What a week it has been so far...

What a week it has been so far...

My colleague Rob Spivey and I just wrapped up a fantastic second day at the Stansberry Conference in Boston.

Every year, our corporate affiliate Stansberry Research assembles some of the best and brightest minds from the world of finance for a series of exclusive presentations. Rob and I had a great time sharing some of the big ideas we've covered here at Altimetry.

I spoke about the current global economic landscape and why the U.S. will remain dominant for decades. I also outlined why our growth rate will continue to outpace China's.

Regular readers are familiar with my thoughts on this... In short, our superior profitability, innovation, and credit health are just some of the things that make the U.S. stock market "the place to be."

Rob discussed our perspective on the current economy. While inflation has been on the rise this year, we haven't panicked. He explained why today's macro trends are similar to what we saw between 1945 and 1950 following World War II.

We love sharing our research with colleagues. And we've already had plenty of opportunities to learn from them as well.

But if I've learned anything over the past two days, it's this...

Casinos are well and truly 'back'...

Casinos are well and truly 'back'...

Normally, the conference is held in Las Vegas. This year, it took place at the Encore Boston Harbor resort – conveniently right down the street from our headquarters.

I'm blown away by how busy the casino has been. Even though it's not quite Sin City-level, the stakes are still pretty high here in Boston. But that hasn't stopped anyone from trying their hand at the slot machines.

It's the same story through the U.S. The gambling industry took a dip in 2020 amid mass shutdowns. Casinos were either completely closed or enforced strict social-distancing policies.

So they were some of the first in line to start lifting restrictions and returning to normal operations.

Now, most restrictions have been lifted across the U.S. It looks like casinos have fully recovered... and then some.

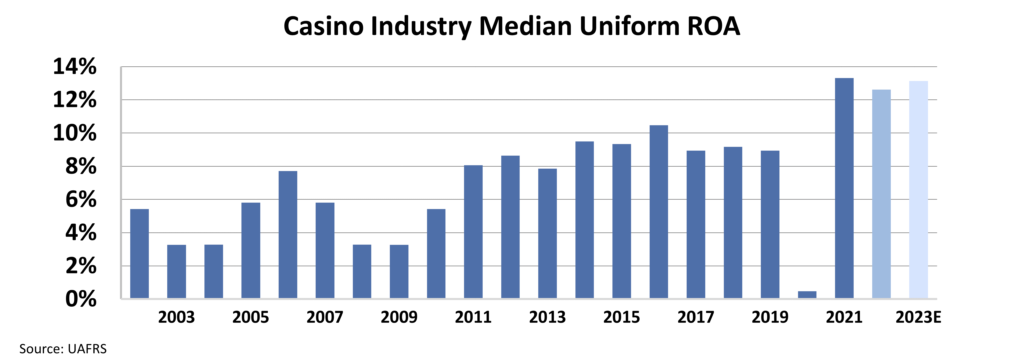

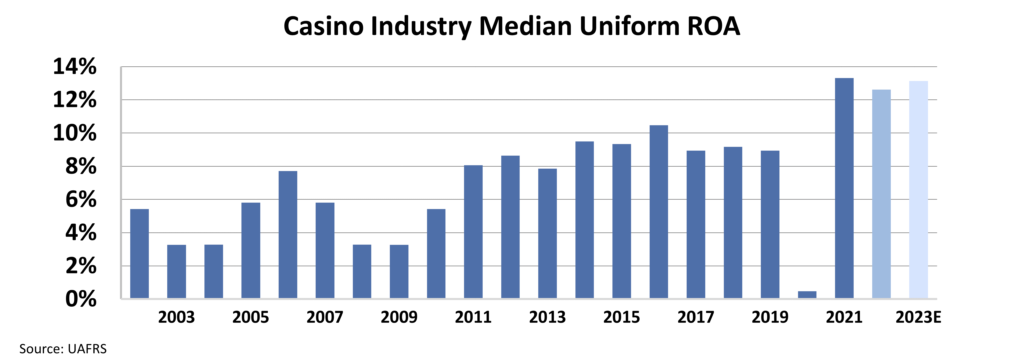

The median Uniform return on assets ("ROA") for the largest casino companies – including Las Vegas Sands (LVS), MGM Resorts (MGM), and Wynn Resorts (WYNN) – hovered between 9% and 10% for most of the past decade. That number fell to almost zero in 2020.

After the pandemic, median Uniform ROA jumped to a record 13%.

The boost in returns could be the result of unusual pent-up demand. And with a recession potentially on the horizon, you might think casinos are in for another strenuous year. Nobody would fault you for thinking these results are unsustainable.

However, that doesn't seem to be the case. Wall Street analysts are projecting returns to stay elevated through at least 2023.

Take a look...

Most businesses dread a recession. But it could actually be good for casinos.

This might sound counterintuitive at first. After all, during a recession, consumers cut back on spending. That's true for non-necessities like new cars, fancy dinners, and vacations.

But it's not the case for so-called "vices." Alcohol and tobacco sales tend to remain stable during a recession. Sometimes, they even increase.

Casinos are no exception.

Despite recession concerns, casino companies are still optimistic. They know that they'll still enjoy a steady stream of revenue even if the economy takes a turn for the worse. Consumers won't stop gambling anytime soon.

Casino companies could be a great opportunity in these uncertain times.

Regards,

Joel Litman

October 26, 2022

What a week it has been so far...

What a week it has been so far...