The Bill & Melinda Gates Foundation is one of the most well-known charitable organizations in the world...

The Bill & Melinda Gates Foundation is one of the most well-known charitable organizations in the world...

The Gates Foundation has donated more than $55 billion to date to various areas and needs across the globe.

When thinking about the Gates family, many folks bring up its donations in the world of health care. While the family and the foundation have made big contributions to the space – namely treating malaria – Bill Gates has also donated to other endeavors.

Beyond the foundation, Gates has also focused on fighting climate change. This includes efforts to address carbon-emission issues. Specifically, he has provided funds to help advance solutions for slowing the release of carbon dioxide into the atmosphere.

And now, Gates seems to have made a breakthrough with new hardware to help carbon-capture technology in Iceland...

And now, Gates seems to have made a breakthrough with new hardware to help carbon-capture technology in Iceland...

Carbon capture is when carbon dioxide that would be emitted from power plants or other polluters is captured before it enters the atmosphere and is then put in the ground, or when carbon dioxide is pulled from the air back into the ground.

Reykjavik-based Carbfix is a startup working with Gates. And it may have developed a way to capture carbon at a cost that's competitive with buying carbon credits for polluters in current carbon-trading mechanisms.

As Bloomberg recently explained, carbon offset is priced at $48 per ton in Europe. On the other hand, Carbfix may be able to price its process at around $25 per ton.

However, we aren't at the point where this can be rushed to market. Carbfix still hasn't applied this solution to high-volume carbon producers, such as coal-power emissions.

Carbfix's breakthrough has only been proven to work with geothermal power, which already has carbon-dioxide emissions below those of "cleaner" fossil fuels like natural gas.

Despite the narrow applicability of the breakthrough so far, the initial progress is beyond what any other carbon capture investments have made... and it's an exciting development.

Even though the progress on making fossil fuel 'green' is slow, coal makers are watching closely...

Even though the progress on making fossil fuel 'green' is slow, coal makers are watching closely...

If carbon capture were widely implemented, the economics of coal power plants would change drastically. Coal power plants could possibly remain viable for a longer period of time than many analysts expected.

The entire coal power industry is eagerly watching for progress on this front. And here in the U.S., one company in particular may benefit...

Southern Company (SO) is one of the country's largest electrical utilities. The company is especially interested in coal-carbon capture, as its Georgia Power subsidiary has a major stake in the two largest coal-power plants in the U.S.

Using as-reported metrics, it appears the market is pricing in Southern Company's heavy exposure to a dying energy source...

Using as-reported metrics, it appears the market is pricing in Southern Company's heavy exposure to a dying energy source...

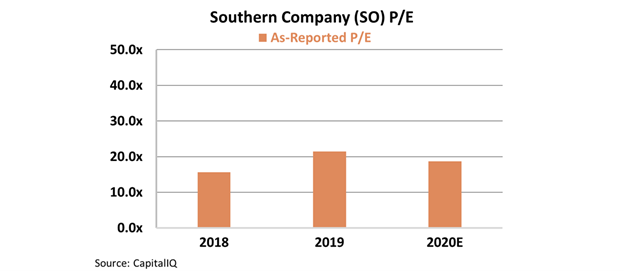

Specifically, the company is currently trading at a price-to-earnings (P/E) ratio of nearly 19 times. That's just below market averages of around 20 times. Take a look...

Considering low market expectations and economic tailwinds for the industry as the overall economy recovers in the coming year, Southern Company looks like it may have upside thanks to these low valuations... even with its coal exposure.

But don't be fooled by the distorted as-reported figure...

But don't be fooled by the distorted as-reported figure...

In reality, the market is already pricing in a bullish outlook for Southern Company.

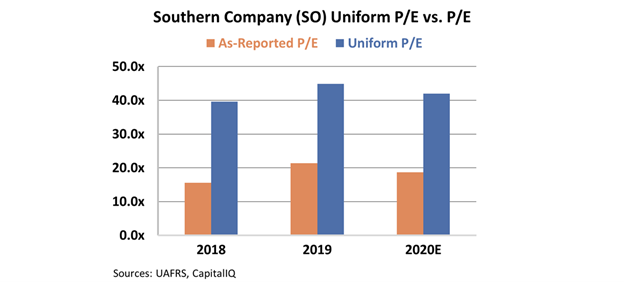

After making adjustments to the financial statements with Uniform Accounting, we can identify the distortions and begin to understand the company's true valuations.

As you can see in the chart below, Southern Company is trading at a Uniform P/E ratio of 42 times. That's more than twice the corporate average.

At this point, the company would almost need carbon-capture technology for its fossil fuel power plants to possibly justify its lofty expectations for sustained high profitability.

Even if Southern Company benefits from the broad economic recovery – which it certainly will, as all electrical utilities generally do – it doesn't look like a stock to rush out to buy.

By using Uniform Accounting, we can see how expensive this stock actually is. And that's before any possible tailwinds from carbon-capture technology.

Understanding inconsistencies like this and seeing the true earnings of a company can help investors avoid the traps of incorrectly priced stocks...

Understanding inconsistencies like this and seeing the true earnings of a company can help investors avoid the traps of incorrectly priced stocks...

That's why we created our Altimeter tool. It's a "stock truth detector" for individual investors.

The Altimeter provides grades based on a stock's real fundamentals and helps you see past the market's misleading valuations. Alongside the grades, you can see exactly how the distorted, as-reported numbers compare to the real, Uniform numbers.

The data can help identify which stocks could be traps. And on the other hand, you can see ones could be poised to skyrocket. Learn more here.

Regards,

Joel Litman

March 23, 2021

The Bill & Melinda Gates Foundation is one of the most well-known charitable organizations in the world...

The Bill & Melinda Gates Foundation is one of the most well-known charitable organizations in the world...