Editor's note: The markets and our offices are closed Monday, January 15, for Martin Luther King Jr. Day. Because of this, we won't be publishing Altimetry Daily Authority. Please look for your next edition on Tuesday, January 16.

Twenty-seven years ago, Federal Reserve Chair Alan Greenspan struck fear into the hearts of all value investors...

Twenty-seven years ago, Federal Reserve Chair Alan Greenspan struck fear into the hearts of all value investors...

It was December 1996, and the S&P 500 was about to finish its second straight year of double-digit returns.

Greenspan was speaking in front of a crowd at the American Enterprise Institute. And he had a simple question for the audience...

He wanted to know how you tell the difference between a real bull market rally... and what he coined "irrational exuberance."

You see, the S&P 500 returned an incredible 34% in 1995... its biggest gain in almost 50 years. And by December 1996, it was on track for another 20% bump.

Young tech and Internet stocks were leading the charge. Chipmaker Intel (INTC) finished the year up about 130%. Software giant Microsoft (MSFT) returned 88%. And tech-equipment maker Cisco Systems (CSCO) locked in a 71% gain.

As 2024 gets underway, we're seeing a similar situation. The market rallied to end the year, and valuations are on the rise. As we'll explain, that alone doesn't mean a downturn is imminent... But investors should be wary all the same.

While investors cheered, Greenspan was worried that valuations were getting out of control...

While investors cheered, Greenspan was worried that valuations were getting out of control...

He was looking at the price-to-earnings (P/E) ratio, which measures a company's – or an entire index's – price versus earnings per share. The higher the P/E ratio, the more expensive valuations are.

When Greenspan gave his "irrational exuberance" speech, the S&P 500's P/E ratio was 23 times... above the long-term average of 20 times.

In short, they were betting on a lot of growth.

Greenspan didn't think this could go on for much longer. Valuations were above average... and the market was up more than 50% in the previous two years.

But stocks don't fall because of valuations alone. If you had heeded Greenspan's warnings and sold at the end of 1996, you would've missed out on three more years of double-digit returns.

And as more young tech companies with little to no earnings joined the indexes, valuations soared even more. At its peak in the second quarter of 1999, the S&P 500's P/E ratio reached 34 times.

That brings us to today's market.

The S&P 500 achieved remarkable growth in 2023, returning just under 25%. That's a significant upswing following its steepest annual decline since 2008. This surge was primarily driven by a 22% increase in the technology sector.

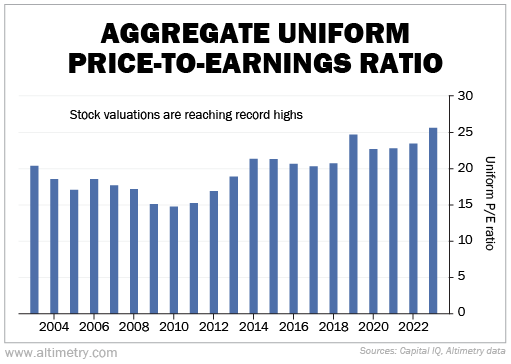

Valuations are getting far too high. The aggregate Uniform P/E ratio for U.S. stocks had been hovering around 23 times through November.

In December, it rose to 25.6 times.

Take a look...

Now, just because valuations are at a 20-year high doesn't mean the market is going to crash tomorrow.

But it does mean that when the recession hits, stocks have further to fall.

The S&P 500 was at a 34 times P/E multiple when the dot-com bubble burst. It fell as much as 49% from its highs.

The Nasdaq, which was far more exposed to Internet stocks, reached as high as a 200 times P/E ratio... and fell 77% in the ensuing downturn.

If the market never finds a reason to fall, valuations aren't going to become that reason...

If the market never finds a reason to fall, valuations aren't going to become that reason...

But credit remains tight, and earnings growth still looks poor. There are plenty of possible recession triggers bubbling to the surface.

With the S&P 500 at all-time highs, it's a compelling period to sell stocks... not to buy them. You should be rotating into safer assets and more tactical strategies.

The more the market rises before a credit crunch, the worse the plunge can be... and the more reason for investors to be cautious in the meantime.

Regards,

Rob Spivey

January 12, 2024

P.S. The next few years could be dangerous for stockholders... And this is the time to start preparing. That's why my team and I are all-in on a little-known strategy that's completely outside the stock market...

This "backdoor" approach can deliver double-digit income and huge capital gains. It's the same strategy used by billionaires like Warren Buffett and Howard Marks. And the best part is, your returns are backed by legal protections... an added "safety net" you won't find with stocks. Get the full details here.

Twenty-seven years ago, Federal Reserve Chair Alan Greenspan struck fear into the hearts of all value investors...

Twenty-seven years ago, Federal Reserve Chair Alan Greenspan struck fear into the hearts of all value investors...