Tension is rising... And everyone wants out of Russia and China.

Tension is rising... And everyone wants out of Russia and China.

Well, almost everyone.

Recent headlines are full of big corporations pulling their business from the countries. Consulting giant Accenture (ACN), ride-hailing leader Uber Technologies (UBER), and investment manager BlackRock (BLK) all left Russia last year.

And it's still happening. Last Thursday, we explained that "Big Tech" behemoth Apple (AAPL) is pouring more money into U.S. operations.

The Western world seems all but united in the face of heightened geopolitical tension. The pandemic and Russia's war with Ukraine have global corporations rethinking their ties.

However, there are always outliers... And one of the biggest is coming from Germany.

Roland Busch, the CEO of the German conglomerate Siemens (SIE.DE), is bucking the trend. He specifically vowed the company will defend and expand its market share in China.

Busch said Siemens' Chinese customers push it to innovate... and that the Chinese market is an important growth driver for the company going forward.

All of that may be true. However, there's likely another reason Siemens is bucking the trend. As we'll explain, Siemens has a lot riding on big success in its Chinese market. It can't afford to follow the mob and abandon China...

Siemens is looking for growth wherever it can...

Siemens is looking for growth wherever it can...

Even though Siemens is a global business, China doesn't make up a very large piece of the pie. It only accounted for 13% of revenue in 2022, compared to almost 25% for the U.S. business.

Clearly, Siemens is looking to grow where it can. And China is the biggest opportunity of them all.

One of Siemens' fastest-growing segments is called digital industries. It comprises automation products used to assist in the manufacturing process.

Said another way, it helps companies with their digital transformations.

Siemens has been producing some of these automation products in China already. Busch noted that continued investment in this type of manufacturing would help improve Chinese industry... and it would help boost Siemens' revenue.

This story goes a bit deeper, though.

There's a reason Siemens is so desperate for growth...

There's a reason Siemens is so desperate for growth...

And it's because investors expect it.

Our Embedded Expectations Analysis ("EEA") framework shows why management isn't letting any opportunity slide...

The EEA works a lot like a betting line in a sports bet. We use the current share price to calculate what investors expect from a company's future performance... and compare those forecasts with our own. It tells us how well our "team" (the company) has to perform to justify the market's "bet" (the current price).

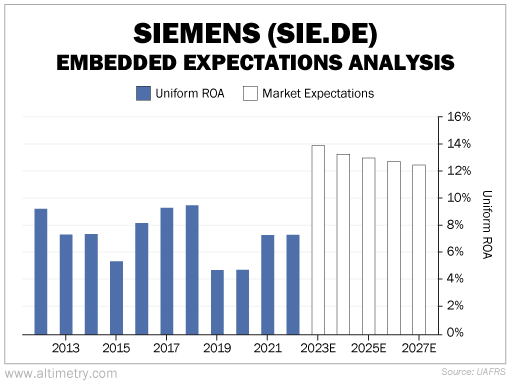

Siemens' Uniform return on assets ("ROA") has historically been modest, around 5% to 10%. That's lower than the 12% corporate average. And ROA has been especially compressed since 2019, as the company struggled to embrace higher-tech offerings.

Investors aren't concerned by past performance. They expect Siemens' Uniform ROA to be much higher in the future, around 12% to 14%.

Take a look...

Investors are confident that Siemens will turn the business around. Those white bars are higher than the company's returns at any point during the past decade.

There's a lot of pressure on Siemens to right the ship. Investors are expecting the company to be more profitable than ever. Management is looking for ways to meet those high expectations.

If Siemens can't prove that it's growing and getting more profitable, investors will be disappointed.

The company's expansion into China is one attempt to reach these lofty targets. It needs to become more profitable – and fast – to make the market happy.

Siemens must be careful, though. If it isn't smart about chasing potential growth opportunities, it could stumble. Any disappointing news could send investors running.

Regards,

Joel Litman

June 20, 2023

Tension is rising... And everyone wants out of Russia and China.

Tension is rising... And everyone wants out of Russia and China.