Online shopping is more than just a digital storefront...

Online shopping is more than just a digital storefront...

Amazon (AMZN) and Shopify (SHOP) are dominating the world of retail in the age of coronavirus.

Amazon is winning by wiping retailers out wholesale. Consumers are getting more and more comfortable with shopping online at Amazon and getting things delivered to them, as opposed to having to go out to stores. The shift to e-commerce was already happening before the coronavirus pandemic... but the acceleration could be a lasting change.

Shopify is a lifeline for many businesses in the midst of the shutdown. The company is helping stores that might otherwise be generating zero revenue without their storefronts open to help stay alive in the current stay-at-home environment.

But for so many businesses, the way they've consistently retained and engaged customers revolves around a personal approach and a unique experience that can't be replicated online.

As such, stores are forced to innovate in intriguing ways to help stay connected...

One company that has been at the forefront of this initiative for years is London-based fashion brand Burberry. The company has been holding digital fashion shows and creating digital engagement with core customers, among other initiatives to reduce the risk that it loses direct customer engagement to intermediaries.

Late last month, market-research firm CB Insights published an article highlighting the ways shops are now trying to keep customers engaged with their brands. Whether it's a virtual trivia happy hour hosted by Anheuser-Busch InBev's (BUD) Busch beer brand, or Chipotle Mexican Grill (CMG) hosting a burrito-based virtual hangout, brands are getting creative with their advertising.

And businesses are trying savvy things like beefing up their online shopping advisor support, to give the same feel as shopping in a store. Hosting live events has also been an initiative to boost engagement.

The retailers and other businesses that innovate successfully are likely to see this translate directly into less of a dip in Uniform returns during this shutdown... and thus a quicker recovery after the crisis ends.

Software firms are changing their economics before our eyes...

Software firms are changing their economics before our eyes...

Historically, software was a strange business for investors and analysts to understand.

Unless you had a deep understanding of software development cycles – and also knew the unique goals and capabilities of different software firms – it was difficult to understand how to model demand.

If a company like Microsoft (MSFT) came up with a new version of its Office suite, it would see a huge spike in sales for the first year or two... but sales would then slow down to a trickle as most people had already bought the newest version.

This model was also subject to losing out on customers who were still happy with the prior version of a software and not ready to upgrade, or who decided to switch to an alternative in the meantime. Additionally, it was exposed to free licenses being passed around on the Internet.

It wasn't so much a bad model as it was unpredictable. That is, until software companies realized they could do things differently...

One of the originators of this new model was Adobe (ADBE), which historically used a perpetual license model to distribute its software.

In other words, if you purchased Adobe Photoshop, you had the license for that version of the software forever. Not only did this have the same problems we mentioned above, but it caused Adobe to have very cyclical profitability – in line with the development and launch cycles for its products.

To maintain profitability, the company had to constantly create new software licenses and new versions of its existing software.

However, about a decade ago, Adobe decided to stop trying to run that rat race, and instead create a subscription service for its software licenses.

This is a much lower upfront cost to consumers, and it includes continuous updates and support so long as you remain a subscriber.

Aside from the fact that you no longer physically own a software license, the value is clear to consumers and to Adobe.

For customers, you always have the most up-to-date software and only pay a fraction of the total license price every month or year. And for Adobe, this meant the company had more stable profitability, lower chances for fraudulent licenses, and better customer retention.

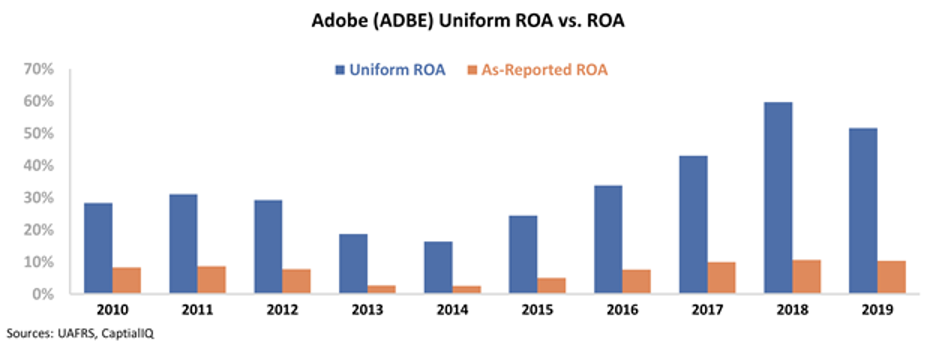

We saw a tangible effect on Adobe's profitability as more customers adopted the subscription model. Over the past decade, the company's Uniform return on assets ("ROA") has accelerated. You can see the trend higher below...

