The way we buy stocks has changed over the years...

The way we buy stocks has changed over the years...

Today we can buy stocks with the simple push of a button. But it wasn't always that easy.

Before the digital era, people bought shares the old-fashioned way. This included going down to an exchange and purchasing a piece of paper signifying ownership.

In-person exchanges of shares could happen anywhere from barbershops to coffee shops, which is why these locations were often located in the center of town.

Over time, person-to-person interactions were formalized into exchanges, such as the London Stock Exchange ("LSE") and the New York Stock Exchange ("NYSE"). Markets became more efficient, as there was the opportunity for higher volumes and less arbitrage.

As the digital age permeates stock trading, physical locations are becoming more obsolete as the exchange infrastructure moves further online.

But it's worth remembering this is a long-term trend, and these short-term catalysts only expedite the process.

This shift doesn't just apply to exchanges but rather to all businesses. Now that the world is moving to be more home-based, real estate investment trusts ("REITs") are under pressure.

For REIT companies, the At-Home Revolution has hastened the inevitable...

For REIT companies, the At-Home Revolution has hastened the inevitable...

That's why for a company like Vornado Realty Trust (VNO), the coronavirus pandemic is causing more than a small shift.

Vornado has a massive footprint in New York. Under normal circumstances, its locations in New York City's Midtown, around Penn Station, and other parts of Manhattan fill up with employees of financial services and other high-priced talent areas like advertising and media.

But with the At-Home Revolution, most of those office spaces are sitting empty or half full at best.

Some leaders, such as JPMorgan Chase (JPM) CEO Jamie Dimon, are trying to get their employees back into their New York offices, including its prestigious Park Avenue headquarters, leading the market to believe the same thing will happen for most financial services companies.

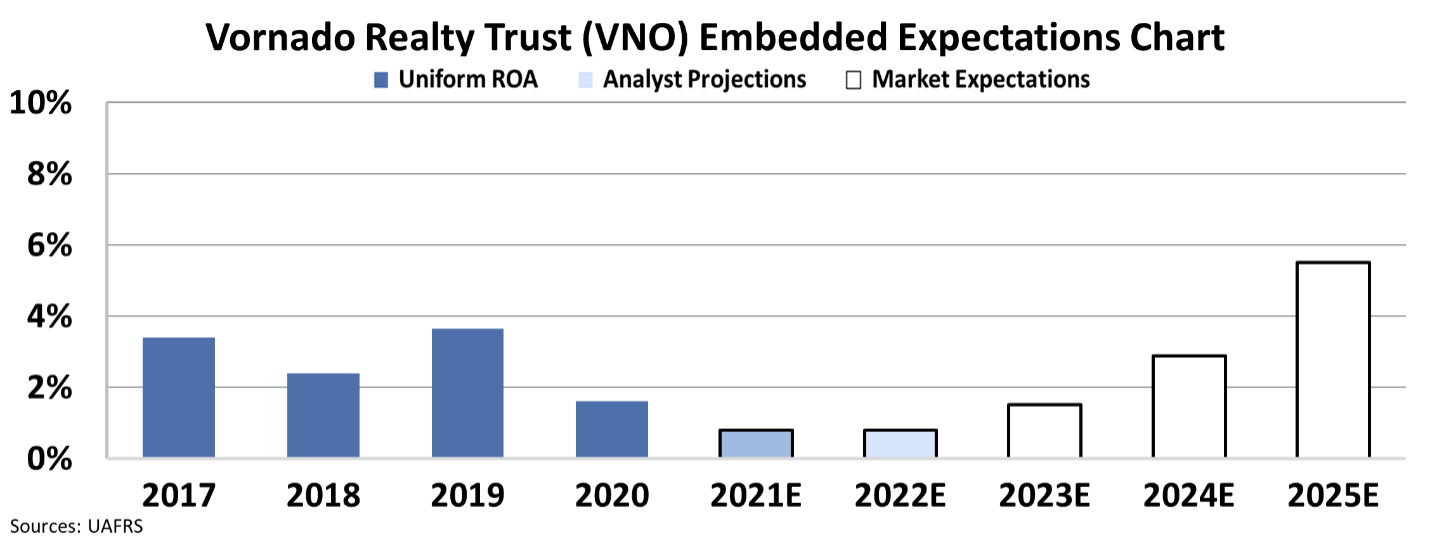

By utilizing our Embedded Expectations Analysis ("EEA") framework, we can see what investors expect Vornado Realty to do at its current stock price.

Stock valuations are typically determined using a discounted cash flow ("DCF") model, which makes assumptions about the future and produces the intrinsic value of the stock.

But here at Altimetry, we know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, we use the current stock price with our EEA framework to determine what returns and asset growth the market expects.

Current market embedded expectations demonstrate that the market assumes everyone will be getting back to the office soon. At current valuations, the market is pricing Vornado's return on assets ("ROA") to reach 6% levels.

These are levels Vornado didn't even realize in the years leading up to the pandemic. Furthermore, thanks to the corporate leases being on three- to five-year agreements, 2020 lows may only be the beginning of a collapse in returns.

These expectations for 6% returns might be a little too optimistic, thanks to the reality that technology has changed the way people work.

Tighter regulations on telephone calls, instant messages, and e-mails have allowed more trading on convenient electronic platforms. Meanwhile, this shift to increased digitalization has made it more efficient for banks to manage balance sheets and risk. As technology becomes more advanced, the need for human capital to run large banks has lessened.

If there's one thing the pandemic has shown employers, it's that most tasks can be done by video or remotely. Gone are the days when everything needs to be done face-to-face.

Is Vornado Realty a good buy in 2022?

Is Vornado Realty a good buy in 2022?

The pandemic has made it clear that teams can easily work in lower cost-of-living areas. While some banks are still pushing for staff to be back in the office, it doesn't have to be in traditional financial centers like New York...

This spells trouble for REITs like Vornado Realty, which has many assets in New York, Chicago, and San Francisco, and the market may be disappointed when people don't return to the office as expected...

With many office workers favoring remote work, it could force many companies to adopt a hybrid policy and reduce their leasing footprint in the future... and that could add to the tailwind of oversupply in the office REIT sector.

While no investment is without risk... there are some stocks that present a better opportunity... even while the market is bottoming out.

Here at Altimetry, we have found three stocks that we think will prove to be among the best stocks of 2022. And it all comes down to a certain type of "hack" that these companies are using, and it could send their stock shares soaring by up to 852%.

I explain all of this in full in my recent presentation.

Watch this time-sensitive presentation by clicking here.

Regards,

Joel Litman

February 1, 2022