Companies going public isn't just a benefit for their investors...

Companies going public isn't just a benefit for their investors...

It was a record year for initial public offerings ("IPOs") in 2021. But many people still worry about the unicorns, or $1 billion-plus venture capital ("VC") funded companies, which remain private.

The concerns aren't just about how capital markets are no longer working to give everyone access to invest in growth companies. There are other issues that the Securities and Exchange Commission ("SEC") is starting to raise as an alarm.

Although these companies are private, they can still significantly impact public markets and the economy. But there's little oversight in the private fundraising world. Issues like how profitable these businesses are, their risks, how much people are paid, and even things as simple as their revenue or assets are all kept under wraps.

Private companies view the lack of disclosure of these accounting numbers as a competitive advantage.

Many public companies have discussed the burden of compliance with the Sarbanes-Oxley Act of 2002, which covers what public companies need to disclose to shareholders. The lack of disclosure burden comes as a cost advantage to companies that remain private.

The SEC has begun to work on a plan that requires the largest private companies to disclose information routinely. Some pundits wonder if this potential increase in disclosure could stifle innovation and strangle private growth.

But it also could push companies to go public sooner, allowing investors to get a piece of the action earlier. It also allows investors to understand better how big players like the $150-billion-valued private payment processor Stripe are disrupting the public market competitors.

Coinbase opted to go public...

Coinbase opted to go public...

A great example of a name with a bigger systematic impact than people may realize is cryptocurrency exchange Coinbase Global (COIN).

Coinbase operates the largest U.S. cryptocurrency exchange market and is an integral player in the global $1.7 trillion cryptomarket. However, before the company went public, it was not clear just how profitable it was. Now that we can access the publicly reported GAAP metrics, we can turn those into something useable.

By turning to Uniform Accounting, we better understand what going public meant for Coinbase Global.

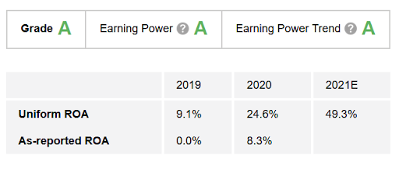

The Altimeter, which shows users easily digestible grades to rank stocks on their real financials, shows Coinbase's optimal outlook.

As-reported metrics lead us to believe the return on assets ("ROA") was just 8% in 2020. It appears Coinbase doesn't have much to offer in terms of profitability.

However, The Altimeter tells us ROA was an impressive 25% in 2020, driving the company's "A" Earnings Power grade. We see this number is also up from 9% in 2019.

That number is forecasted to further increase to 49% in 2021, which earns Coinbase a strong Earnings Power Trend grade of "A" as well.

These strong metrics earn Coinbase an "A" grade overall.

For Coinbase, it seems the exchange isn't solely reliant on cryptocurrency prices to generate strong returns. While investors may be concerned about how volatile the market is, Uniform Accounting shows that shining a light on these companies isn't always bad for how they look.

The company's valuations are roughly in line with market averages, making it an interesting opportunity for investors...

Of course, to understand if post-IPO Coinbase is still a buy is another question. We need to see if the market is already pricing in its expected success.

Altimeter subscribers can click here to see how Coinbase is valued based on Uniform Accounting and if the story is being correctly priced.

But there's an even better opportunity for investors than this crypto-exchange play right now...

But there's an even better opportunity for investors than this crypto-exchange play right now...

Recently, at Altimetry, we ran a backtest of 75 tech firms and found a 96% success rate among firms categorized with four specific words. Amazingly, the average gain among these stocks was nearly 760% – including the losers.

We would like to tell you more about what we discovered with the power of Uniform Accounting.

In Joel's recent video, he reveals these powerful four words and how they led us to find the next tech superstar.

Watch the presentation by clicking right here.

Regards,

Rob Spivey

February 3, 2022

Companies going public isn't just a benefit for their investors...

Companies going public isn't just a benefit for their investors...