Sometimes the most important market stories aren't the ones making headlines...

Sometimes the most important market stories aren't the ones making headlines...

Investors are busy debating rate cuts and geopolitical risks. But beneath the noise, a more foundational trend is reshaping the U.S. economy – and powering this bull market from below...

We're talking about capital spending.

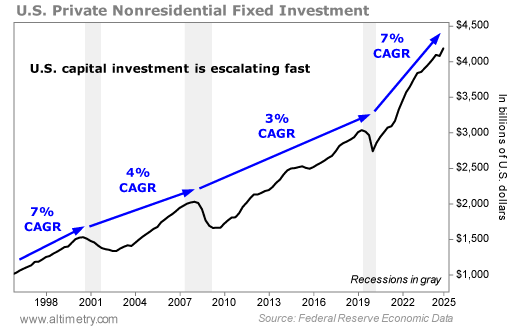

Private nonresidential fixed investment – corporate spending on equipment, infrastructure, and technology – just notched another quarter of strong gains. It has now grown at a 7% compound annual growth rate ("CAGR") since 2020.

That's not only faster than the post-2008 expansion... it's faster than anything we've seen since the late 1990s.

And it's one of the biggest reasons the economy, and the market, should remain unstoppable.

In the 2000s, capital investment barely kept up with assets that were aging out...

In the 2000s, capital investment barely kept up with assets that were aging out...

It ticked slightly lower after the Great Recession, averaging 3% annual growth.

And corporate assets kept getting older and older... a trend that continued through the early pandemic.

Companies were still scarred from the financial crisis and the sluggish recovery that followed. Share buybacks and efficiency took priority over long-term reinvestment.

But that era is over. Since the COVID-19 recovery began, U.S. companies have opened the spigots.

Investment in structures, equipment, and intellectual property has surged. In dollar terms, total annualized spending is up more than $1.2 trillion over the past four years.

This is the fastest capital-investment growth since the dot-com era...

A big driver of that growth is the digital-infrastructure arms race. Tech giants are racing to build data centers to power AI, machine learning, and next-generation cloud platforms.

Semiconductor companies are spending tens of billions of dollars on new fabs. Manufacturers are bringing production back home. They're rebuilding domestic supply chains and modernizing our logistics networks.

Even utilities and traditional industrials are upgrading core infrastructure to support our automation needs.

These aren't short-term capital expenditure bursts...

These aren't short-term capital expenditure bursts...

They're multiyear build-outs that require massive upfront investment.

And historically, this kind of spending is a reliable lead indicator for future productivity and profit growth.

It's no coincidence that the S&P 500 has nearly doubled in the past five years. This surge in investment is translating into significant earnings power.

Better still, valuations remain in check. U.S. stocks trade for around 22 times earnings.

That's not cheap versus the 20 times long-term average... but it's justified given the trajectory of earnings and reinvestment.

And it tells us the market is being driven by real profit growth, rather than speculation...

And it tells us the market is being driven by real profit growth, rather than speculation...

Sentiment, too, remains measured. After a spate of volatility in April, investor optimism has settled. Credit conditions remain neutral. Banks are still lending.

In short, the economy's financial plumbing is intact.

This setup is creating a powerful backdrop for stocks. We're not dependent on Federal Reserve cuts or stimulus checks right now.

We're seeing powerful capital investments. And that's the best foundation for durable market strength.

Regards,

Rob Spivey

July 7, 2025

Sometimes the most important market stories aren't the ones making headlines...

Sometimes the most important market stories aren't the ones making headlines...