Today, let's take a look at another software firm trying to adopt the "Adobe model" to take profitability to the next level...

Citrix Systems (CTXS) offers a variety of workplace software and services, including for servers, cloud computing, and applications.

Prior to 2016, it also owned the GoToMeeting family of video conferencing software, which it sold to LogMeIn (LOGM) in order to jumpstart its conversion to a pure software subscription model.

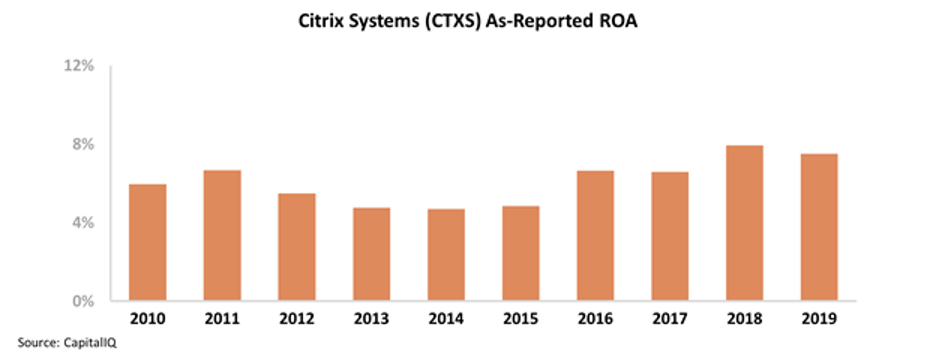

Looking at Citrix's as-reported profitability, it appears the transaction and subsequent push to the subscription model has had a modest impact at best. Over the past decade, the company's profitability has remained near long-term averages of 6%, and reached a high of only 8% in 2018.

That said, the as-reported numbers don't display how much momentum Citrix is building.

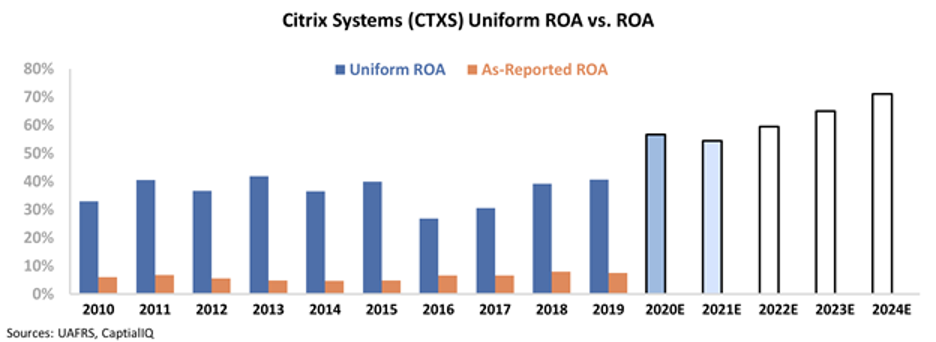

When looking at Uniform Accounting metrics, we can see that Citrix is actually in the early stage of an Adobe-style transformation.

The chart below highlights Citrix's historical profitability in terms of Uniform ROA (dark blue bars) compared to what Wall Street analysts think the firm will do over the next two years (light blue bars) and what the market is pricing in at current stock prices (white bars).

Since 2016, the company's Uniform ROA has already started accelerating thanks to its conversion to a heavier reliance on subscription revenue... and both analysts and the market forecast this to continue in the years ahead.

Without the proper Uniform metrics, current forecasts for Citrix may seem unrealistic. That said, by comparing its projected profitability to what Adobe was able to do over the past decade, we can see that the market seems to already understand the value of a subscription-based software company.

Regards,

Joel Litman

May 13, 2020

Online shopping is more than just a digital storefront...

Online shopping is more than just a digital storefront...