Mark Andreessen is getting a second shot at building the future of tech...

Mark Andreessen is getting a second shot at building the future of tech...

Andreessen was instrumental in launching the dot-com era boom. He co-founded the first big Internet browser company, Netscape, in 1994.

Netscape helped set off the next six years of stellar market returns, which most know as the dot-com bubble. Companies set out to build the next big Internet business, any way they could.

The stock market continued to rally hard for years... until people realized how many so-called Internet companies were still half-baked ideas.

Sound familiar?

We're a year and a half into the AI rally. And some of the biggest tech companies investing in AI have started to stumble.

Market darling Nvidia (NVDA) is down 12% in the past month... and where it goes, it feels like the rest of AI goes, too.

The market is quick to react to the headlines. Many folks are now wondering if the AI hype train has run its course.

But as we'll explain today, Andreessen isn't convinced. And neither are we...

Andreessen recently said that every idea from the dot-com bubble would work today…

Andreessen recently said that every idea from the dot-com bubble would work today…

Of course, some companies actually survived... and turned into the biggest Big Tech giants around. Amazon (AMZN) and Google parent Alphabet (GOOGL) are great examples.

But plenty of dot-com failures were in the right place at the wrong time. Pets.com, for example, promised to deliver pet supplies from the Internet. It was basically a precursor to Chewy (CHWY). You can even buy pet supplies on Amazon these days.

Back in 2000, a company called pop.com tried building a service to stream video clips... and it failed spectacularly. Today, Netflix (NFLX) and YouTube are among the most valuable businesses on Earth.

Andreessen sees the similarities between the dot-com era and the AI revolution. Both were kicked off by a landmark moment... Netscape in the 1990s and ChatGPT in 2022. And both feature plenty of hype-chasing businesses desperate to win investor cash.

But for Andreessen, the big difference is technology. We're capable of making a lot more "crazy ideas" actually work this time around.

As many wonder if the AI hype train has already run its course, Andreessen's "a16z" venture-capital fund is investing aggressively.

Late last year, it funneled more than $400 million into Mistral AI... a large language model company competing with OpenAI and others. And in May, a16z invested in Yellow, an AI-powered 3D-graphics company.

Andreessen seems to expect this market to follow the dot-com pattern...

Andreessen seems to expect this market to follow the dot-com pattern...

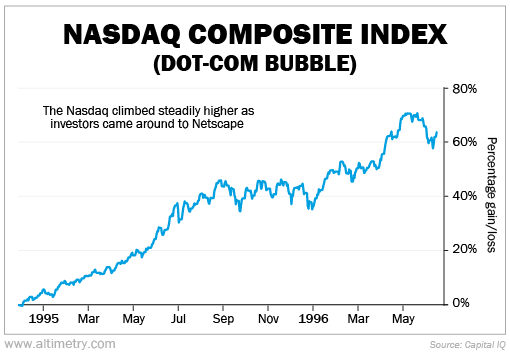

Take a look at the chart below. As you can see, once investors grasped how transformational Netscape could be, they piled in.

The tech-heavy Nasdaq Composite Index climbed a little more than 60% from December 1994 through mid-1996...

Many were already calling for a bubble and stock market mania. They thought the biggest move had already happened... and this was all a lot of excitement over nothing.

In fact, Nobel Prize-winning economist Paul Krugman predicted in the late 1990s that the Internet's value to the economy wouldn't be much greater than the fax machine's.

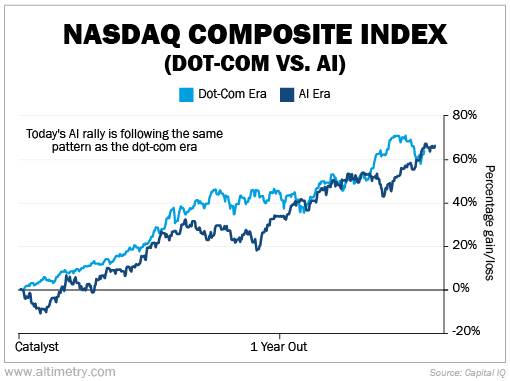

That's about where we are in today's market. OpenAI released ChatGPT to the public on November 30, 2022.

After a year and a half, the Nasdaq is up about 60%...

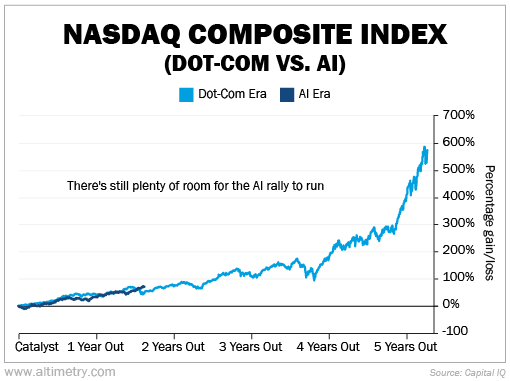

You likely know what happened to the Nasdaq through the market peak in late March 2000. But we'll remind you all the same...

From that fateful launch in mid-December 1994, the Nasdaq rallied almost 600%.

And if history is anything to go by... we're in for a lot more upside from here.

Don't count out the AI explosion yet...

Don't count out the AI explosion yet...

We're still in the early innings of this unprecedented boom. It's not only about the biggest AI players. Plenty of smaller beneficiaries will soar to new heights.

And according to my colleague and Altimetry founder Joel Litman, a big catalyst will soon kick off the next chapter.

Behind the AI buildup, a single dramatic event is set to shake up the entire stock market (and completely blindside investors). This change is coming fast, and it's going to create a lasting impact across the economy.

Joel went live yesterday to reveal the AI bombshell most investors aren't prepared for... and the No. 1 step you need to take with your money today. Click here to watch the urgent free replay.

And keep an eye out for less-popular AI stocks backed by powerful businesses. The AI trend is far from over.

Regards,

Rob Spivey

July 19, 2024

Mark Andreessen is getting a second shot at building the future of tech...

Mark Andreessen is getting a second shot at building the future of tech...