Tesla (TSLA) had a great quarter... but we wouldn't get too excited...

Tesla (TSLA) had a great quarter... but we wouldn't get too excited...

The electric-vehicle ("EV") maker once stood out as a pioneer in its market. It used that status to reach a trillion-dollar valuation back in 2021.

But Tesla's first-mover advantage is evaporating fast. Tough competition in China hit the business hard in 2024. And the pain has continued this year. Tesla's U.S. market share fell to 41% in the third quarter of 2025 versus 48% a year ago.

Bullish investors are scrambling for any piece of good news to hold on to. And Tesla tried to provide that in its most recent earnings report.

Third-quarter revenue was $28 billion... up 12% from a year ago and above consensus estimates. Vehicle deliveries surged to 497,000, beating analyst expectations by more than 50,000 vehicles.

Those numbers look impressive. But they're distracting from a concerning downswing. Profits plunged to $1.4 billion, down 37% year over year.

Said another way, while Tesla boosted its sales... that didn't translate to higher profits.

And we wouldn't hold our breath for a big boost to its EV business anytime soon...

Tesla's latest quarter wasn't really about momentum...

Tesla's latest quarter wasn't really about momentum...

It was more about desperation – and a one-time tailwind.

The EV maker did everything it could to prop up sales... even selling stripped-down versions of the Model 3 sedan and Model Y sport-utility vehicle at around a $5,000 discount.

Tesla also got a small boost as federal tax credits for EVs expired on September 30. Buyers rushed to secure cheaper prices, leading to a short-term sales bump.

But those efforts aren't enough. Tesla's costs are piling up.

Aggressive investments in AI, robotics, and other research and development projects are driving expenses higher. The company plans on unveiling the latest version of its humanoid robot, Optimus V3, in the first quarter of 2026.

All those expenditures are adding millions of dollars in overhead... without a clear payoff.

Investors are expecting too much from Tesla...

Investors are expecting too much from Tesla...

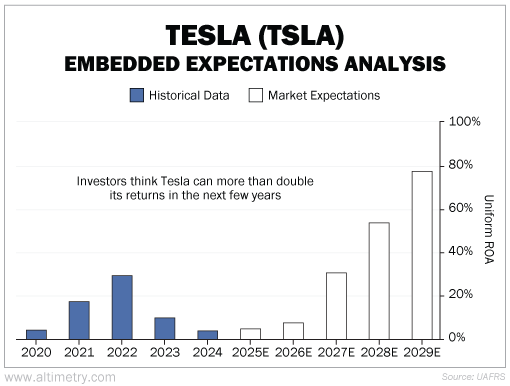

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

Said another way, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Tesla's Uniform return on assets ("ROA") was just 11% last year and 10% in 2023. That's higher than the roughly 5% average for traditional automakers.

But it's well below Tesla's peak Uniform ROA of 30% back in 2022. And it's lower than the 12% broader corporate average.

Investors don't seem to care that returns are slipping. At current prices, they expect Tesla's Uniform ROA to soar to 78% by 2029.

Take a look...

These are some extreme expectations. Automakers rarely generate returns higher than 12%. And robotics investments or not, cars still comprise the lion's share of Tesla's business.

Even if Tesla somehow manages to claw back market share... and records massive profits along the way... we don't see how it could generate these returns.

This is an outlier interpreted as a comeback story...

This is an outlier interpreted as a comeback story...

Tesla's third quarter was the result of discounts and policy deadlines... and not the early stages of a massive resurgence.

Investors are looking for sky-high future returns. We haven't seen anything in the EV maker's performance to indicate it can hit those marks.

Said another way, the market looks set for a big disappointment. We'd watch this one from a distance for now.

Regards,

Joel Litman

November 4, 2025

P.S. This week, shareholders will vote on Tesla CEO Elon Musk's controversial $1 trillion pay package.

It hinges entirely on what Musk calls "the biggest product of all time"... a secret he has been working on around the clock.

And while we're skeptical of Tesla's performance from here, there's no denying this could be one of the defining investment stories of the next few years.

We've identified a handful of smaller stocks that could soar as much as 10 times while Musk's project unfolds. But the window to buy in is closing fast – a major breakout could be days away. Click here to learn more.

Tesla (TSLA) had a great quarter... but we wouldn't get too excited...

Tesla (TSLA) had a great quarter... but we wouldn't get too excited...