BP's (BP.LSE) stock just made its biggest move since 2020...

BP's (BP.LSE) stock just made its biggest move since 2020...

And it's all because of Elliott Investment Management – one of the most aggressive activist funds in the world.

Elliott acquired a £3.8 billion stake in BP last month, becoming its third-largest shareholder. The fund now holds 5% of BP's shares.

This was a critical move, as BP has been struggling for years...

Poor strategic bets, leadership shake-ups, and a weak balance sheet put it behind rivals like Shell (SHEL.L) and TotalEnergies (FP.VI)... While their market caps have soared nearly 40% over the past five years, BP's has remained flat.

Simply put, investors are ready for a turnaround. And that's where Elliott comes in...

The activist fund rarely takes on companies without pushing for serious change. And it gets results... The BP stock jumped 8% on the news of Elliott's acquisition, and it could go even higher.

Today, we'll explain why Elliott's involvement could improve BP's profitability... and why the market has yet to recognize its full upside potential.

The energy leader pivoted away from oil and gas in 2020 to focus on low-carbon businesses...

The energy leader pivoted away from oil and gas in 2020 to focus on low-carbon businesses...

But things didn't go as expected...

BP bet that oil demand would peak in 2019, yet it has kept rising. And low-carbon energy hasn't gotten the boost BP expected.

In other words, it was a questionable move that worried investors.

Despite the weak performance that followed, BP's board and management remain largely unchanged. That has put the company directly in Elliott's crosshairs.

Historically, activists like Elliott push for management shake-ups and cost cutting. They focus on high-return businesses, and BP is likely to benefit from that.

Elliott might soon demand executive changes and restore BP's focus on oil and gas. It could also force BP to sell off underperforming low-carbon assets and move its primary listing from the London Stock Exchange to the higher-volume New York Stock Exchange...

That could help a lot more investors gain access to the stock... and get the company trading at higher valuations.

Despite the potential turnaround, investors have little confidence in the company...

Despite the potential turnaround, investors have little confidence in the company...

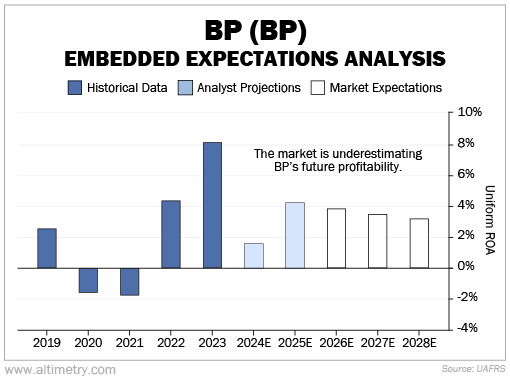

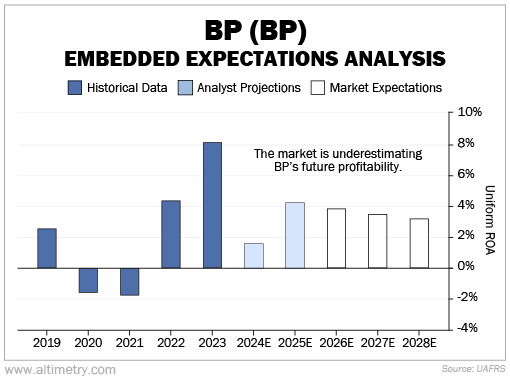

We can see this through our Embedded Expectations Analysis ("EEA") framework...

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Prior to 2023, BP's Uniform return on assets ("ROA") was pretty modest... at times, far less than the 12% U.S. corporate average.

It jumped to 8% in 2023, as oil and gas demand recovered after the COVID-19 pandemic. (Of course, this benefited energy companies across the board.)

Investors expect BP's profitability to stagnate around 3%, which is below the company's cost of capital. Take a look...

Elliott has a strong track record of driving change.... Its strategic shifts have produced big gains for underperforming energy companies like Suncor (SU.TO) and NRG Energy (NRG).

If Elliott applies the same approach to BP, its growth could be much higher than what the market currently anticipates.

And that could help BP close the gap among industry peers...

And that could help BP close the gap among industry peers...

We know it has struggled to keep pace with oil and gas rivals, especially after shifting to renewable energy.

However, Elliott could be just the catalyst BP needs... to become a much leaner and more profitable business.

If BP follows Elliott's usual strategy – of increasing efficiency, restructuring assets, and doubling down on high-value operations – BP should quickly catch up to its peers.

And investors who recognize this transformation early on could benefit handsomely.

Regards,

Joel Litman

March 5, 2025

BP's (BP.LSE) stock just made its biggest move since 2020...

BP's (BP.LSE) stock just made its biggest move since 2020...