The U.S. Department of Energy signed an emergency order as Winter Storm Fern barreled down on 24 states...

The U.S. Department of Energy signed an emergency order as Winter Storm Fern barreled down on 24 states...

It allowed PJM Interconnection – the largest power provider in the country – to redirect electricity away from large customers... to avoid rolling blackouts.

That meant shutting off data centers to prioritize electricity for households, hospitals, and other critical customers.

This was no easy feat. PJM serves 67 million people across a huge stretch of the U.S., from Illinois to Virginia.

When Fern hit, the extreme cold strained the electrical supply and demand surged...

On January 27, wholesale prices jumped 241% across the PJM grid to more than $2,300 per megawatt ("MW")-hour. And this is just the beginning...

Extreme weather and rising electricity demand will continue squeezing the U.S. power grid. And that will catapult demand for backup power supplies. As we'll explain today, this is great news for one particular industry leader.

Backup power is no longer a luxury...

Backup power is no longer a luxury...

It's becoming an essential part of businesses that rely on big electrical loads. Data centers are a perfect example...

The average midsize data center uses between 5 MW and 10 MW of energy annually. And there are about 4,000 of them in the U.S. today.

If data centers shut down during high traffic, they'll lose customers. So data-center operators need to do everything possible to maximize uptime.

As we noted earlier, the Department of Energy is ready to divert power away from these facilities. And Winter Storm Fern is just the latest example.

Backup power is a necessity during extreme weather. But as we continue straining the grid, we won't need massive storms to trigger blackouts... It could just be a hot summer day, or even regular equipment maintenance.

Generac (GNRC) – a leader in commercial and consumer generators – is poised to capitalize on these trends...

Generac (GNRC) – a leader in commercial and consumer generators – is poised to capitalize on these trends...

Generac introduced the first affordable, automatic home standby generator in 1989... And it quickly became a staple among homeowners.

When Generac went public in 2010, it began entering new markets (including data-center applications) and diversifying its products. The company's brand advantage helped it grow revenue from $2.2 billion in 2019 to $4.6 billion in 2022.

Things cooled off after that. A lot of households had already bought the equipment they needed during the COVID-19 pandemic. At the same time, investor attention moved toward the flashier AI build-out, which involved data-center infrastructure.

Generac is now reviving its business... In April 2025, the company unveiled five generator models aimed at data centers. They range from 2.25 MW to 3.25 MW and form part of broader energy systems.

The message is clear. Generac wants a seat at the table for large-scale backup power...

Data-center operators can't afford to be blindsided by grid events. And Generac's new product line can help them build resiliency.

However, investors don't seem to understand Generac's shift...

However, investors don't seem to understand Generac's shift...

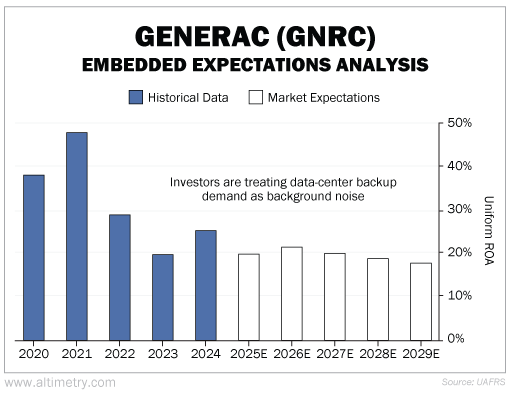

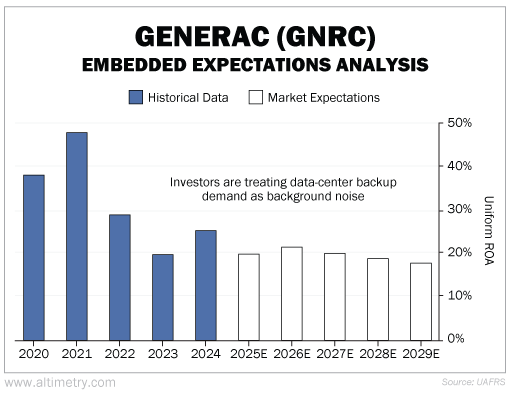

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Generac's Uniform return on assets ("ROA") peaked at 47% in 2021. And it has remained above 19% every year since then. Investors seem to think Generac's returns will keep dwindling to just 17% by 2029. Take a look...

They're ignoring the vast potential of Generac's new backup generators. But we know where the industry is really headed...

Data centers have no choice but to prepare...

Data centers have no choice but to prepare...

Extreme weather isn't going anywhere... And no matter when it happens, data centers need to run without disruptions.

Their future depends on the right kind of backup technology. And savvy investors know that Generac's products hold the key...

You see, the company didn't focus on data centers when they first came out... It stuck to smaller generators on the residential side. So most investors have already moved on.

Right now, the market is treating Generac like a COVID-era winner. And it's grossly underestimating the market for data-center backup power.

Keep an eye on the next few quarters... Generac will likely see an uptick in orders and revenue.

Regards,

Joel Litman

February 4, 2026

The U.S. Department of Energy signed an emergency order as Winter Storm Fern barreled down on 24 states...

The U.S. Department of Energy signed an emergency order as Winter Storm Fern barreled down on 24 states...