Lumber, copper, uranium, steel, sugar… There is another commodity shooting up in price...

Lumber, copper, uranium, steel, sugar… There is another commodity shooting up in price...

The global supply chain breakdown is a dominant theme throughout the business world right now.

We hear about it constantly on almost every management earnings call.

One of the more concerning cases is sourcing silicon, which is tied to auto and electronic production.

While silicon is ubiquitous in the natural world, it requires an energy-intensive processing stage for chips. The vast majority of that processing occurs in China. But the Chinese energy crisis has forced officials to ration their energy uses.

As China clamps down on energy-intensive industries, the silicon supply chain is experiencing historically difficult disruptions. This is causing problems for the hundreds of midstream supply chain players that fulfill specialized tasks necessary for the supply chain to function.

Elkem (ELKO.OL), a Norwegian company that manufactures silicon-based materials for the foundry industry, needed to declare force majeure in September, taking legal protection because it can't deliver the products it had committed to delivering.

The shortage has caused silicon prices to skyrocket 300%, marking another price shockwave that is raising production costs for everything downstream.

Silicon is integral to our economy, but there is even more to the story...

Silicon is integral to our economy, but there is even more to the story...

Silicon is crucial not only for microchips, but also for various alloys in car engines, a component of cement, and the base material for key adhesives in manufacturing.

The key issue isn't just the direct effect on industries that depend on silicon. The real issue is broader, highlighting an important feature of the economy.

We recognize the importance because it creates an opportunity. These disruptions may weigh on the economy in the near term. However, they can also be a potential longer-term catalyst for growth that vigilant investors can capitalize on...

Silicon, like many other materials, has seen surging industrial demand in recent years. But in the U.S., corporations have been unwilling to invest the capital expenditure ("capex") dollars needed to increase capacity materially.

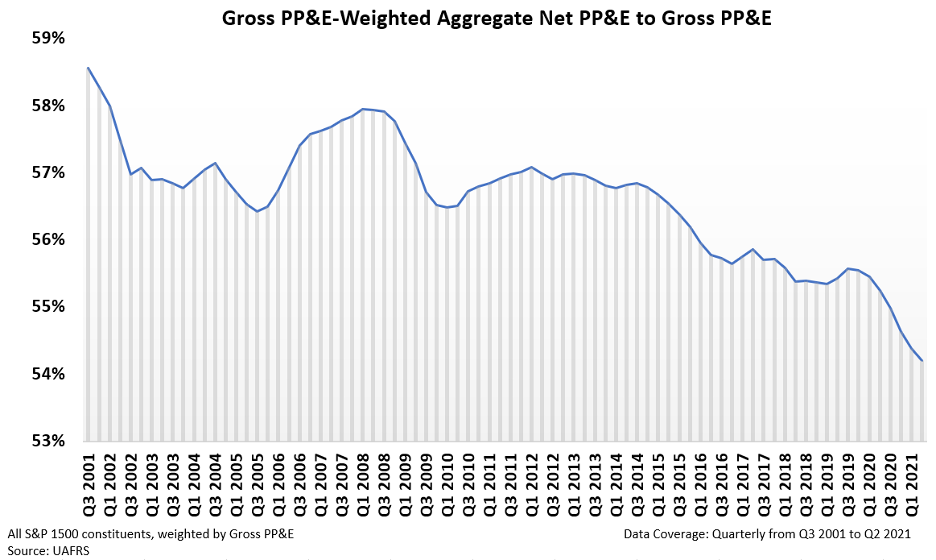

We can see this when we look at Net/Gross PP&E ratios...

We can see this when we look at Net/Gross PP&E ratios...

PP&E stands for "plant, property, and equipment" and is the balance sheet line-item representing companies' large, physical assets.

This chart shows how old assets are. A lower net/gross PP&E ratio means assets are more heavily depreciated on U.S. corporate balance sheets. This is the accountants' way of saying that the physical stuff that companies own is older, and right now, it is as old as ever.

This is because U.S. corporations, just like many worldwide, have limited capex investments in the past decade to maximize their cash flows. This is now coming home to roost, creating supply chain issues, where supply can't ramp fast enough to meet demand.

The reason is fairly straightforward. As factories and equipment get older, companies think about the looming upcoming replacement cycle. They won't want to install or repair older equipment, only to replace it sooner rather than later.

Hence, many companies are revamping their entire production systems, replacing old equipment with new equipment, and increasing short-term capacity while they're at it. It's a "two birds with one stone" solution. While this is the needed fix, it takes time to implement.

Had equipment been more up to date, it would have been easier for companies to add capacity without these overhauls, potentially alleviating some of the supply chain problems.

This explains some of the near-term problems, and it's a catalyst for global growth in the coming years...

This explains some of the near-term problems, and it's a catalyst for global growth in the coming years...

That's because we could be primed for a massive capex cycle, which the U.S. hasn't seen in decades.

If companies continue to see scarcity, they'll be more willing to ramp capacity to meet that scarcity, overhauling their older equipment while they're at it. This can lead to a virtuous spending cycle, as they buy goods from their suppliers, and new capital floods the supply chain.

This is also the federal government's hope, which just passed a massive $1.2 trillion infrastructure spending bill, which may help kick things off.

So while the headlines may be worrying now, be ready for this supply chain problem to transform into a powerful capex cycle, lifting hundreds of companies with it.

And we identified one company that stands to benefit from this new capex cycle. Today, we're publishing our brand-new recommendation in our High Alpha service about one stock that will ride the wave of this capex cycle.

To learn more about this name along with several others stock picks that we've recommended that are poised to take off with these macroeconomic tailwinds – click here.

Regards,

Joel Litman

November 15, 2021

Lumber, copper, uranium, steel, sugar… There is another commodity shooting up in price...

Lumber, copper, uranium, steel, sugar… There is another commodity shooting up in price...