New data centers across the U.S. may look finished, but inside many, there's nothing going on...

New data centers across the U.S. may look finished, but inside many, there's nothing going on...

It could take them years to connect to the energy grid. And even when they do, it won't supply all the power they need.

As we noted last week, the average midsize data center uses between 5 megawatts ("MW") and 10 MW of energy annually. And there are about 4,000 of them in the U.S. today.

Many of these data centers power artificial-intelligence ("AI") models.

This massive energy load is also becoming a serious issue for consumers. U.S. retail electricity hit a record 18.07 cents per kilowatt-hour in September... That's up 7.4% from the same month last year. Residential energy costs rose 10.5% from January through August 2025.

President Donald Trump, along with 13 governors, see this as an opportunity...

They want PJM Interconnection – the largest U.S. grid operator – to have data-center owners and operators sign 15-year contracts that support new power generation.

The idea is to keep rising energy costs from landing on households... while feeding the data centers of tomorrow.

Right now, data-center developers are working "behind the meter" to meet soaring energy demand. And they're finding out that natural gas is the fastest way to do it.

Some operators are bypassing the power grid altogether...

Some operators are bypassing the power grid altogether...

They're developing behind-the-meter data centers, which don't rely on the grid. In fact, operators are building their own power plants.

There are at least 46 behind-the-meter data centers in the U.S. (About 90% of these projects were launched in 2025 alone.) And they have a combined 56 gigawatts ("GW") of planned capacity... That's roughly 30% of the total planned capacity for these sites.

That share will likely rise as AI continues evolving and the grid gets more and more bogged down.

Why are operators rushing to connect data centers? Naturally, the longer they sit without power, the less revenue they generate.

Clean energy data and software provider Cleanview estimates that AI data centers can generate $10 million to $12 million per MW annually... That's $10 billion to $12 billion per GW.

There are huge profits at stake. And that's why the U.S. government is stepping in...

Bloomberg describes Trump's plan as a one-time emergency intervention...

Bloomberg describes Trump's plan as a one-time emergency intervention...

You see, only data-center owners and operators would be allowed to bid for the long-term contracts we noted earlier.

The goal is to raise a lot of money for PJM... so it can expand its power supply.

The grid operator serves more than 67 million people and hosts a huge share of global data centers in northern Virginia. And it expects peak demand to rise 17% by 2030 from this year's high.

PJM also holds auctions to determine the cost of running power plants. Its December auction fell 6.6 GW short of its required safety buffer – the minimum amount of electricity PJM needs to handle emergencies. (That's enough to power 5 million homes.)

With PJM unable to fulfill the recent auction, one thing is clear... Demand is outstripping supply. That's a big reason why utility costs are going up.

It's also setting up opportunities in one energy subset.

And it's not renewables or nuclear power...

And it's not renewables or nuclear power...

Almost all behind-the-meter plants are run by natural gas. That's nearly 75% of the power-generation equipment (about 23 GW worth).

Instead of waiting for heavy-duty gas turbines to come on line, developers are relying on existing equipment. They're using mobile gas generators and engines to funnel natural gas to data centers.

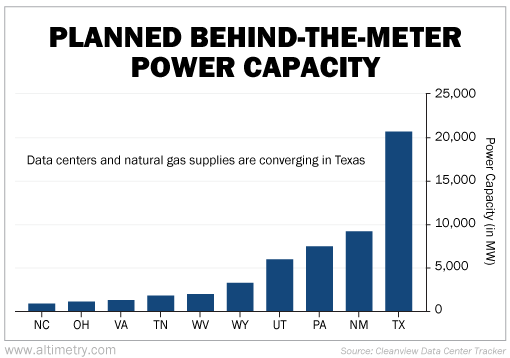

It helps that most of these data centers are popping up in America's natural gas hub... Texas. In fact, Texas has the biggest behind-the-meter capacity in the U.S. – at 20,695 MW. Take a look...

So, new data centers can get power directly from the source and start running as soon as possible.

The market will reward behind-the-meter projects...

The market will reward behind-the-meter projects...

Data centers need a lot of energy... And they need it now.

Natural gas is the easiest way to channel that power. It's the key to breaking up the energy bottleneck piling up behind the scenes.

With the AI boom in full swing, demand for natural gas production and transportation will soar.

That will benefit natural gas exploration and production companies, plus U.S. pipeline operators.

Make no mistake... Behind-the-meter data centers will power up this year. And when they do, natural gas will become a hotter commodity than most folks realize.

Regards,

Joel Litman

February 11, 2026

New data centers across the U.S. may look finished, but inside many, there's nothing going on...

New data centers across the U.S. may look finished, but inside many, there's nothing going on...