If the product of the future can exist, it must be measurable...

If the product of the future can exist, it must be measurable...

When the media industry first emerged, newspapers were the only source of information for the average citizen.

As newspaper companies began to grow and further monetize, the publishers had an easy way of tracking their viewership. By measuring subscriptions and newsstand sales, newspaper publishers could easily track and improve their product... and justify what they'd charge for advertising.

However, with the rise of TV, news companies were no longer able to easily track their viewership. As their signal was broadcast, networks like NBC or ABC could never know if their viewers' TVs were even turned on.

As networks couldn't be sure which shows were popular, they overpaid for the licensing fees of underperforming shows. This also meant advertisers couldn't be sure of how many eyeballs were watching their ads, making pricing a challenge.

This problem was solved by analyst Arthur Nielsen, who invented a way to track television habits and better monetize TV. By measuring ratings, networks could more effectively monetize their product.

For the past decade, content providers have struggled with the same issue in a new medium. Large streaming services such as Netflix (NFLX) or Disney's (DIS) Hulu could internally track engagement on their shows but were loath to disclose any information to the public. This gives Netflix the upper hand when negotiating prices for content.

Furthermore, this allows Netflix to own the story when communicating about its original content. The company can talk to the success of its different initiatives on a metric of its choice, without needing to compare viewership trends with cable channels or other streaming providers.

However, a new startup called Parrot Analytics is focused on providing a Nielsen solution in the new streaming world. Parrot goes a step beyond simply tracking audience size.

As competition has further fragmented the streaming space, both content providers and streaming networks are looking to find the true value of different original content. Parrot measures viewer enthusiasm for a show, using multiple social media platforms to track engagement and international appeal.

This next step of analytics is a crucial step in the streaming market. Any product that can be measured can be further monetized by the players involved. Just as we say with Uniform Accounting, if you don't have the right data, you can come to very wrong conclusions about a business...

We're always impressed with the innovation at one of the companies we often work with...

We're always impressed with the innovation at one of the companies we often work with...

Talent acquisition company MBO Partners has built a successful platform that makes it easy for high-end independent contractors to find work. It has never been easier for businesses and contractors to find each other.

MBO's impressive platform is a clear image of where the world is heading. A growing number of independent contractors are working on projects that excite them... and they're billing out accordingly. Between 2005 and 2015, the number of workers in alternative work arrangements jumped by 50% to 23.6 million.

The coronavirus pandemic has only sped up that growth. Walls are being torn down... and now, anywhere can be an office. As people explore the boundaries of the traditional work dynamic, many employees and employers may find their work is more suited to a contractor role.

MBO has been able to take advantage of the increased number of Americans looking for contracted work. And as the platform gets bigger, it brings on more businesses and independent contractors. That will inherently grow the business through the "network effect." The same dynamic takes place with companies like social media giant Facebook (FB). As more people use the platform, the more popular it becomes... and the more it draws in more users.

Another big player in this independent contractor space is Upwork (UPWK). Both MBO and Upwork are platform businesses, as they offer contractors the ability to find work. This allows companies to find highly talented candidates.

In the past, we've criticized "fake platforms" like ride-hailing company Uber (UBER), which don't benefit from this network effect.

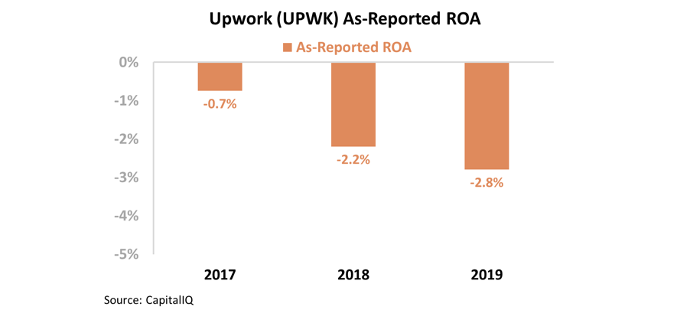

And at first glance, it looks like Upwork is yet another example of a fake platform... On an as-reported basis, the company has a return-on-assets ("ROA") problem.

This is due in large part to the desire to grow as much as possible. Companies like Uber and Upwork accept razor-thin margins just so they can gain more market share. The end goal for these firms is to eventually crush their competition and enjoy economies of scale.

On an as-reported basis, Upwork's plan doesn't seem to be working. The company has yet to post a positive ROA, and its returns have decreased in each of the past three years...

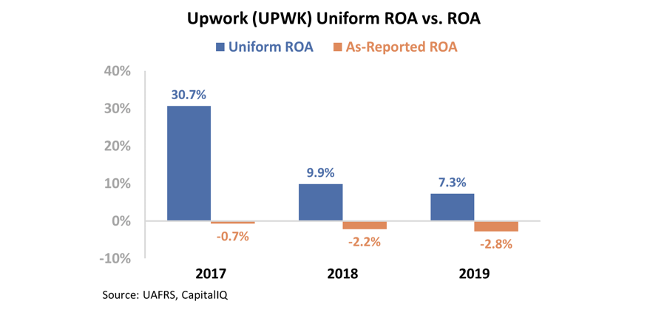

But as-reported numbers have never been able to tell the entire story. Upwork's profitability and asset base are being distorted due to stock option and research and development (R&D) expenses, among other distortions.

When we remove the accounting "noise" and look at the real Uniform returns, we can see that Upwork has actually been profitable the past several years, signaling it has been a relatively successful platform.

The company's Uniform ROA has fallen over the past three years, but the real numbers still show a much more profitable company than as-reported metrics do. Take a look...

As new entrants like MBO have entered the space, Upwork is losing its competitive moat... which is why returns are declining. However, unlike companies like Uber with a "fake platform," Upwork is able to make money per every transaction.

The problem with Upwork is that it might not have the economic safeguards to protect itself from increased competition. Although very much a platform business, it will be tough for the company to sustain high returns. Without significant switching costs in Upwork's network, it will be hard to protect margins.

By only using as-reported accounting, it would be easy to assume Upwork is a firm currently in competition to draw in users and become profitable. However, Upwork has already seen success... and is now just battling for how much profit it can sustain in the industry. But without the real numbers, the market is blind to this reality.

Regards,

Rob Spivey

July 31, 2020

P.S. Do you think the revolution in the work-from-home world – and how it's changing the relationship between workers and businesses – might lead to a sustainable move in more higher-value work moving to independent contractors? Have you had any experience seeing this happen already? Tell us at [email protected].

If the product of the future can exist, it must be measurable...

If the product of the future can exist, it must be measurable...