The market just won't quit...

The market just won't quit...

For more than a year, investors have been climbing a "wall of worry"... digesting inflation scares, tariffs, tight credit, and geopolitical flare-ups.

And yet, despite all those challenges, stocks have continued to rise. The S&P 500 notched fresh highs this summer, even as new reasons to panic seem to arrive every week.

The headlines have been plenty busy in the past month alone...

President Donald Trump's camp announced more tariffs, including a 50% levy on copper... a 15% tariff on many EU goods... and new duties on countries like Brazil.

Rumors surfaced that Trump would fire Federal Reserve Chair Jerome Powell. Then he said he wouldn't. And now, the administration is once again making noise about Powell's future.

Elon Musk hinted at starting a new political party. Inflation ticked higher in June. Tensions bubbled even higher in the Middle East and Russia.

That's a lot to absorb. But stocks kept rallying. And for the first time all year, investors are getting too bullish.

The S&P 500 is up more than 3% since mid-June...

The S&P 500 is up more than 3% since mid-June...

This is classic wall-of-worry behavior. Investors are scared. But the market keeps climbing despite their fears.

The rally is supported by two critical factors... better earnings and resilient credit conditions.

Corporate profits grew 9% in 2024. They're on track to rise another 8% this year. Meanwhile, corporations are investing again after neglecting their assets for the better part of two decades.

AI and supply-chain tailwinds mean these trends are unlikely to slow down anytime soon. In fact, every time you turn around, a new data center... AI breakthrough... or innovative product launch seems to be making headlines.

That strength has powered stocks higher, even in the face of macro noise.

All that said, the story is starting to shift...

All that said, the story is starting to shift...

The market is showing signs of overheating for the first time since the "Liberation Day" tariff tantrum.

Valuations have pushed back into stretched territory. And sentiment has surged to levels we haven't seen all year.

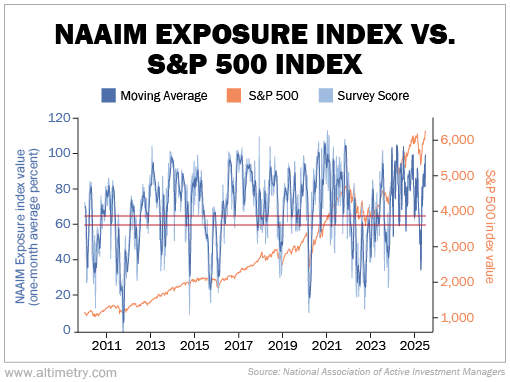

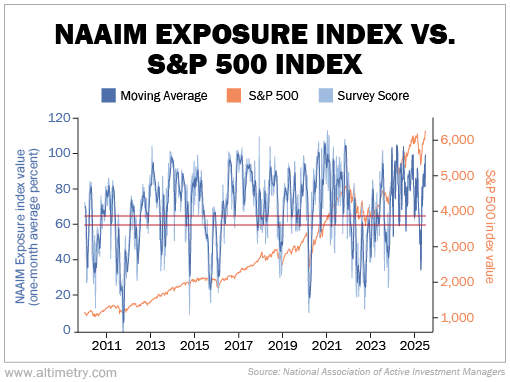

We can see this through the National Association of Active Investment Managers ("NAAIM") Exposure Index. It draws data from a weekly survey that tracks the proportion of assets members invest in equities.

Results tend to fall between 0% and 100%... They can be lower than 0% if investors are shorting stocks or higher than 100% if investors are using leverage to buy assets.

The long-term average allocation falls between 60% and 65%. That means active investors in an average market have 60% to 65% of their assets in stocks.

When allocations rise, investors are bullish, leading them to pour a lot of money into the stock market.

In July, the NAAIM Exposure Index jumped to about 99%. Investors are pretty much "all in" on stocks...

Frankly, these levels never last.

At the same time, the Uniform price-to-earnings (P/E) ratio climbed back around 24 times earnings... up from last month's 22 times. Even with renewed earnings growth, that's a high valuation.

None of this means the market is about to crash...

None of this means the market is about to crash...

In fact, there has never been a bear market started by valuations. Bear markets are caused by fear about changes to corporate earnings... or worse yet, credit.

But it does mean the market may get choppier in the coming weeks. When investors are all in, good news stops looking so great. And bad news gives them more and more reason to worry.

When investor sentiment and valuations get this stretched, the market often trades sideways. We might even see a short-term pullback.

If that happens, don't panic. All those tailwinds aren't going anywhere.

This is not the time to let scary headlines push you out of the market.

Regards,

Rob Spivey

August 4, 2025

P.S. Volatility is stressful. But setting up your portfolio doesn't have to be...

My colleague Joel Litman recently went live with his "Three-Stock Secret" – a simple, easy-to-follow investing strategy that we both use with our own money.

Joel has shared this approach with his friends and family, too... including his mother, who went from a broke divorcee to a millionaire using a similar method.

The Three-Stock Secret is easily one of the most powerful wealth-management tools I've seen. With market turbulence on the horizon, this is the perfect time to set your portfolio up for success. Get the details here.

The market just won't quit...

The market just won't quit...