Joel's note: The Altimetry offices are closed for the next two days. We'll be back in touch with the Daily Authority on Monday, December 28, after the holiday weekend.

Cyber Monday saw record sales this year...

Cyber Monday saw record sales this year...

According to data from Adobe (ADBE), shoppers spent a record $10.8 billion on the e-commerce shopping event. This was a 15.1% increase over the prior year – setting a record for the largest U.S. Internet shopping day ever.

Despite shattering the previous record set last year, these results were lower than expected. Adobe Analytics had originally estimated sales of $12.7 billion, so this year's figure came in 15% lower than anticipated.

While that might initially sound warning bells, much of the drop in demand was due to earlier gift buying. The pandemic has led to a rise in not just e-commerce shopping, but also Black Friday and Cyber Monday sales that started weeks before the normal late November rush.

Big-box companies were less dependent on Cyber Monday to drive sales numbers this year, with Walmart (WMT) and Target (TGT) starting their deals in mid-October to coincide with Amazon's (AMZN) Prime Day.

Additionally, people are spending more on online outlets after the big day. Adobe forecasts total sales for the holiday season at $184 billion – a 30% increase from the prior year.

While Cyber Monday is seeing a diminished role, overall e-commerce shopping continues to thrive.

Among the big winners of this e-commerce boon have been toys...

Among the big winners of this e-commerce boon have been toys...

Consumer spending has changed... Throughout the year, folks have curtailed their spending on travel and experiences. Many countries remain closed to visitors, and some states have mandated quarantine periods.

This has led to an increase in spending on consumer goods instead – things like electronics, clothes, books, and toys.

As kids are home more than ever this year, parents are looking for sources of entertainment. These include popular toys like American Girl dolls, Barbie, Hot Wheels, Fisher-Price, and more.

All of these brands fall under the umbrella of Mattel (MAT) – a multinational toy-manufacturing company with a variety of iconic brands.

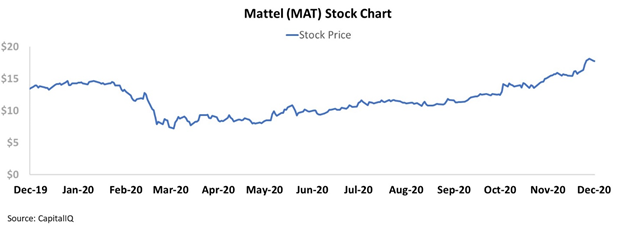

Equity investors have rewarded this increased demand with a stock price near 52-week highs.

But credit-ratings agencies appear to have the opposite outlook. Moody's (MCO) rates Mattel as a "B1" credit, which implies a nearly 25% chance of Mattel defaulting on its debt within the next five years.

However, our Credit Cash Flow Prime ('CCFP') analysis can give us a sense of Mattel's true credit risk...

However, our Credit Cash Flow Prime ('CCFP') analysis can give us a sense of Mattel's true credit risk...

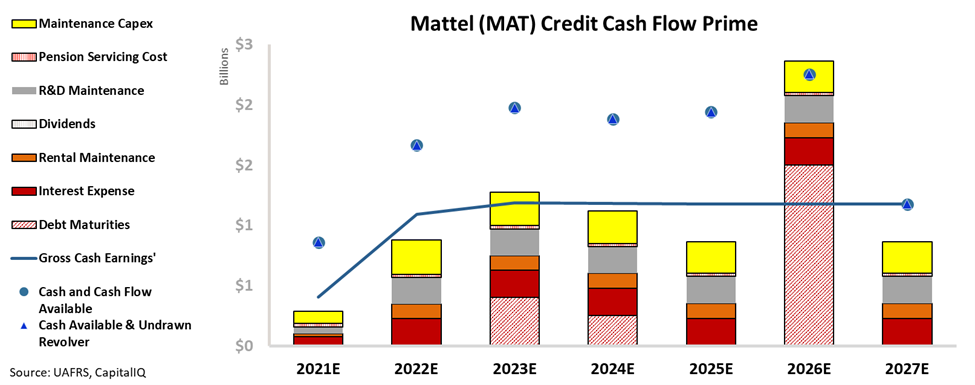

In the chart below, the stacked bars show the company's obligations each year for the next five years. We compare this to cash flow (blue line) and cash on hand at the beginning of each period (blue dots).

The bottom bars are the hardest obligations for Mattel to "push off" – costs such as debt maturities and interest expense. The higher bars are obligations that are more flexible, like maintenance capital expenditures ("capex") and share buybacks.

As the CCFP shows, Mattel has a significant cash balance and a long runway before its largest debt maturities.

Cash flows are expected to exceed operating obligations every year going forward. Additionally, Mattel's expected cash balances will exceed all outstanding obligations until a big debt headwall in 2026.

This gives Mattel a five-year runway to improve operations or refinance the debt. That doesn't sound like a company that has a roughly 25% chance of going under in the next few years.

That's why we rate Mattel with an investment-grade "IG4+" rating, which is equivalent to a "Baa1" rating from Moody's.

The investment-grade rating implies a less than 2% risk of default within the next five years. This is a far cry from the 25% implied by ratings agencies, and it makes much more sense considering Mattel's credit profile.

Ultimately, Uniform Accounting and the CCFP highlight how Mattel is far less of a credit risk than ratings agencies believe. The company has a long runway before any potential cash shortfalls and should see an uptick in demand thanks to increased e-commerce spending on toys.

As Moody's wakes up to how wrong its ratings are, Mattel's bonds might be an opportunity to consider for credit-focused investors.

Regards and Happy Holidays,

Joel Litman

December 23, 2020

Cyber Monday saw record sales this year...

Cyber Monday saw record sales this year...