Editor's note: The markets and our offices are closed on Monday, February 16, for Presidents Day. Please look for your next Altimetry Daily Authority on Tuesday, February 17.

Yale University's endowment chief David Swensen took one look at the school's investment portfolio and decided it deserved better...

Yale University's endowment chief David Swensen took one look at the school's investment portfolio and decided it deserved better...

Back in the 1980s, universities relied on the classic 60/40 ratio to bring in money. They invested endowed gifts into stocks and bonds, and turned gains into revenue.

Under Swensen, Yale took a different approach... It leaned into private equity.

A hedge-fund manager convinced Swensen to invest $300 million worth of Yale's endowment into a new fund (Farallon Capital).

This obviously carried some risk. But the overall strategy grew Yale's endowment from $1.3 billion in 1985 to $31.2 billion in 2020.

The "Yale Model" (aka the "Endowment Model") helped the university lead the Ivy League in annual returns for decades.

But recently, that model has broken down. Competition in the private-equity sector, plus high interest rates, has brought returns back to earth.

Now, a new endowment model is taking shape. And it's showing how one asset class could benefit regular investors.

Private equity used to be a bargain until everyone piled in...

Private equity used to be a bargain until everyone piled in...

Twenty years ago, there were only about 300 private-equity funds. Today, there are more than 10,000.

Interest rates were also lower. So private-equity firms could easily borrow money for one deal after another... Money managers would buy cheap companies, improve operations, and then sell them for a profit.

For institutions like Yale, private equity offered the right value at the right time... and in the right market.

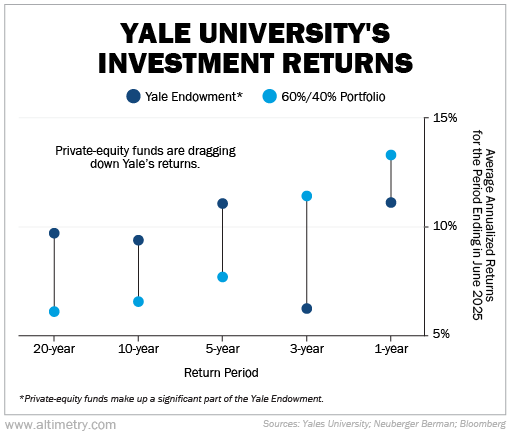

That equation has completely flipped today. Private markets are saturated, and higher interest rates persist. Simply put, private-equity funds (which make up most of the Yale Endowment) are finding it harder to produce big returns. Take a look...

All of this is hurting major endowments...

Over the past three years, Yale's endowment has returned just 6%. That's the second-lowest figure in the Ivy League, ahead of only Princeton.

Meanwhile, index funds have become the go-to investments...

Meanwhile, index funds have become the go-to investments...

That's not a typo. Low-cost index funds have replaced "elite" private-equity funds in university endowments... They're simply the better investment right now.

The University of California ("UC") system, for example, managed to return an average of 15% over the past three years in one of its largest funds.

The UC system took a page out of Warren Buffett's book and held on to low-cost index funds for the long term. And that's exactly how the UC system managed to beat the entire Ivy League.

Index funds are more liquid (and more transparent) than private-equity funds. Investors can easily buy and sell shares on public exchanges. Private-equity funds usually keep money locked up for years.

Index funds also charge lower fees. They've spent decades whittling them down to almost zero... The average index mutual fund now charges 0.06% in annual fees. Private-equity funds charge about 2%, plus "performance fees."

That's a game changer... If a public investment costs almost nothing to maintain, a private fund must offer something special to justify its fees. And that's not happening today.

The best option is sometimes the simplest one...

The best option is sometimes the simplest one...

Especially when private markets become overcrowded... and overpriced.

Right now, institutional investors are pulling out of private equity. And the industry is scrambling to adapt.

These money managers are looking for new buyers... And they're focusing on individual investors. But most folks can't afford to lock up their money for the next 10 years.

You're much better off following the best-performing assets. Today's leading endowments show that low-cost index funds fit the bill.

If you get on board, you'll spend less time chasing the so-called "smart money"... and more time cashing out.

Regards,

Joel Litman

February 13, 2026

Yale University's endowment chief David Swensen took one look at the school's investment portfolio and decided it deserved better...

Yale University's endowment chief David Swensen took one look at the school's investment portfolio and decided it deserved better...