A change is in the wind for managers and employees...

A change is in the wind for managers and employees...

The U.S. and the world continue to make progress with rolling out the coronavirus vaccine. And society is slowly marching back to some form of normalcy.

According to a survey from The Economist, at the beginning of the pandemic, employees were generally optimistic about working from home. On the other hand, managers and executives were concerned about productivity. Now, executives are more excited about the potential cost savings of remote work... while many employees are longing for a type of "hybrid" model with time in and out of the office.

Across the globe, people are wondering when they'll be returning to the office once again. They also want to know how things will be different.

Initially, folks thought the lockdowns and quarantines would only last a few weeks. As we pass the one-year mark since the pandemic escalated, many estimate a return to the office between July and the beginning of September.

A tentative return date continues to be a moving target. So now experts are grappling with how much work will change permanently thanks to the pandemic, and what aspects will return to 2019 standards.

One of the biggest changes is less loyalty to existing work relationships. We've seen this with both employees and employers.

Here at Altimetry Daily Authority, we've said previously how the world of remote work has made companies more comfortable with using independent contractors as the line between employees and contracts breaks down.

However, this trend cuts both ways...

With many remote workers at arm's length from colleagues, the prior loyalty employers used to take for granted is also breaking down. Folks are updating their LinkedIn profiles to look for jobs once companies start to ramp up hiring again.

With a changing work-life balance and the ability to work from anywhere, many employees no longer feel tied down. As the pandemic recedes and mass hiring resumes, this trend is only set to continue.

The biggest winners from this phenomenon are the platforms making these career changes possible...

The biggest winners from this phenomenon are the platforms making these career changes possible...

LinkedIn is set up for success. As employees and employers alike are looking at a shake-up, the social media platform can help match job seekers with employers.

Tech giant Microsoft (MSFT) wisely acquired LinkedIn in 2016. Marrying the business insights of LinkedIn with the rest of the company's enterprise software was a natural fit.

As more folks are spending time managing LinkedIn profiles, networking, and job hunting, that means more ad revenue and recruiting insights for Microsoft.

The company has done an impressive job leveraging this data, along with its other business software, such as Windows, Office, and Azure.

However, as-reported accounting metrics fail to show the benefits of Microsoft's business-focused strategy...

However, as-reported accounting metrics fail to show the benefits of Microsoft's business-focused strategy...

Instead, we can turn to Uniform Accounting. This eliminates the distortions in GAAP financial metrics. Then, our Altimeter software tool breaks the numbers down into grades based on the real fundamentals.

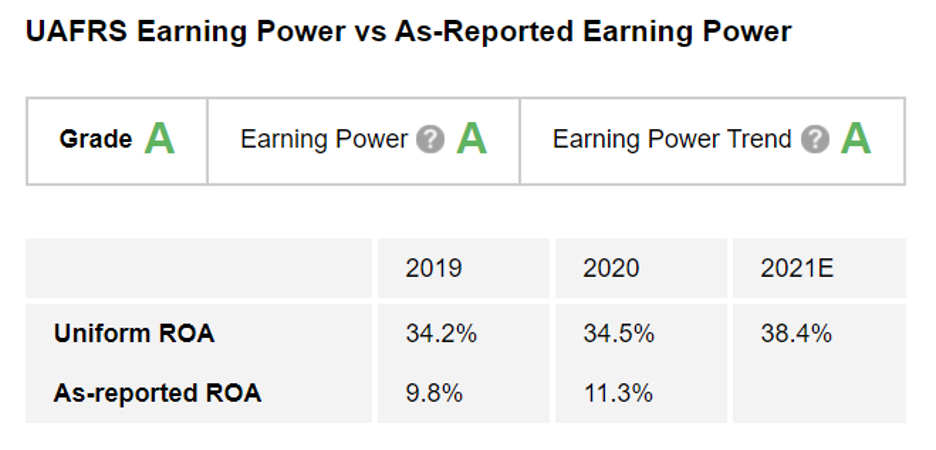

After making adjustments though Uniform Accounting, we can see that Microsoft's Uniform return on assets ("ROA") has been robust. This figure came in at 35% in 2020 – more than three times greater than its as-reported ROA of 11%.

As Microsoft has consistently unlocked value from the synergy in its winning business portfolio, the company gets an "A" grade for Earning Power in The Altimeter.

Furthermore, analysts are already seeing acceleration in Microsoft's earnings. The company powers many business cloud systems, and its software suite is just as essential for home offices.

With its Uniform ROA expected to jump to 38% in 2021, Microsoft also earns an "A" Altimeter grade for Earning Power Trend.

Microsoft is able to unlock huge value through integrating its software portfolio.

However, this strong performance doesn't mean that MSFT shares are a good buy. If the market is overpaying for the name and the stock's valuation is high, it may be best to avoid.

The Altimeter can also show the true valuations based on Uniform Accounting... and grade them accordingly. Altimeter subscribers can click here to see how Microsoft grades for valuation.

If you aren't yet a subscriber to The Altimeter, click here to find out how to gain immediate access to the full Uniform Accounting data on Microsoft's real valuation. You can also see the grades of thousands of U.S.-listed companies in the database.

Don't be fooled by the distorted as-reported numbers... Make sure you're using the right, Uniform data to make the smart stock picks yourself.

Regards,

Rob Spivey

March 25, 2021

A change is in the wind for managers and employees...

A change is in the wind for managers and employees...