The busiest hours of the year are causing a major bottleneck...

The busiest hours of the year are causing a major bottleneck...

U.S. electricity prices are rising as utilities funnel cash into our aging infrastructure. Energy bills in some states have climbed more than 20% in just a few years thanks to surging AI demand.

Many data centers and factories now face multiyear waits for grid upgrades. And those upgrades must be built solely to handle a few dozen critical hours each year.

The issue is every data center wants to deliver during those peak bottleneck times. So instead of waiting in line, some are taking matters into their own hands... by relying on batteries as a bridge.

As you'll see, "grid scale" battery storage is emerging as the most important relief valve in the modern power system. It's even being backed by the government.

And one company has just crossed a major milestone as demand accelerates...

Batteries are moving from a supporting role to core infrastructure...

Batteries are moving from a supporting role to core infrastructure...

In October, the Department of Energy urged regulators to allow big new customers to connect earlier if they commit to curbing demand during the limited hours when the grid is most strained.

And these rules are already influencing development.

Developer Aligned Data Centers just announced it's installing a 31-megawatt battery at an upcoming data center in the Pacific Northwest.

The battery will be operated by the local utility company. It's allowing a new data center to connect to the grid years ahead of the traditional schedule.

Put simply, by funding grid investment, data centers can skip the line to get power.

Aligned's battery is likely the first of many under this new model...

Aligned's battery is likely the first of many under this new model...

It's creating clear demand for companies built specifically for grid storage.

And Fluence Energy (FLNC) stands out as a big potential winner.

Fluence is a battery supplier. But it's not tied to consumer devices or electric vehicles.

Instead, it focuses on the large utility-scale systems needed for peak demand management. Grid operators need Fluence's capabilities as they balance rising loads and longer queues.

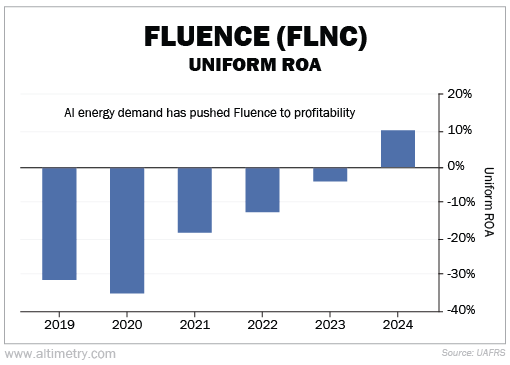

It hasn't always been a smooth ride... The company lost money for five straight years. But in 2024, Fluence reached an important milestone when it turned a profit for the first time.

Take a look...

Fluence's Uniform return on assets ("ROA") came in at 10% last year. Its systems are finally drumming up demand as data centers get desperate to hook into the grid.

We're watching a new phase of energy investment take shape...

We're watching a new phase of energy investment take shape...

Energy storage is one of the few tools capable of relieving grid pressure.

Utilities gain a flexible, reliable asset that defers costly upgrades. Developers gain access to power years sooner than they otherwise would.

And customers benefit when peak costs don't cascade into higher rates.

Fluence's shift to profitability happened just as all of these pieces came together. Our grid is only getting more stressed. The companies providing energy flexibility to the AI revolution are stepping into a much larger role.

That's a great sign for Fluence in the future.

Regards,

Joel Litman

December 3, 2025

The busiest hours of the year are causing a major bottleneck...

The busiest hours of the year are causing a major bottleneck...