Shell's (SHEL.LSE) June 26 statement was clear: It has 'no intention' of acquiring BP (BP.LSE)...

Shell's (SHEL.LSE) June 26 statement was clear: It has 'no intention' of acquiring BP (BP.LSE)...

This came out soon after news broke that the British oil giants had explored a $200 billion deal.

The merger would have created one of the largest energy companies on the planet. But Shell shut down the rumors fast.

It also triggered a rule that prevents Shell from making a BP offer for the next six months...

Under the U.K.'s Takeover Code, this restriction applies unless another bidder emerges or BP invites an offer.

So right now, Shell doesn't want anything to do with BP. In fact, this energy deal was doomed from the start...

Shell and BP are both trying to untangle the past...

Shell and BP are both trying to untangle the past...

Like most oil supermajors, Shell has taken a lot of heat... Climate advocates say it hasn't gone green fast enough. Oil-and-gas purists say it pursued renewables too aggressively.

Under CEO Wael Sawan, Shell said it would ramp up traditional oil-and-gas investments and generate shareholder returns...

The company has repurchased more than $50 billion of its own stock since 2021. Shell's shares outpaced BP's by 30% during the same stretch.

BP itself never fully recovered from the Deepwater Horizon disaster of 2010. The oil spill killed 11 workers and released millions of barrels of oil into the Gulf of Mexico.

BP tried rebranding itself as a renewables leader by pivoting away from oil and gas. Yet management hasn't delivered on that promise. Activist investor Elliott Investment Management is also calling for a strategic overhaul.

On top of that, BP posted losses in four of the past 10 years. It only became profitable again in 2024. But investors remain skeptical, as shares lag behind nearly every industry peer.

That's why the market doesn't have high hopes for BP...

That's why the market doesn't have high hopes for BP...

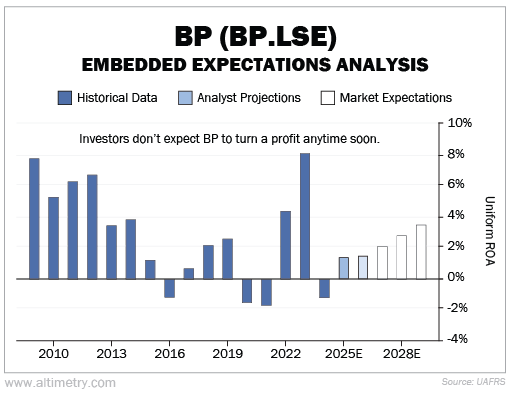

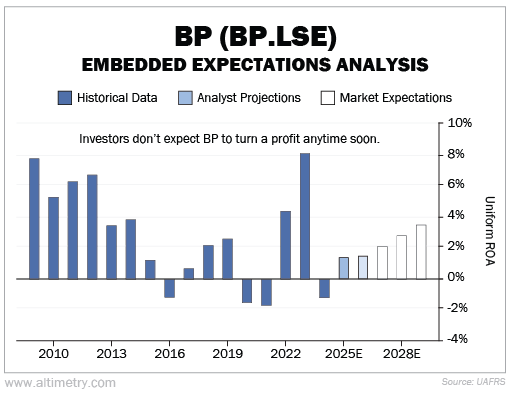

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

BP's Uniform return on assets ("ROA") was negative in 2016, 2020, 2021, and 2024. That's far below the 6% to 8% profitability we saw before 2013.

And analysts aren't too optimistic about a recovery... They project a Uniform ROA of about 1% for the next two years. The market expects it to rebound to 3.5% by 2029 – a definite improvement from current levels. Yet that would still fall below BP's 5% cost of capital. Take a look...

Simply put, investors aren't overlooking BP's value... They're pricing in the company's persistent weakness.

Investors shouldn't count on a BP rescue...

Investors shouldn't count on a BP rescue...

Shell has flirted with a BP takeover before. Rumors of a merger surfaced when oil prices crept up in the early 2000s. But Shell ultimately backed away.

The recent shutdown is even more definitive, given the U.K. bid restriction.

Investors understand that BP isn't a missed opportunity... The company is struggling to restore its image. And industry leaders don't want to absorb its problems.

Ultimately, BP has a lot of work to do if it wants to boost returns... and attract serious investors.

Regards,

Joel Litman

August 14, 2025

Shell's (SHEL.LSE) June 26 statement was clear: It has 'no intention' of acquiring BP (BP.LSE)...

Shell's (SHEL.LSE) June 26 statement was clear: It has 'no intention' of acquiring BP (BP.LSE)...