A pricing war opens a new frontier...

A pricing war opens a new frontier...

And it's one Elon Musk probably wanted to avoid. As CEO of electric-vehicle ("EV") leader Tesla (TSLA), he has garnered a cult-like following.

Musk led the company from a tiny startup to the largest automaker by market cap in the world. And for a long time, he could charge whatever he wanted for Teslas.

For years, the company operated on a deposit system. When a new car model was announced, would-be buyers had to "line up" by paying an upfront deposit.

Sometimes, the deposit was as small as $100. Other times, it was thousands of dollars. When the Cybertruck first started taking deposits in 2019, 200,000 people paid $100 each. That was $20 million in Tesla's pockets... without having to deliver a car.

And the cars themselves cost a pretty penny. When the "entry level" Model 3 launched, it cost about $10,000 more than comparable cars. The Model Y SUV peaked at a $20,000 premium to the average.

Tesla used to have significant cachet in the auto market. But its glory days seem to be fading. Over the past few months, Musk has quietly lowered prices for almost all of the company's car models.

Musk has been uncharacteristically quiet about these changes. Even so, investors are sure to notice them in Tesla's future financial statements. Today, we'll take a look at why Musk's price war might be the final nail in the coffin for Tesla's valuations.

Tesla became the world's biggest EV maker thanks to its reputation...

Tesla became the world's biggest EV maker thanks to its reputation...

Sure, plenty of car companies charge a premium for their vehicles. But nobody else gets the margins Tesla managed in the past few years. At its peak, the company was charging more than $36,000 for the basic Model 3... and over $60,000 for the Model Y.

Frankly, Tesla could get away with these prices because it was one of the only viable EV makers at the time. The company's fanbase was willing to pay almost any price.

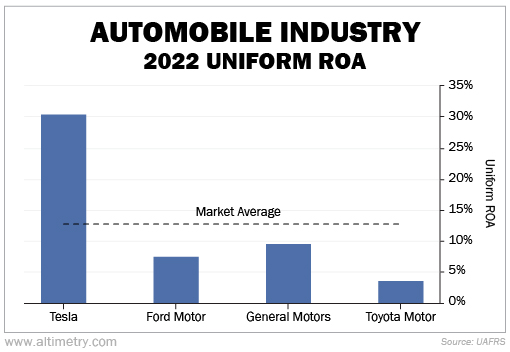

Just take a look at Tesla's Uniform return on assets ("ROA") versus other leading automakers like Ford Motor (F), General Motors (GM), and Toyota Motor (TM)...

Legacy automakers have been competing on price for years. Last year's returns make that clear. None of them are even at the 12% corporate average.

For Tesla, things have changed... fast. Many competitors finally got their EVs up and running. Stateside, legacy companies have introduced EV versions of models like the Ford Mustang and F-150, and the Chevrolet Bolt.

Startups like Rivian Automotive (RIVN) are also ramping up production. And internationally, companies like BYD (BYDDF) are quickly catching up.

That's why Tesla has started cutting costs.

In fact, the Model Y just crossed a major milestone. It's now $46,990... about $800 cheaper than the average car in the U.S.

With such aggressive price cuts, Tesla will be hard pressed to continue its current performance...

With such aggressive price cuts, Tesla will be hard pressed to continue its current performance...

The company has managed industry-leading returns recently. But this price war seems like the beginning of the end. And investors are unprepared.

Tesla's stock is down 61% from its all-time high... and it's still expensive.

The market isn't pricing in the effect of Tesla's price cuts. We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that figure with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

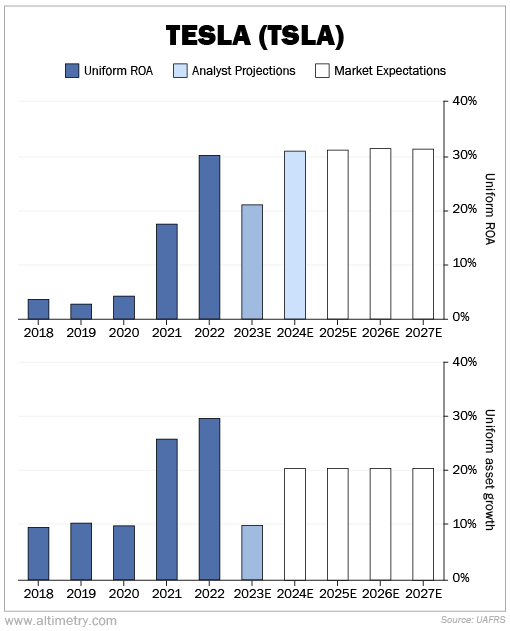

Wall Street analysts are catching on to Tesla's difficulties. They forecast Uniform ROA to drop from 30% in 2022 to 23% this year.

But the market is behaving like this is a one-off issue... not the first step toward Tesla becoming an average car company. As you can see in the charts below, investors expect Tesla's Uniform ROA to stay at 30% every year while growing assets 20% annually.

Take a look...

Investors don't think these massive price cuts will hurt profitability at all. Nor do they expect rising competition to slow down growth.

That's wishful thinking. Something has to give. Tesla can't have the best of both profitability and growth forever.

Don't be surprised when returns take a turn for the worse. Tesla is on track to become just another automaker.

Regards,

Rob Spivey

May 4, 2023

A pricing war opens a new frontier...

A pricing war opens a new frontier...