When it comes to business, Elon Musk doesn't have small ideas...

When it comes to business, Elon Musk doesn't have small ideas...

And his latest venture, xAI, is no exception.

This company aims to revolutionize artificial intelligence ("AI") by creating advanced tools... ones that rival Microsoft (MSFT)-backed OpenAI and Alphabet's (GOOGL) DeepMind.

To compete with these industry leaders, xAI must match their resources and technology. And that's no easy task.

For starters, building AI models at scale requires a huge amount of computing power...

This is why Musk is assembling a powerhouse team of tech giants to support his vision... and build up the infrastructure.

Today, we'll explain how one "old dog" is ready to profit from this development, and the growing investments in AI technology...

AI needs a complete ecosystem to thrive...

AI needs a complete ecosystem to thrive...

This includes hardware, software, and networking equipment... like chips and servers. They form the critical infrastructure that powers big AI projects.

One example is the massive supercomputer facility xAI is building in Memphis, Tennessee...

This cutting-edge site will house at least 1 million graphics processing units ("GPUs")... These high-powered chips are essential for training and running advanced AI models.

For this mission, xAI has partnered with some of the biggest names in tech... One of them is leading chipmaker Nvidia (NVDA), which supplies xAI with GPUs.

Dell Technologies (DELL) – another key partner – provides, arguably, the most critical part of the AI infrastructure... AI-optimized servers.

This business line has been nothing short of explosive...

This business line has been nothing short of explosive...

From May 2024 through August 2024, Dell saw an 80% growth in sales for its AI servers... It brought in an astounding $3.1 billion in revenue for this segment, up from $1.7 billion.

In the most recent quarter, the company logged $3.6 billion in AI server orders.

Dell's rapid, sustained sales growth is a big vote of confidence from more than 10 million customers.

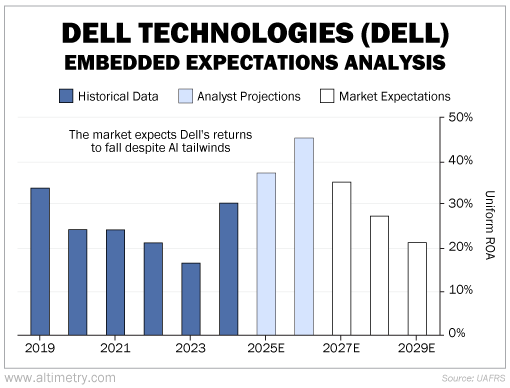

However, the market doesn't seem to recognize Dell's potential. We can see this through our Embedded Expectations Analysis ("EEA") framework...

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Dell's Uniform return on assets ("ROA") has been swinging up and down... between 34% and 17%. This is mostly due to the company's cyclical personal computer ("PC") business.

Its AI server segment has now become more profitable than the PC part... Last year, the server business earned over $700 million more in profit on roughly $15 billion less in revenue. That means its Uniform ROA is set to test higher levels.

That's why analysts expect Dell's Uniform ROA to reach 37% by 2025 and 45% by 2026. Yet, the market expects it to plummet to 21% by 2029. Take a look...

This scenario, however, is unlikely. It all comes down to investor psychology... Some just don't view Dell as an AI powerhouse... Others don't understand how profitable that segment is becoming.

In reality, Dell is a leader in AI servers. And we're going to see huge investments in this space in the next couple of years.

With Musk at the helm, AI is undergoing a powerful evolution...

With Musk at the helm, AI is undergoing a powerful evolution...

AI servers are the centerpiece of that infrastructure. And yet, investors are still overlooking key opportunities in the AI space.

I'll be frank... the mainstream media isn't accurately covering this story. Very few folks are connecting the dots and understanding how much is about to change.

That's why I recently put together a presentation detailing exactly what's going on with the new Department of Government Efficiency ("DOGE"), headed by Musk.

I explain how it could create extraordinary new wealth for anyone who understands Musk's real agenda.

And I share how you can learn the names and ticker symbols of nine promising stocks across the AI industry... each of which could soar as this story unfolds. Learn more here.

This could be one of the greatest economic transformations America has seen. Companies like Dell are already securing major deals... getting in position to benefit.

But plenty more are poised to win big. Make sure you're prepared.

Regards,

Joel Litman

January 30, 2025

When it comes to business, Elon Musk doesn't have small ideas...

When it comes to business, Elon Musk doesn't have small ideas...