Investment banks are being cautious with their spending...

Investment banks are being cautious with their spending...

With interest rates so high in the U.S. and abroad, the majority of banks are focused on maintaining or trimming their head counts and operations. They're scaling back on aggressive investments.

Deal volumes for mergers and acquisitions (M&A) were down 32% in the first half of 2024 compared with the second half of 2021 (before central banks started hiking rates). M&A values fell 50% in the same time frame.

However, there's always an exception. And in today's financial sector, that outlier is Deutsche Bank (DBK.DE)...

The German lender is pouring money into its investment banking operations. In the past, it made a huge chunk of revenue on bond and stock issuances. It's hoping to speed up its business and shift away from its usual bond-dependent operations.

Today, we'll take a closer look at Deutsche Bank's latest efforts... and what they mean for anyone interested in its stock.

On the bright side for Deutsche Bank, it doesn't have much competition in today's job market...

On the bright side for Deutsche Bank, it doesn't have much competition in today's job market...

With its competitors keeping quiet on hiring, Deutsche has been able to recruit 125 investment bankers since the beginning of 2023. About 60% of them were at the director or managing director level.

The bank also bought U.K.-based broker Numis to scale up its investment banking. This acquisition brought along nearly 300 staff.

Deutsche Bank has been highly dependent on its bond trading business for years. It accounted for around 80% of last year's revenue.

Bonds tie the company's performance to interest rates and the macro environment... making the business volatile and limiting management's flexibility to put capital elsewhere. They often need to wait years to see a return.

Plus, investment banking can be way more profitable than traditional fixed income. That's especially the case in economic boom periods. Bond trading tends to take a lot more work and offers lower profit margins.

CEO Christian Sewing expects the economy to normalize this year and grow significantly in 2025, with increasing investments in most of Deutsche Bank's business areas. That should help M&A volumes pick back up to the highs of 2021.

And it seems Deutsche Bank is getting ready to capitalize on that environment.

The market isn't convinced this lender can level up its business...

The market isn't convinced this lender can level up its business...

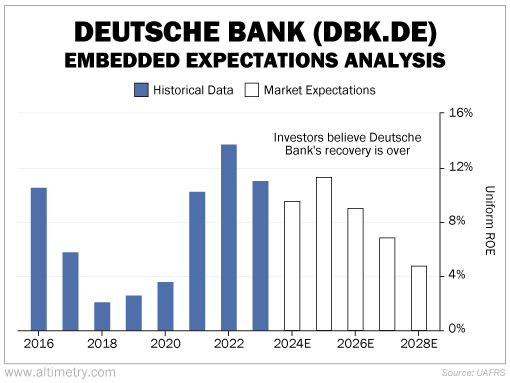

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Deutsche Bank's Uniform return on equity ("ROE") bottomed out around 2% in 2018. After that, it had a nice recovery run... hitting a decade high near 14% in 2022.

But the rebound ended last year. Returns were only around 11%. And the market expects the downtrend to continue, with Uniform ROE falling to 5% by 2028.

Take a look...

Investors will need more tangible results to get on board with Deutsche Bank. They're convinced returns will fall back toward all-time lows.

In this weak era for economic growth, it takes guts to invest so much in investment banking...

In this weak era for economic growth, it takes guts to invest so much in investment banking...

Especially when pretty much all the other financial companies are slowing down.

Deutsche Bank is definitely not a safe bet. That's why investors set the bar so low.

On the other hand, if M&A activity starts to accelerate soon... Deutsche Bank will have a head start.

It's too early to tell whether Deutsche Bank's investments will bear fruit. But with investors so skeptical, any positive surprise could mean a ton of upside.

Regards,

Joel Litman

July 30, 2024

Investment banks are being cautious with their spending...

Investment banks are being cautious with their spending...