The grandfather of private credit is in dire straits...

The grandfather of private credit is in dire straits...

Prospect Capital (PSEC) launched its first business development company ("BDC") two decades ago... and unwittingly laid the groundwork for today's $2 trillion private-credit market.

BDCs are designed to help small businesses grow. Like venture-capital firms, they finance young companies with loans or equity investments.

They're often public companies, too. BDCs have a special classification that allows them to skip paying taxes, as long as they distribute most of their earnings as dividends.

Prospect started as a low-key business. It lent money to small, distressed firms and earned a steady stream of payments in return. As a BDC, it could do this tax-free... as long as it distributed 90% of its income as dividends.

For a long time, Prospect bagged consistent, but modest, returns in silence. And when the Federal Reserve hiked interest rates after the COVID-19 pandemic, Prospect was able to start charging higher rates. Its portfolio reached a value of $8 billion in May 2024.

Big private-equity players like Blackstone, Ares Management, and Golub Capital didn't want to miss out on stealing market share from banks. So they jumped on the bandwagon, too... lending directly to companies at higher interest rates.

In short, private credit has become a huge business. But it's losing some of its charm... particularly when it comes to Prospect Capital.

Prospect's portfolio is starting to struggle...

Prospect's portfolio is starting to struggle...

Last year, its cash flow from investments fell $200 million short of the amount Prospect paid in dividends. This marked its largest shortfall in seven years.

Prospect's borrowers are having trouble paying the much higher interest on their loans. So those loans aren't generating as much cash for Prospect. And with defaults and bankruptcies on the rise, that trend is likely to persist.

The business is now resorting to risky strategies for salvation. One of its latest methods is called "payment in kind" ("PIK") debt... That's when borrowers are forced to take on additional loans from their lender instead of paying cash.

Basically, instead of collecting interest today, or forcing its borrowers into default, Prospect is delaying the inevitable. One-third of its net investment income in 2023 was generated by PIK... twice the industry average.

Prospect can write off the payments from additional loans as PIK income, so its returns seem fine on paper. But it doesn't solve the underlying issue.

PIK debt only postpones credit troubles and worsens the problem.

Prospect is now turning to individual investors to cover the shortfall...

Prospect is now turning to individual investors to cover the shortfall...

The company has resorted to selling bonds and equity for financing... which by itself isn't out of the ordinary for BDCs.

