return on assets ("ROA") has exceeded 50% every year except for 2024. Take a look...

In the future, the market expects the company to return more than four times the corporate average. But that doesn’t reflect Perimeter's past performance, which could easily repeat.

And it certainly doesn’t capture the company's future potential.

The stock's recent rally doesn't eliminate investment opportunities...

The stock's recent rally doesn't eliminate investment opportunities...

Perimeter has unmatched pricing power and no real competitors in the fire-retardant space.

It also operates within federal and state infrastructure... and influences policy. In short, Perimeter functions more like a public utility than a private supplier.

All these factors are tightening the company's grip on the fire-retardant market.

As the threat of wildfires grows and product prices rise, Perimeter will see more demand and rake in huge profits.

The market is slowly catching on to this trend. But it hasn't yet priced in Perimeter's dominance. That's where the opportunity lies...

Investors who get in now can profit from a growth story that's far from over.

Regards,

Joel Litman

August 21, 2025

Wildfires ripped through Southern California, forcing evacuations and blanketing hillsides in smoke...

Wildfires ripped through Southern California, forcing evacuations and blanketing hillsides in smoke...