A decade ago, Tesla (TSLA) entered the Chinese market with its Model S...

A decade ago, Tesla (TSLA) entered the Chinese market with its Model S...

At first, everything seemed to be going well. The company delivered 11,000 vehicles by 2016 and generated more than $1 billion in sales. It seemed like Tesla was becoming a critical player in the market.

By 2018, the electric-vehicle ("EV") maker announced its first international "Gigafactory" in Shanghai. The factory would make EVs locally to avoid tariffs and high costs.

However, despite its decent exposure to the Chinese market... Tesla has fallen behind over the past five years.

Today, we'll look at the company's latest struggles to keep pace in China. And we'll explain why it's a sign of more problems to come.

Musk has paid special attention to China from the start...

Musk has paid special attention to China from the start...

That's because China is the biggest car market in the world by far. It recorded more than 26 million passenger-car sales in 2023... more than the next 10 countries combined.

But since Tesla opened its Gigafactory, it has faced fierce EV competition. Local Chinese competitors like BYD (1211.HK) and Li Auto (LI) match Tesla's quality at lower prices. And they're light-years ahead in terms of churning out new models.

Carmakers plan to launch more than 100 new models so far in 2024. Tesla has failed to release a new EV model in the past five years.

Tesla is protected from Chinese brands in the U.S. market by extremely high tariffs. However, Chinese consumers have little incentive to remain loyal to Tesla. The company lost its car-sales crown to BYD in the fourth quarter of 2023.

And it has been losing ground in China, fast...

Sales in the country are down more than 13% year over year in the first half of 2024. Tesla's share in the Chinese EV market is down from 9% in 2023 to 6.5% in the first seven months of this year.

Mind you, more than 20% of Tesla's total revenue comes from China...

Mind you, more than 20% of Tesla's total revenue comes from China...

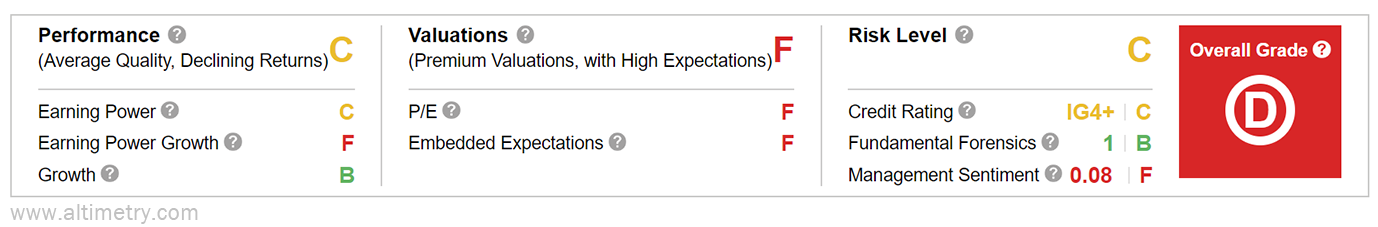

We took a closer look at the EV maker using the Altimeter Pro. It cuts through the noise of flawed generally accepted accounting principles ("GAAP")... and assigns companies easy-to-understand grades using Uniform Accounting metrics.

In the past few years, Tesla has stood out among competitors. It brought EVs to the market before mainstream car companies like Ford Motor (F) and General Motors (GM) were even considering them.