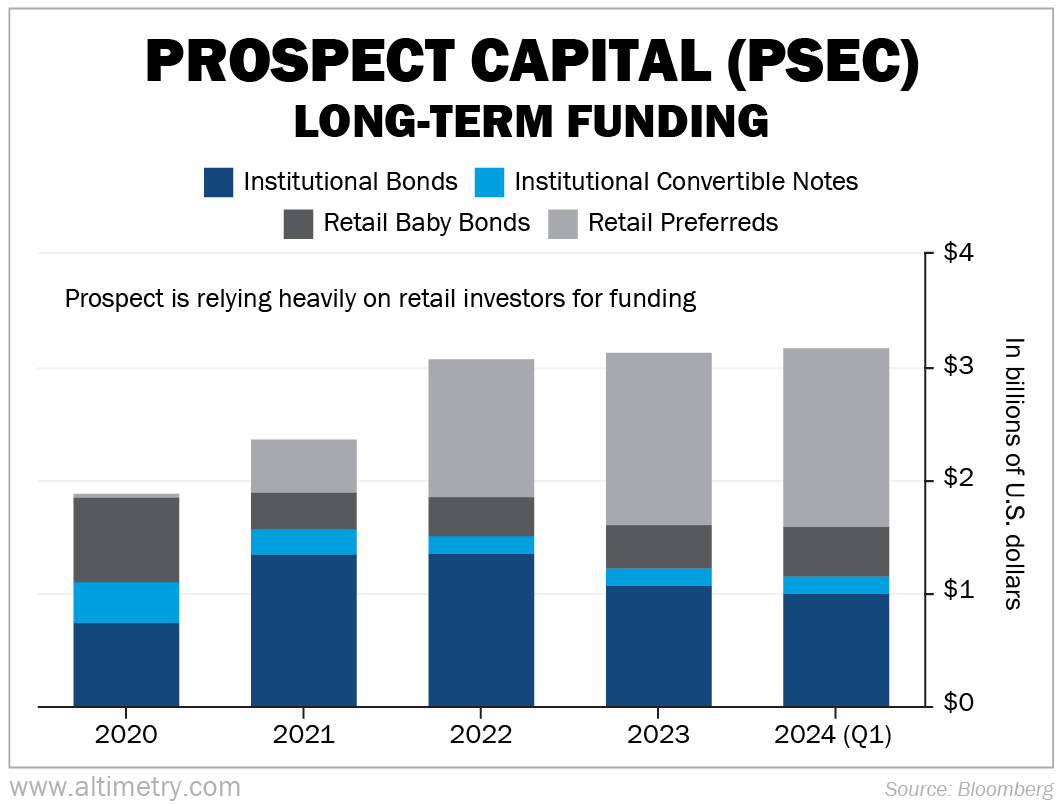

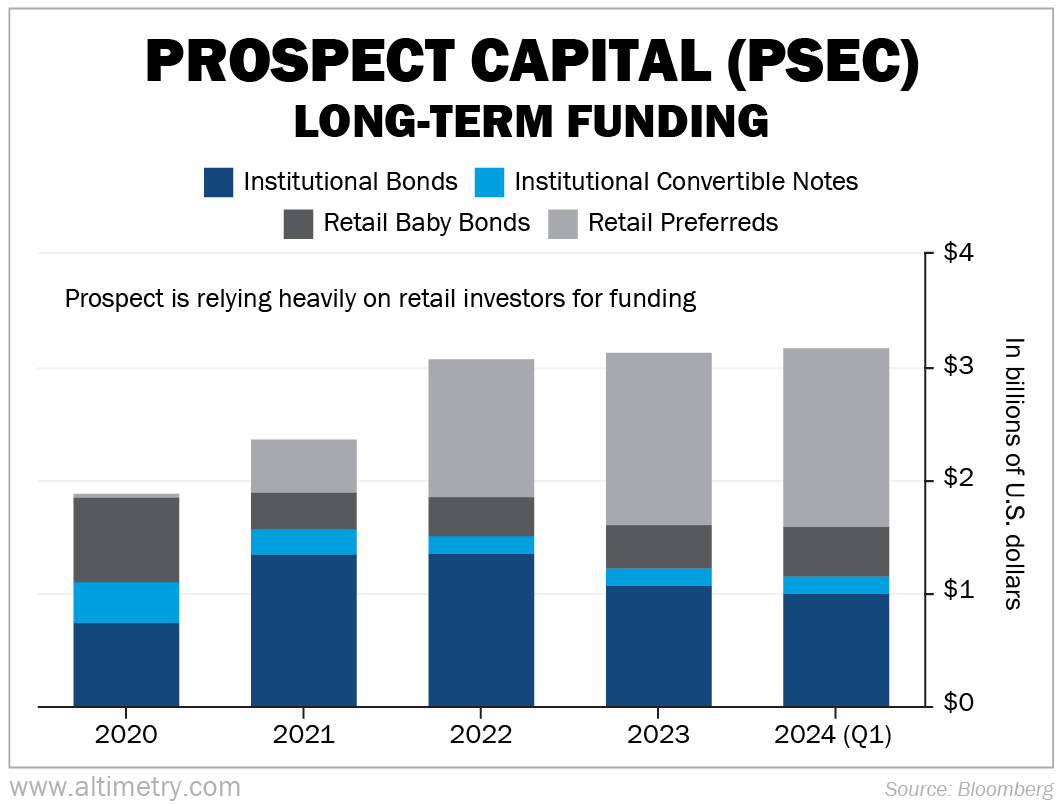

The concerning part is that Prospect is heavily pushing preferred stock. It's turning to retail investors over institutional investors.

That's often a sign that institutional demand is drying up. Retail investors have no way of knowing this... until it's too late.

Folks rushed to buy preferred stock from Prospect. It has sold more than $1.6 billion worth of units in less than four years. And cash from preferred stock represents more than half of Prospect's long-term funding... versus less than 1% in 2020.

Take a look...

Ordinary investors are using preferred shares to buy into this business. And they're getting less money back.

Some of their cash is actually funding payouts to other investors... since Prospect's own loan portfolio can't do it alone.

Said another way, institutional shareholders are effectively getting bailed out by retail investors.

Prospect shows why it's critical to understand where your money is going... before you invest a cent.

Prospect shows why it's critical to understand where your money is going... before you invest a cent.

Asset managers may use external funding to hide the poor performance of their private investments... and to artificially pump valuations.

It sure seems like that's what Prospect has been doing. Funding from preferred stock has helped boost assets from $5.3 billion to $8 billion in the past four years.

And if you want those hefty, promised dividends, you'd better hope more new investors hop on board to finance them.

Regular readers know we still see some life in the private-credit party. But Prospect won't be the last fund to resort to risky methods when times get tough.

The bottom line is, pay close attention to where you're putting your money.

Regards,

Rob Spivey

August 26, 2024

The grandfather of private credit is in dire straits...

The grandfather of private credit is in dire straits...