Too many equity investors fail to understand the credit side of the business...

Too many equity investors fail to understand the credit side of the business...

This dual focus is something that sets Altimetry apart from many of the big Wall Street firms. I'll always remember getting this sage advice from cross-capital investing great Mitch Julis of Canyon Capital: "To be a great equity investor, you need to be a great credit analyst."

This is because the debt profile of a company affects how its stock can trade. An income-focused investor who wants to know if a business can fund its dividend should start by looking at its credit profile... not what the equity markets are saying.

Similarly, growth investors need to start by understanding upcoming debt maturities and creditor outlook for the company, and how these could inhibit management's ability to execute a long-term plan... or even worse, force a company into bankruptcy.

We use the same Uniform Accounting framework we look at equities with to look at all corporate credit. And that's not just true for individual equities... It's true for the market as a whole.

By taking our credit research and aggregating it, we can get a picture of the entire economy. We've explained previously that our Credit Cash Flow Prime ("CCFP") analysis shows that, in general, companies have limited debt maturities coming up. This means we should see limited issues with potential defaults.

However, even with healthy overall corporate credit, this doesn't mean every company is well-positioned. And with yields so low, investors are venturing further into high-yield debts to find superior returns... and that means greater risk.

It's critical for investors looking at these companies to have the necessary tools to make informed decisions. And that's where our corporate partners at Stansberry Research come in with Stansberry's Credit Opportunities...

If you're venturing into the world of higher-risk credits, this is a critical service for separating the opportunities from the traps. Right now, we're not aware of anyone else who's offering this level of research to help individual investors navigate this corner of the market.

You can find out more about the strategy – and how one reader used it to retire at age 52 – right here.

Looking at the bigger picture, many indicators help to explain how credit is flowing through the economy...

Looking at the bigger picture, many indicators help to explain how credit is flowing through the economy...

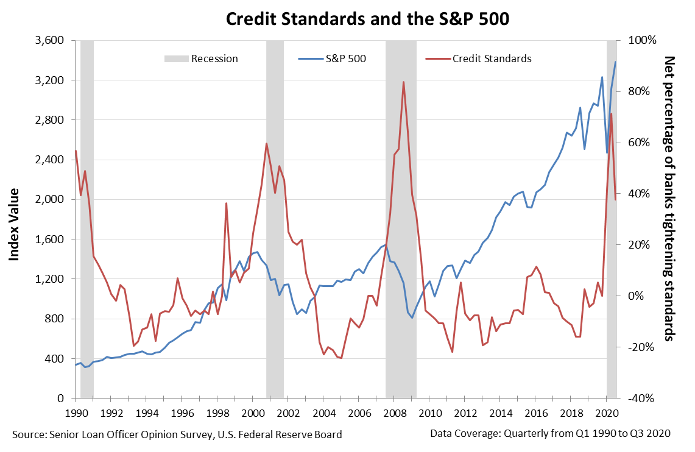

Two of the most powerful are the Senior Loan Officer Opinion Survey ("SLOOS") and loan charge-off rates.

The SLOOS allows us to see how willing banks are to lend to creditors. When the index is positive, it's harder for people to borrow... and when it's negative, it's easier for people to borrow.

Currently, the SLOOS is in positive territory and is near its highs of the past decade. Normally, alarm bells would be going off in our credit macro analytics. But this isn't concerning, for a handful of reasons...

First, the federal government has taken multiple steps to free up capital flows. The Federal Reserve's Main Street Lending and the Treasury Department's Paycheck Protection Program have helped to fill in the lending gap for small companies from banks that have tightened lending standards. And with market interest rates exceptionally low, big companies are able to tap credit markets to raise debt.

Another reason not to be concerned is because the rate of the tightening of credit based on the SLOOS is already coming off its highs from the beginning of the pandemic. The downward trend in recent months bodes well for the future.

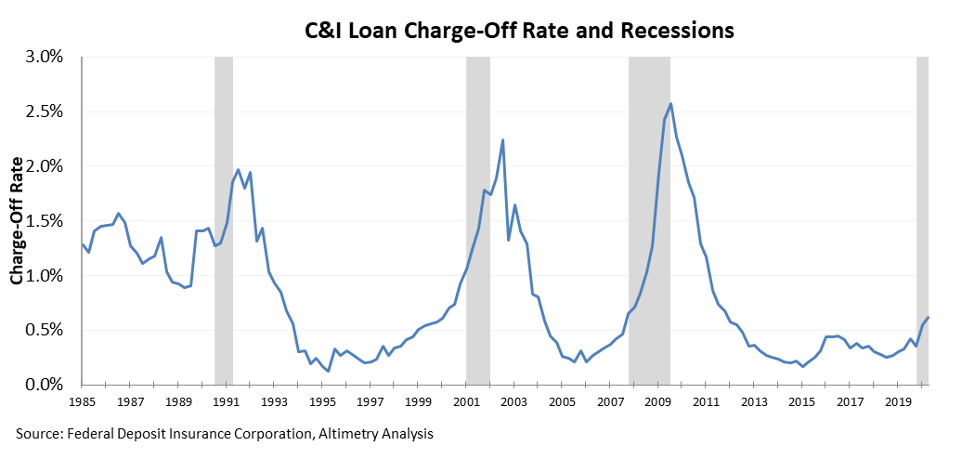

Banks generally restrict lending not just because they're worried about loans defaulting, but because they need to rebuild their balance sheets after older, riskier loans have failed.

When loans fail, banks don't deploy new capital. Instead, they wait for the payments from debt they've already issued that's still paying to help rebuild capital levels until they're comfortable lending again. So the worse the loan default rates, the longer it'll take for banks to be comfortable lending again to fuel economic growth.

Additionally, watching Commercial and Industrial (C&I) loan charge-offs is a useful way to understand how bad default rates are for a bank's borrowers, and therefore how slowly a recovery from a recession might be.

Right now, C&I loan charge-offs are at a slightly elevated level. However, the rate is nowhere near the highs of the Great Recession or the dot-com bubble. More important, these charge-offs are nowhere near the levels they normally are this far into a recession...

This is incredibly important for the economy. If the charge-off rate can stay low relative to normal recessions, banks won't take as long to rebuild balance sheets. Therefore, even if some companies default, banks can start to lend more aggressively sooner.

These two charts and the context behind them explain why we aren't worried about credit availability. Even as some governmental programs run out, banks will likely be able to ramp up lending sooner than normal to fill that gap.

Thanks to our credit data, we can have confidence in our equity market outlook... and it's why we continue to think there's no major risk to the market anytime soon.

Regards,

Joel Litman

December 7, 2020

Too many equity investors fail to understand the credit side of the business...

Too many equity investors fail to understand the credit side of the business...