Steve Jobs didn't make Apple's current CEO a billionaire...

Steve Jobs didn't make Apple's current CEO a billionaire...

When Tim Cook joined the tech company as chief operating officer in 1998, he knew founder Steve Jobs was a visionary leader and an incredible designer. He'd be able to capture people's attention with his products.

Apple's (AAPL) problem wasn't design. It was manufacturing.

The company just didn't have good factories. Apple's manufacturing didn't match Jobs' vision. The plants weren't ambitious... They weren't world-class... And they were just too small.

Building a bunch of factories wasn't the answer. Instead, the company needed to find a manufacturing partner. So Cook turned to Terry Gou, a former colleague who owned a manufacturing business in Taiwan and mainland China.

Gou's company, Foxconn Technology, had three things going for it that Apple simply didn't... manufacturing know-how, low labor costs, and a massive potential workforce. It could build factories in China and quickly staff them with hundreds of thousands of workers.

With manufacturing taken care of, Apple could focus on what it does best – coming up with revolutionary products.

For a time, it seemed like this partnership would never change. Then COVID-19 rocked the world's supply chains. Companies have started to realize that they're too reliant on one part of the world. Plus, China isn't the cheap, unlimited labor source it once was.

China is starting to lose its grip as the world's top manufacturer. Apple is already expanding production to other parts of the world. And earlier this year, it announced yet another big investment in U.S. products... this time in the semiconductor industry.

Today, we'll look at what Apple's reinvestment in the U.S. means for one of the biggest chip designers.

American chipmakers are on the rise...

American chipmakers are on the rise...

At the end of May, Apple signed a new multiyear, multibillion-dollar agreement with Broadcom (AVGO)... a leading U.S. technology and advanced manufacturing company.

With this agreement, Broadcom will develop 5G radio frequency components and cutting-edge wireless connectivity components for Apple.

These investments are part of Apple's 2021 commitment to invest $430 billion in the U.S. economy over five years. The company paved the way for outsourcing in the early 2000s.

Now, it's leading the way in "reshoring" and "nearshoring"... bringing production closer to American soil.

This puts companies like Broadcom in a critical spot. Yesterday, we discussed how Chinese markets are falling while U.S. markets are still rising. And both countries are embracing more isolationist policies.

This isolation is another factor leading to the growing importance of reshoring and nearshoring.

Apple was one of the biggest proponents of outsourcing to China. Its return to the U.S. is just another sign that Chinese chipmakers are losing business to American ones.

Apple was already Broadcom's biggest customer...

Apple was already Broadcom's biggest customer...

And this commitment will only grow their relationship. That should be a good thing for the chipmaker. By looking at its returns over the past five years, we can determine how it might benefit from these growing trends going forward.

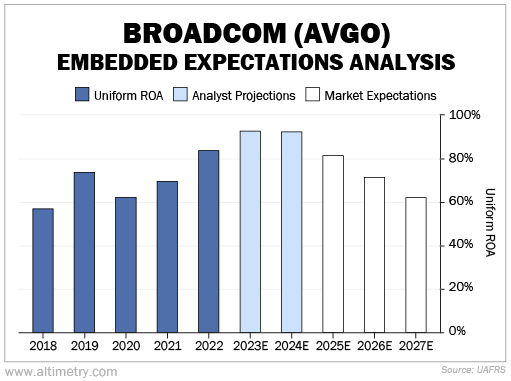

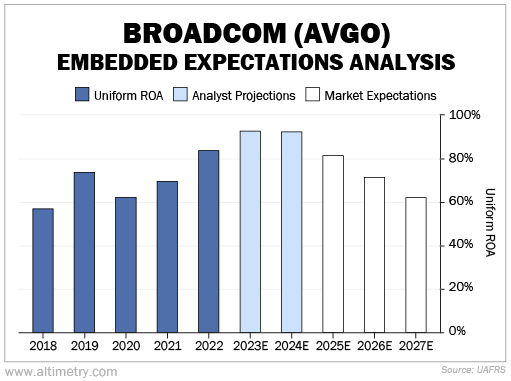

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At current valuations, the market expects fading returns for Broadcom. Its Uniform return on assets ("ROA") rose steadily for years... from just under 60% in 2018 to more than 80% last year.

Investors think the company is going to give all those gains back. Take a look...

We don't think Broadcom's expanding ROA is a temporary blip. It's a clear sign that the company is one of the biggest beneficiaries of reshoring and nearshoring trends.

And yet, for some reason, the market just hasn't caught on.

Wall Street analysts are on our side. They estimate that the upgraded commitment from Apple will drive the company's returns to all-time highs this year.

On the other hand, the market is still pricing ROA to fall to its lowest level since 2020... right in the middle of the pandemic. The only other time it has been that low recently was in 2018, way before tech companies started moving back to U.S. chips.

This is just the beginning of nearshoring and reshoring trends. Broadcom's returns could keep improving for years. The market isn't paying attention.

And that leaves plenty of room for investors to capitalize on this opportunity.

Regards,

Joel Litman

June 15, 2023

Steve Jobs didn't make Apple's current CEO a billionaire...

Steve Jobs didn't make Apple's current CEO a billionaire...