Over the past few years, advancements in technology and data analytics have unlocked big opportunities...

Over the past few years, advancements in technology and data analytics have unlocked big opportunities...

Demand for cloud-computing offerings, the technology that manages the cloud, and the analytics platforms that can extract data from all that cloud storage is growing exponentially.

As a result, valuations for companies offering cloud computing and data center technology have skyrocketed in the public markets... and in the private markets.

Unsurprisingly, large private-equity shops want more "skin in the game." They don't want to sit on the sidelines.

With the global cloud services market growing to more than $300 billion, these big firms want to capture some of that significant cash flow generation.

For example, earlier this month, private-equity giants KKR and Clayton Dubilier & Rice announced that they would acquire data analytics firm Cloudera (CLDR).

For these two, it's just another step in the land grab to gain further exposure to the data analytics and software space.

KKR and Clayton Dubilier & Rice agreed to take Cloudera private at a valuation of roughly $5.3 billion, or $16 per share – a 24% premium to its previous closing price.

Famed investor Carl Icahn – Cloudera's largest shareholder, with an 18% position in the company – likely had a hand in the transaction. He has had a significant voice at Cloudera since his 2019 agreement gave him two board seats.

While the industry is booming, those private-equity investors, as savvy as they are, may want to ask why Icahn supported the sale. After all, Icahn normally has a good idea of what his investments are worth.

Perhaps he thinks these shops are overpaying for an investment that's almost doubled for him since he reached the agreement to get a seat at the Cloudera table in 2019.

Let's take a closer look at what the acquirers are paying for when they get control of the company...

Let's take a closer look at what the acquirers are paying for when they get control of the company...

Since Cloudera went public at a $2 billion valuation in 2017, it has struggled to make money. As a result, some folks are questioning its current nearly $5 billion valuation.

But it's not enough to just look at investor sentiment and whether the public agrees with the value the firms decided to pay.

We need to look at future expectations and valuations. And to get the real story, we can turn to Uniform Accounting to cut through the financial "noise" and see what KKR and Clayton Dubilier & Rice are betting on.

Most investors determine stock valuations using a discounted cash flow ("DCF") model. This makes assumptions about the future and produces an "intrinsic value" for the stock.

However, as regular Altimetry Daily Authority readers know, models with garbage-in assumptions based on the distorted GAAP numbers only come out as garbage.

Instead, we leverage Uniform Accounting and use the current stock price to determine what returns the market expects with our Embedded Expectations Framework.

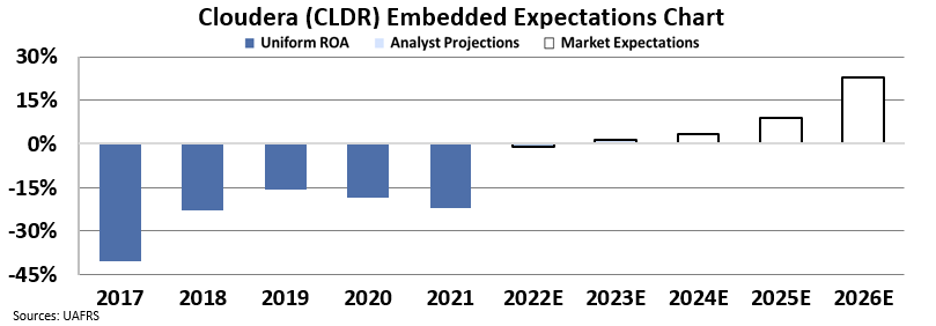

In the chart below, the dark blue bars represent Cloudera's historical corporate performance levels in terms of return on assets ("ROA"). The light blue bars are Wall Street analysts' expectations for the next two years, while the white bars are the market's expectations for how the company's ROA will shift over the next five years.

In this case, the "market" is the expectations of Cloudera's future private-equity holders.

As you can see below, our Embedded Expectations analysis shows that the private-equity shops would need Cloudera's ROA levels – which have never even been positive historically – not just to go positive, but to exceed 23% for their investment to be worth more than these two firms are paying for it.

Wall Street analysts hold low expectations – pricing Cloudera's Uniform ROA to reach only 1% by 2023.

That might be why Icahn was open to selling... and why KKR and Clayton Dubilier & Rice may not be thrilled with this acquisition when they look back on it in the future.

It's just a reminder that even the smartest guys in the room and big private-equity players don't always get it right, especially when they get caught up in the mania of a good story like the cloud-computing explosion.

Regards,

Rob Spivey

June 16, 2021

Over the past few years, advancements in technology and data analytics have unlocked big opportunities...

Over the past few years, advancements in technology and data analytics have unlocked big opportunities...