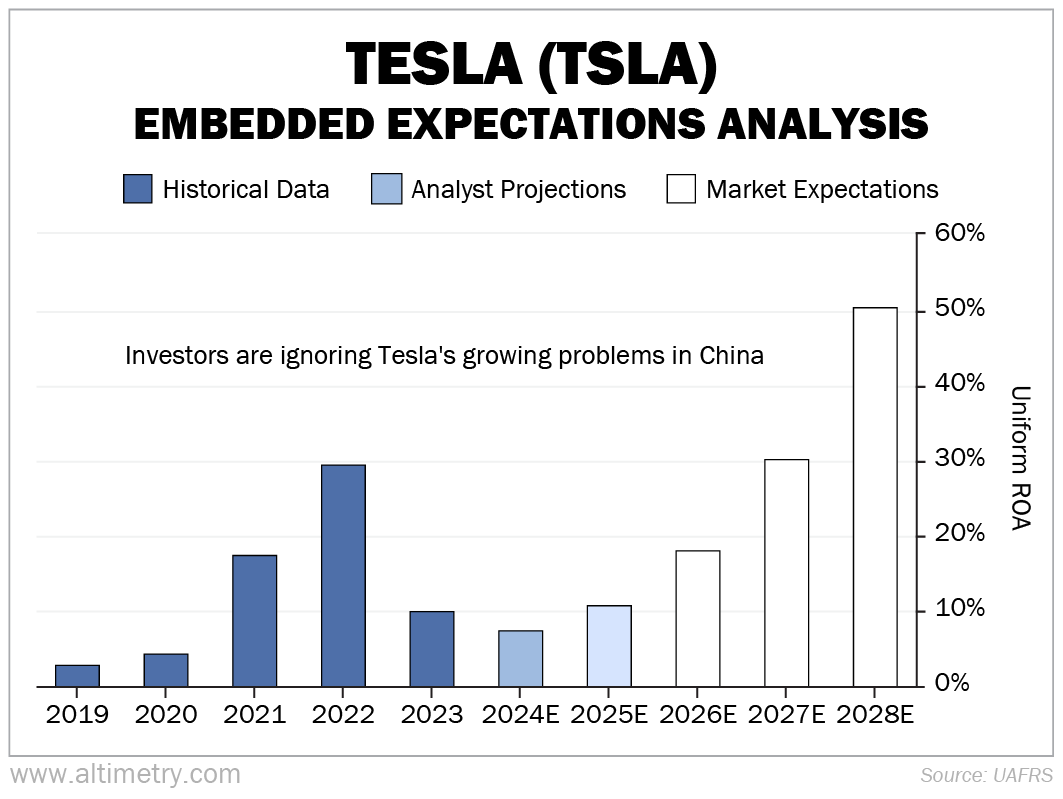

As a result, it was significantly more dominant and profitable in the EV space. Its Uniform return on assets ("ROA") climbed into the double digits, jumping from 5% in 2020 to 30% in 2022.

Growing competition and price cuts are starting to take their toll, though. Uniform ROA dropped to a meager 10% in 2023. And we believe that's only the start...

To put it simply, we wouldn't expect any car company – even one as innovative as Tesla – to keep profits high. Making cars is asset intensive and not very profitable. Most carmakers just manage to cover their costs or eke out a modest return.

And a ton of Tesla's upside is pegged to that 20% of its business that relies on China... just when Chinese EV makers are starting to eat Tesla's lunch.

Despite this year's disappointing returns, Tesla's valuation is sky-high... Its Uniform price-to-earnings (P/E) ratio is more than six times the market average, sitting at 125 times.

That's after the stock has fallen almost 50% from its all-time high.

As competitors enter the EV market, Tesla is struggling to keep up its prior impressive profits. Shares shouldn't be anywhere near this expensive. The Altimeter Pro gives Tesla an "F" for Valuations... and a "D" overall.

Investors don't seem to understand how bad the situation is for Tesla...

Investors don't seem to understand how bad the situation is for Tesla...

Wall Street analysts are catching on. They think returns will fall to 8% this year – Tesla's worst profitability in the past four years – and "rebound" to only 11% in 2025.

But the market has far loftier expectations. We can see this through our Embedded Expectations Analysis ("EEA") framework...

The EEA works a lot like a betting line in a sports bet. We use Tesla's current share price to calculate what investors expect from future performance... and compare those forecasts with our own.

It tells us how well our "team" (the company) has to perform to justify the market's "bet" (the current price).

Investors aren't bothered by Tesla's sliding returns. They believe Uniform ROA will surge to 51% by 2028... a record high.

Take a look...

Dwindling returns and falling share in a key market haven't dissuaded investors. They're still betting on Tesla's returns to reach unparalleled levels for an automaker... even though all signs point to the opposite.

Elon Musk is a big personality, and he generates a lot of excitement about Tesla. It can be easy to fall into that trap. But don't let the company's popularity blind you to its recent performance.

Everything isn't as rosy as the market wants to believe. Investors should proceed with caution.

Regards,

Joel Litman

October 17, 2024

A decade ago, Tesla (TSLA) entered the Chinese market with its Model S...

A decade ago, Tesla (TSLA) entered the Chinese market with its Model S...